In this report I will review the key points of my trading this week, focusing on the actual trades I took.

This Weekly Trade Report is published every Saturday.

When you read it together with Trade Scenarios, which I post every Sunday, I believe it will give you a useful reference for how I think in advance and how I actually execute trades based on those scenarios.

This is not advice saying “you should trade like this,” nor am I claiming that this is the correct answer.

It is not about showcasing individual winning or losing trades, nor is it about recommending a specific strategy based on those results.

My purpose is to show, at a practical level, how I repeatedly follow a consistent process based on pre-defined scenarios, and to offer that as a reference for your own strategy building and for achieving consistency in your process.

The outcomes I show are nothing more than my personal results, and they do not guarantee your future profits.

Please keep that firmly in mind, and when it comes to your own trading, make sure you carry out your own testing and preparation, and trade entirely under your own responsibility.

My trading is based on buying pullbacks and selling rallies on the 4h timeframe.

If you are interested in my pullback and rally strategy, please read my past blog posts on Dow Theory and multi-timeframe analysis.

Now, please take a look at the following charts.

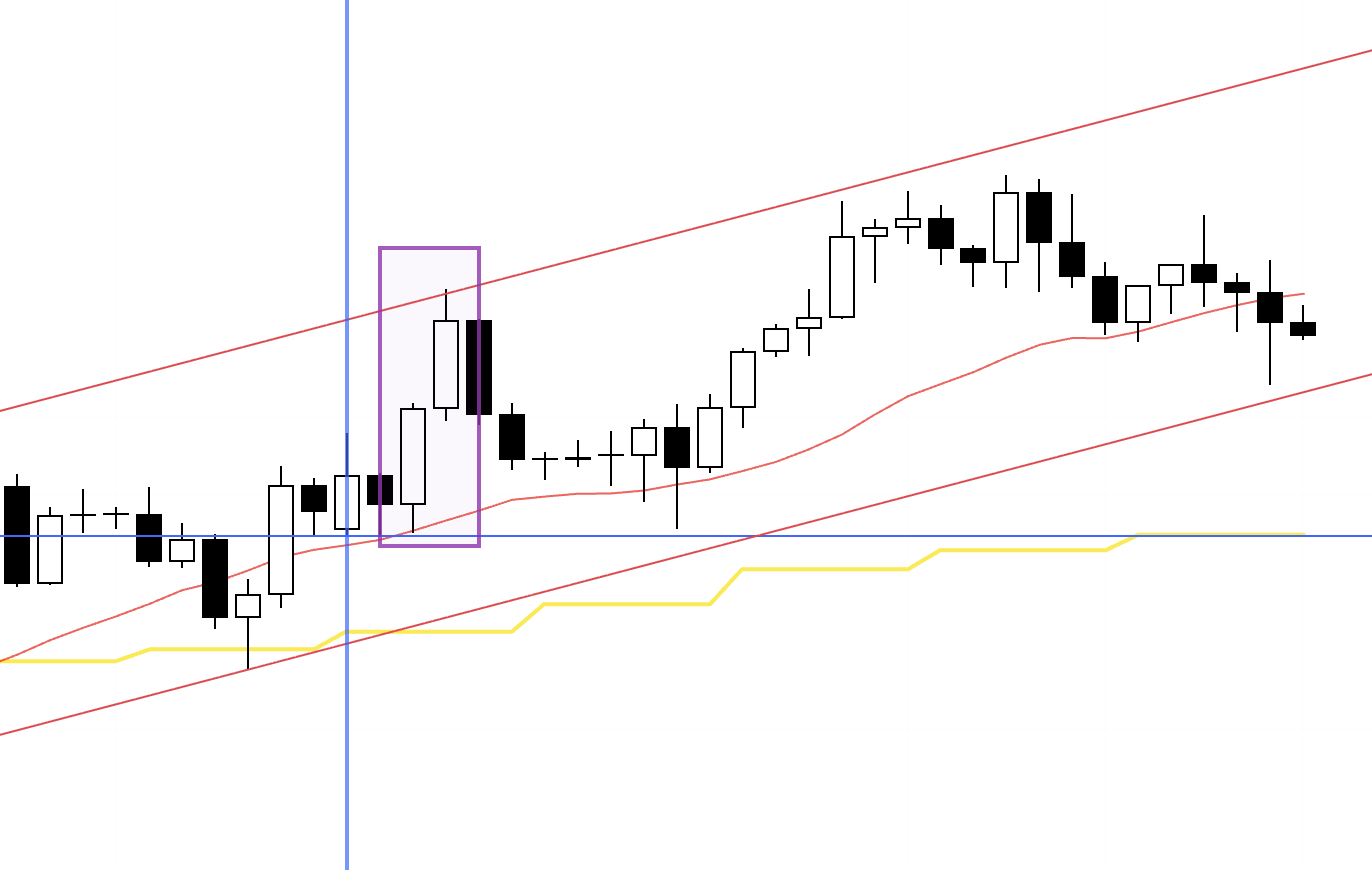

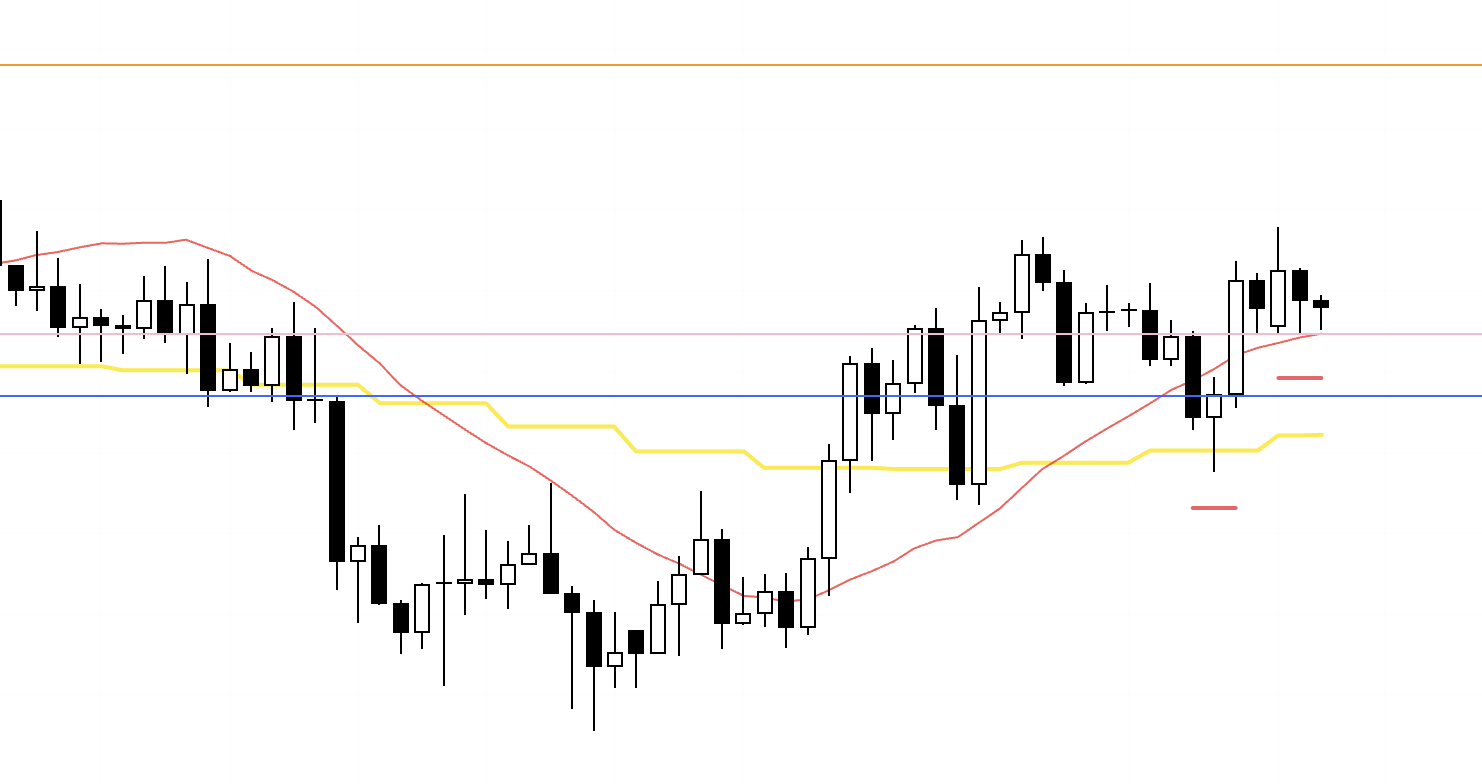

USDJPY 4h

This is the 4h chart of USDJPY.

Price action for this week is from the blue vertical line on the chart onward.

There were no tradable setups in USDJPY this week.

On the 4h chart there were several potential sell-the-rally opportunities, but as I had noted in Sunday’s scenario, there was a line where buying was likely to come in, so I chose not to initiate any shorts.

Next, please take a look at the following EURUSD chart.

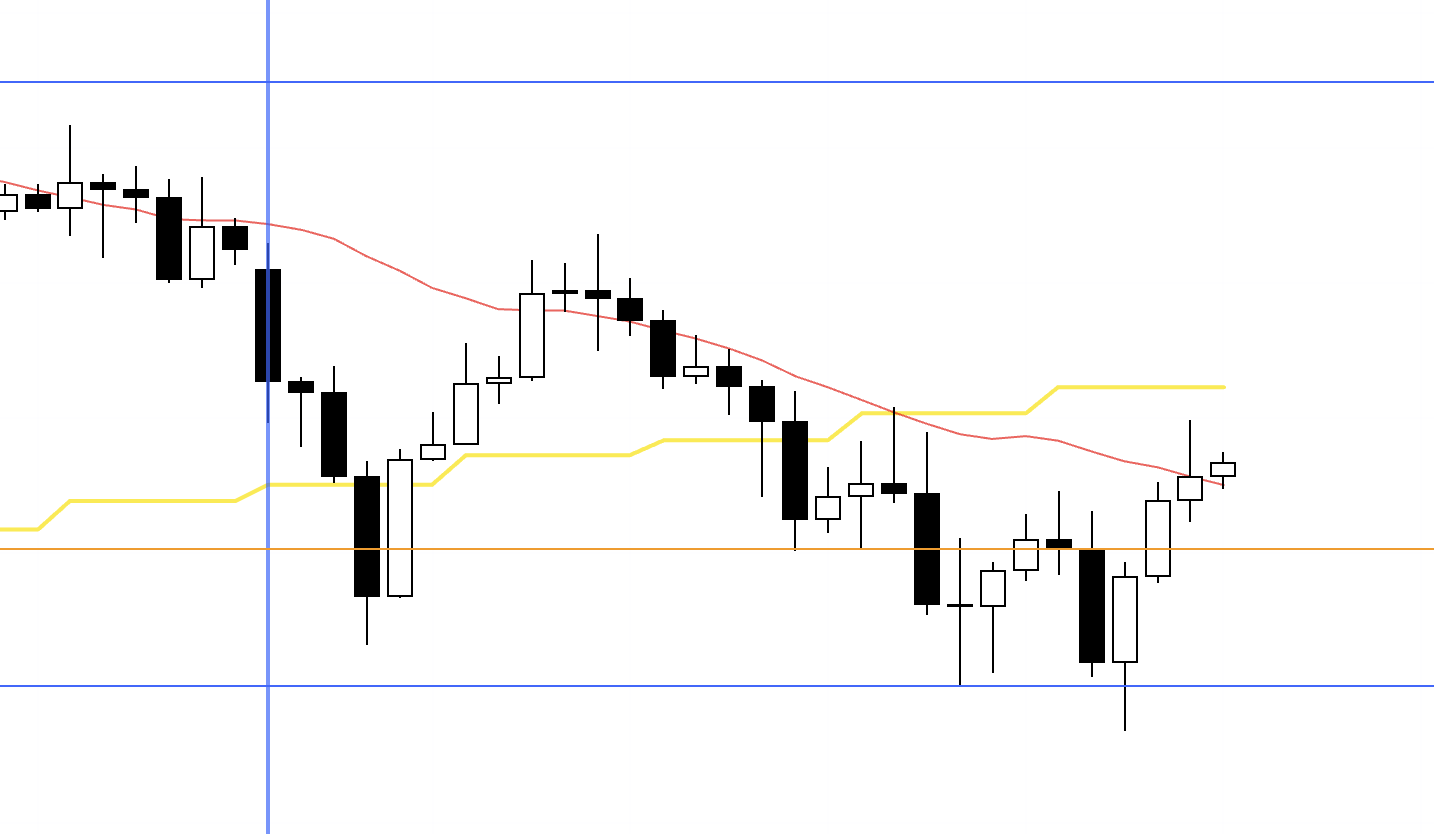

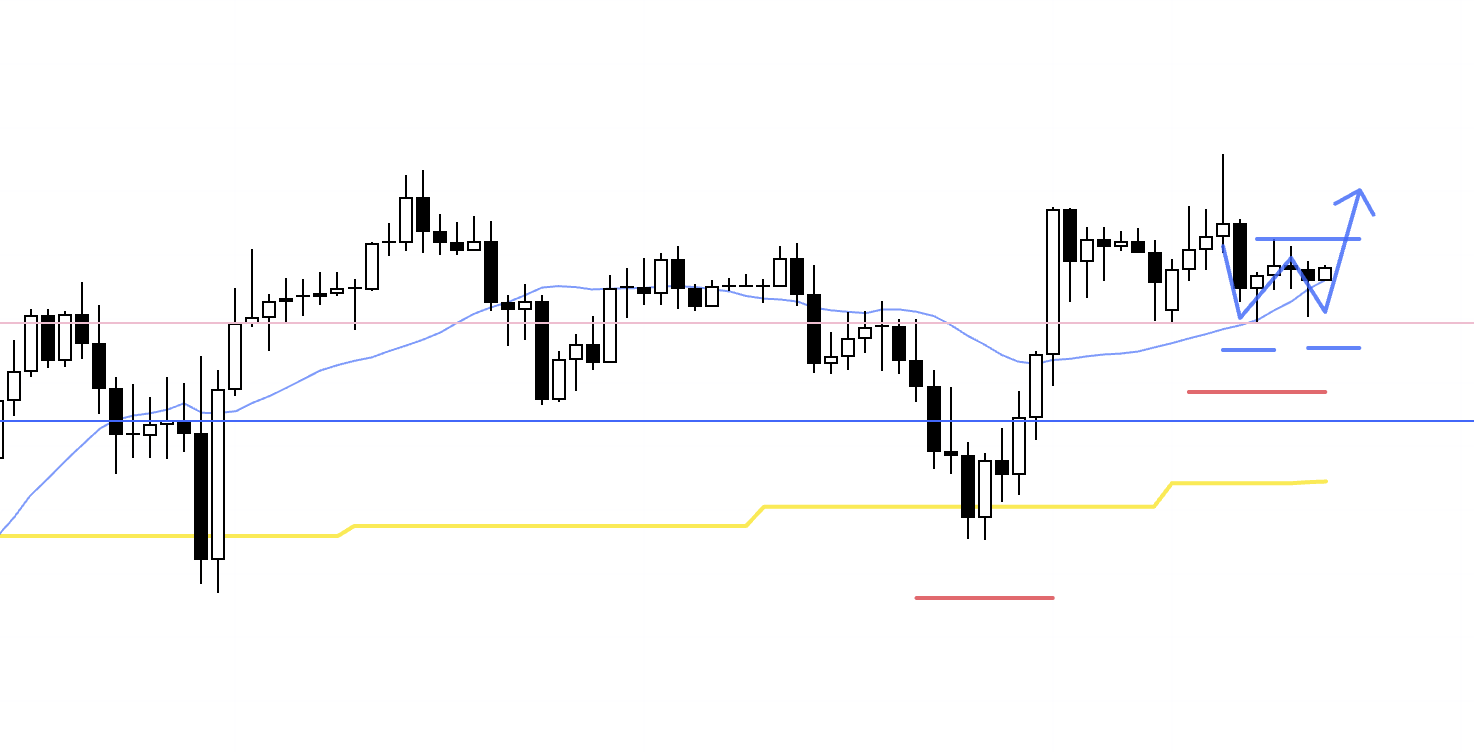

EURUSD 4h

This is the 4h chart of EURUSD.

The only trade I took in EURUSD this week was at this single point.

This was the long setup I had planned in Sunday’s scenario, and because the market unfolded in exactly that form, I traded it according to the scenario.

After that, there were no conditions for either buying or selling, so this ended up being my only trade this week.

I will explain this trade in detail below.

Now I will walk through the trade I took this week, using my real-time notes from each moment.

〜・〜・〜・〜・〜・〜・〜・

December 1 (Mon)

EURUSD

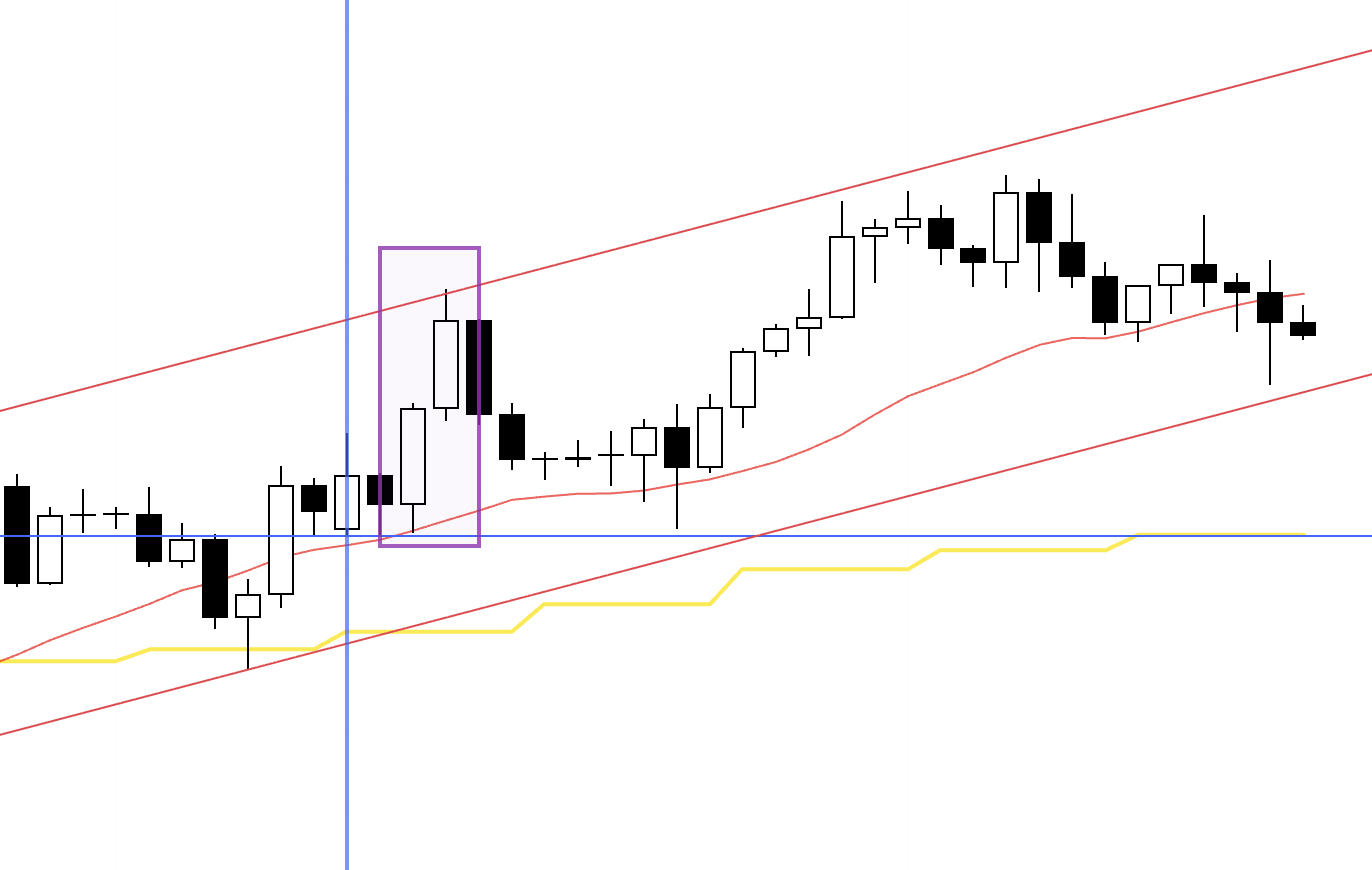

4h chart from Sunday’s scenario blog

In Sunday’s scenario blog, I had outlined a plan to look for buying opportunities at this 4h higher-low area.

This long is a trade where I need to be a bit careful, and as I also wrote in Sunday’s scenario, I am planning to secure half of the profits around the key level near the orange line above and to manage the position accordingly.

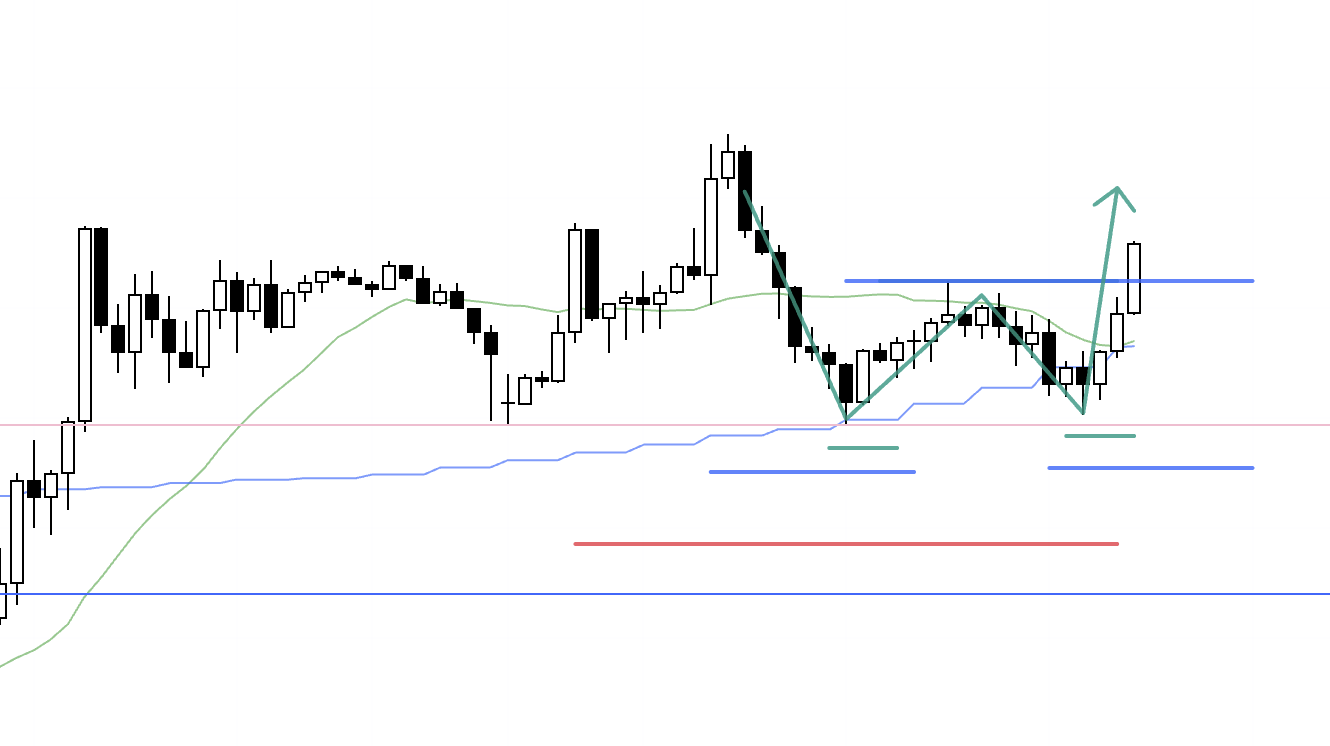

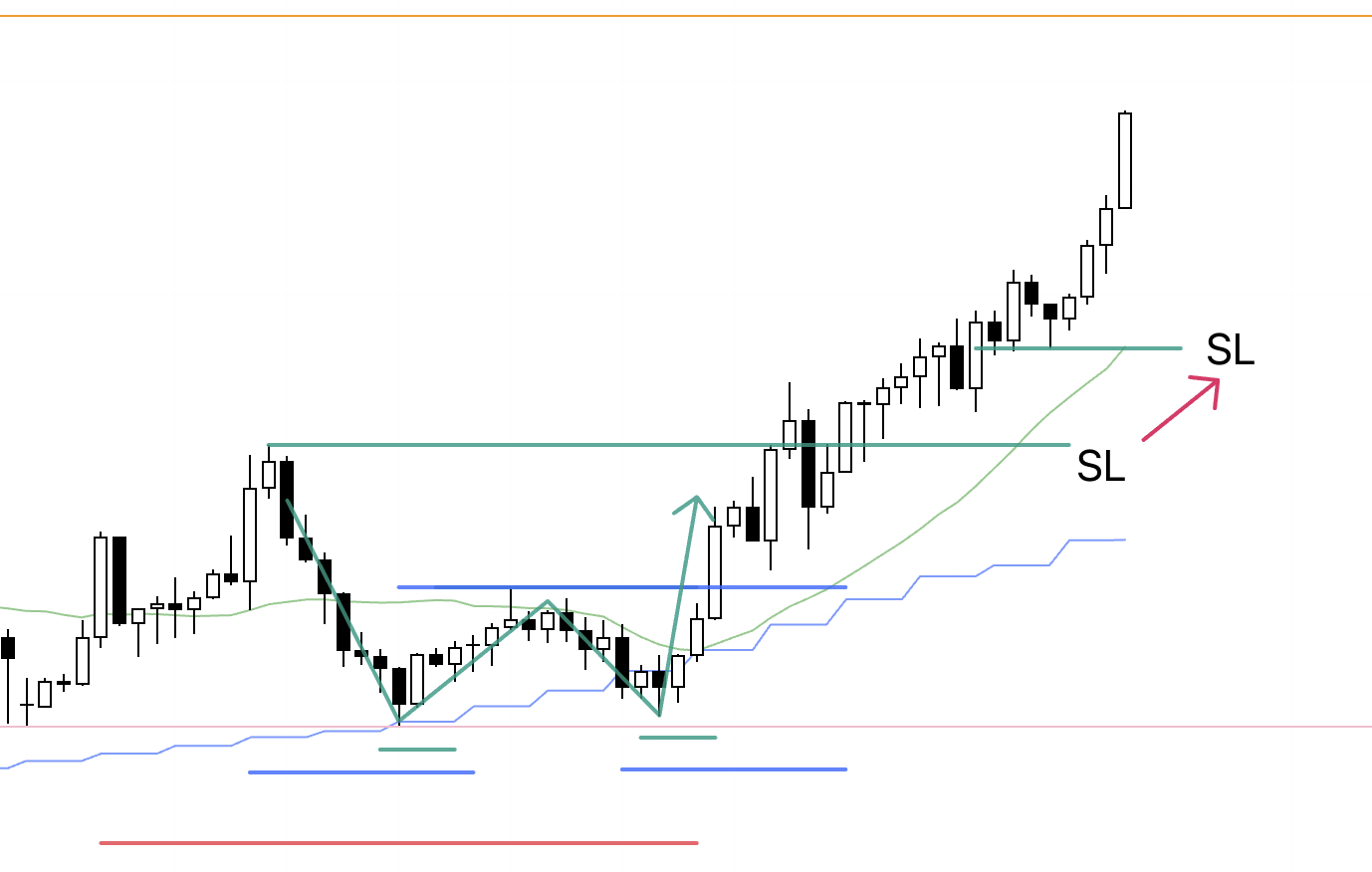

4h

Here is the current 4h chart, and price has just formed a new higher-low point, so I have placed a buy stop order.

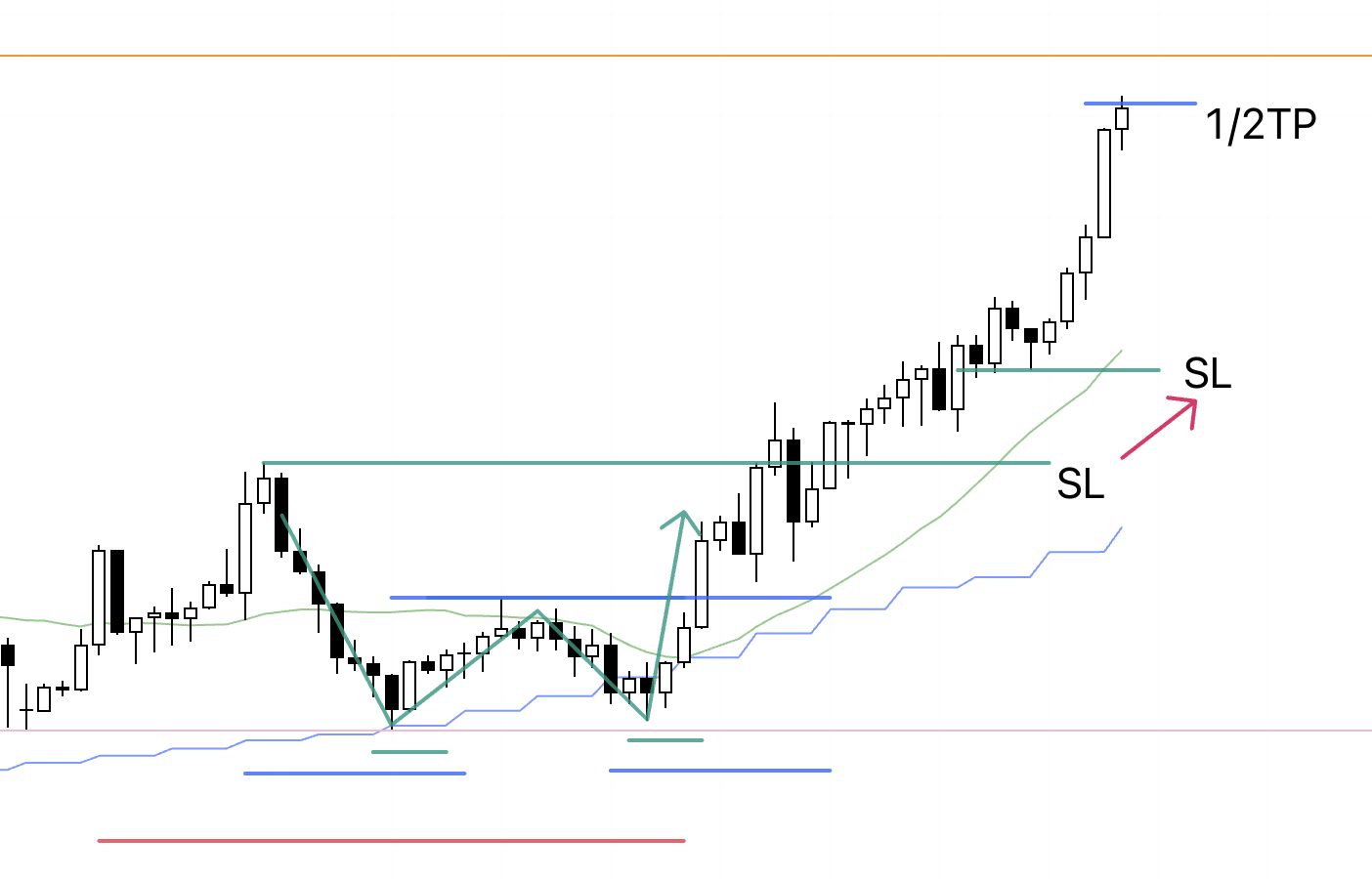

1h

On the 1h chart, you can see that within the 4h higher-low area, the 1h has also formed a triple bottom, so I am looking to enter once price breaks the most recent high.

This low also coincides with a line that has functioned as both support and resistance in the past, so if a 1h uptrend starts from this level, a temporary strong edge on the long side will appear.

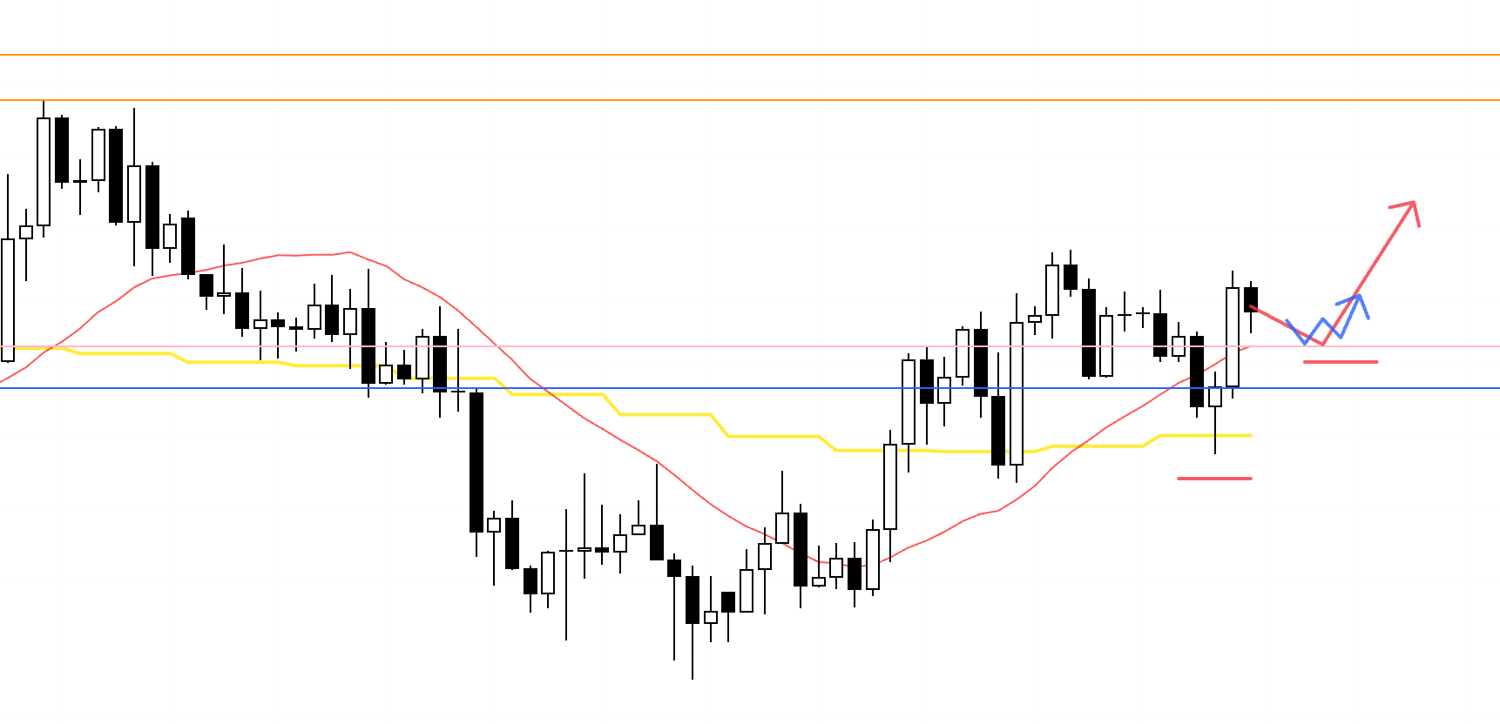

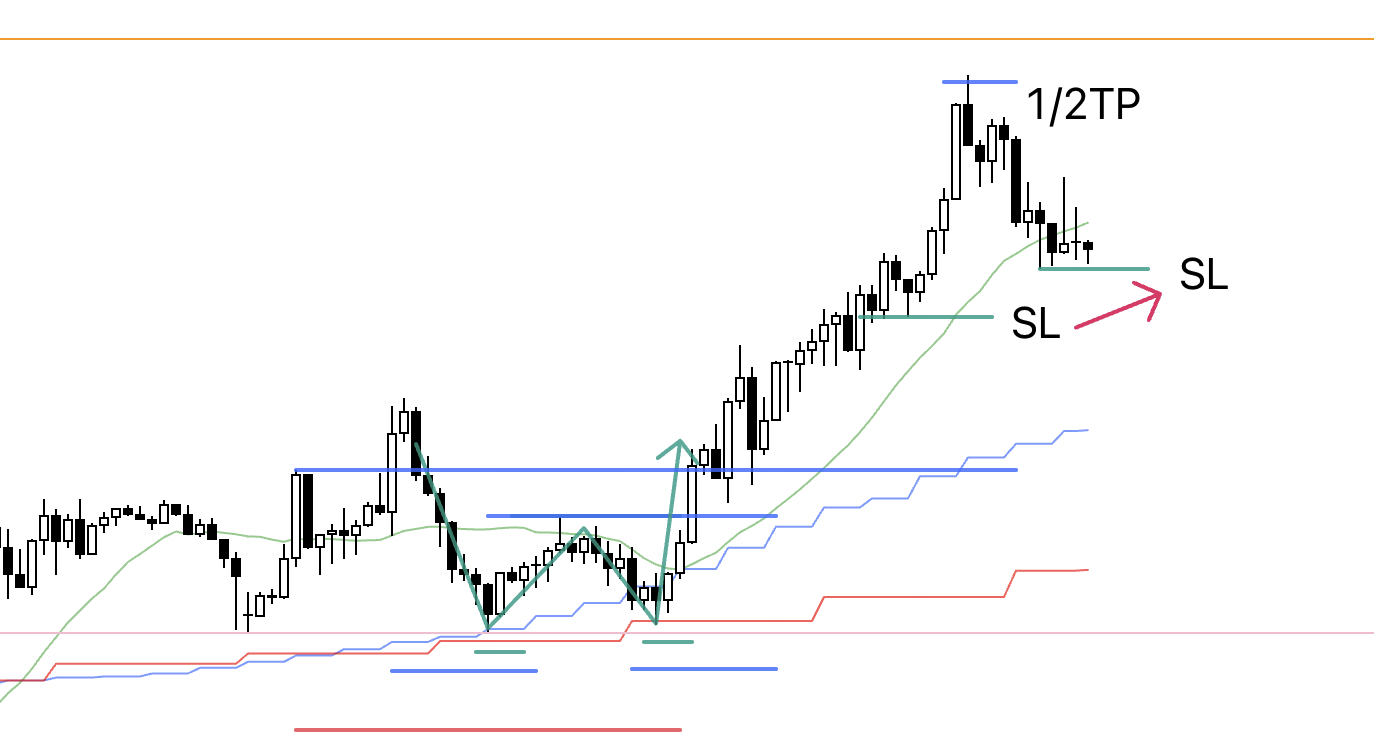

15m

The entry has been triggered.

In this case, the 1h breakout of the high and the 15m breakout of the high are the same level.

As I noted in the scenario, this is a trade where the higher the market goes, the greater the risk that selling pressure will build, so it is not a trade to hold slowly and for a long time, and this time I will hold it only until the trend breaks on the 15m.

And as I also wrote in Sunday’s scenario, there is a risk that selling pressure will increase around the orange line above, so once price reaches that area I plan to secure profits on half of the position.

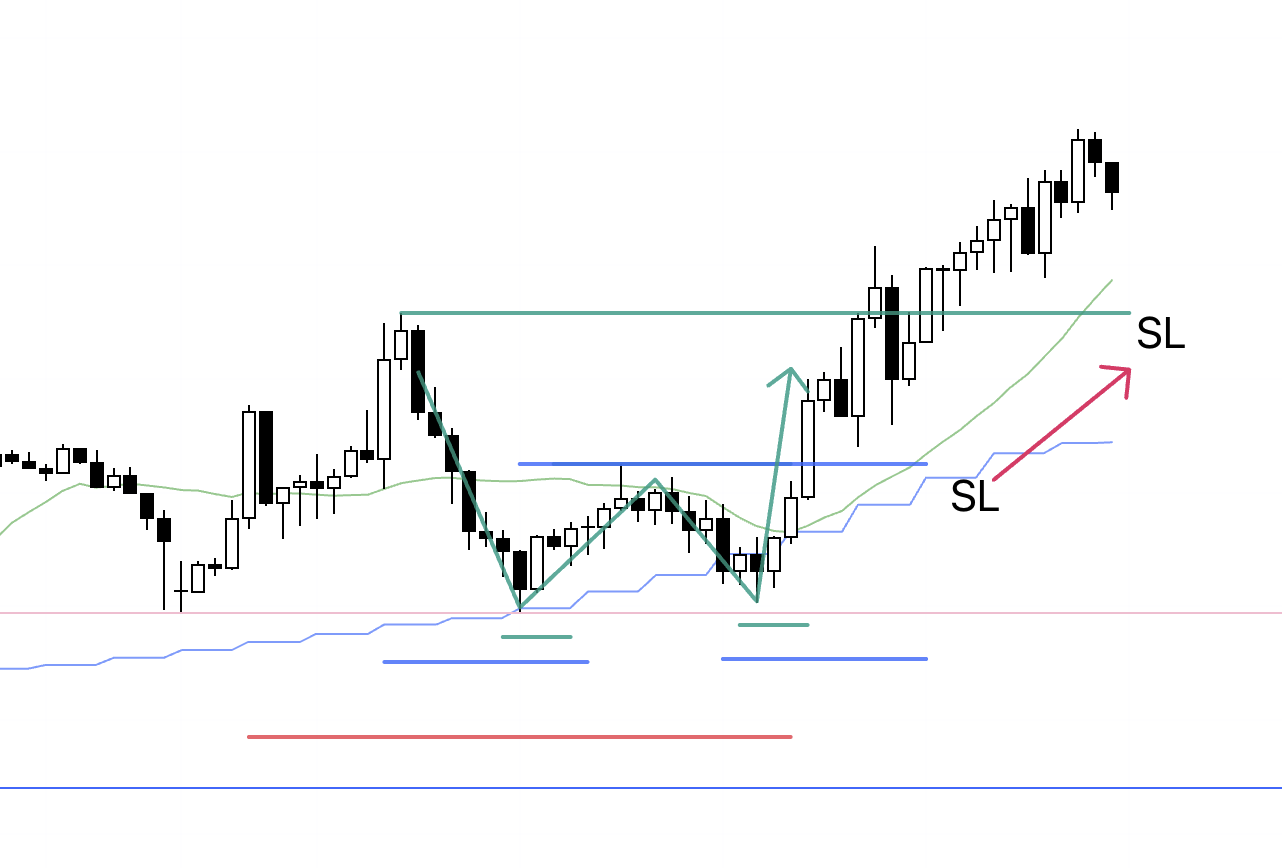

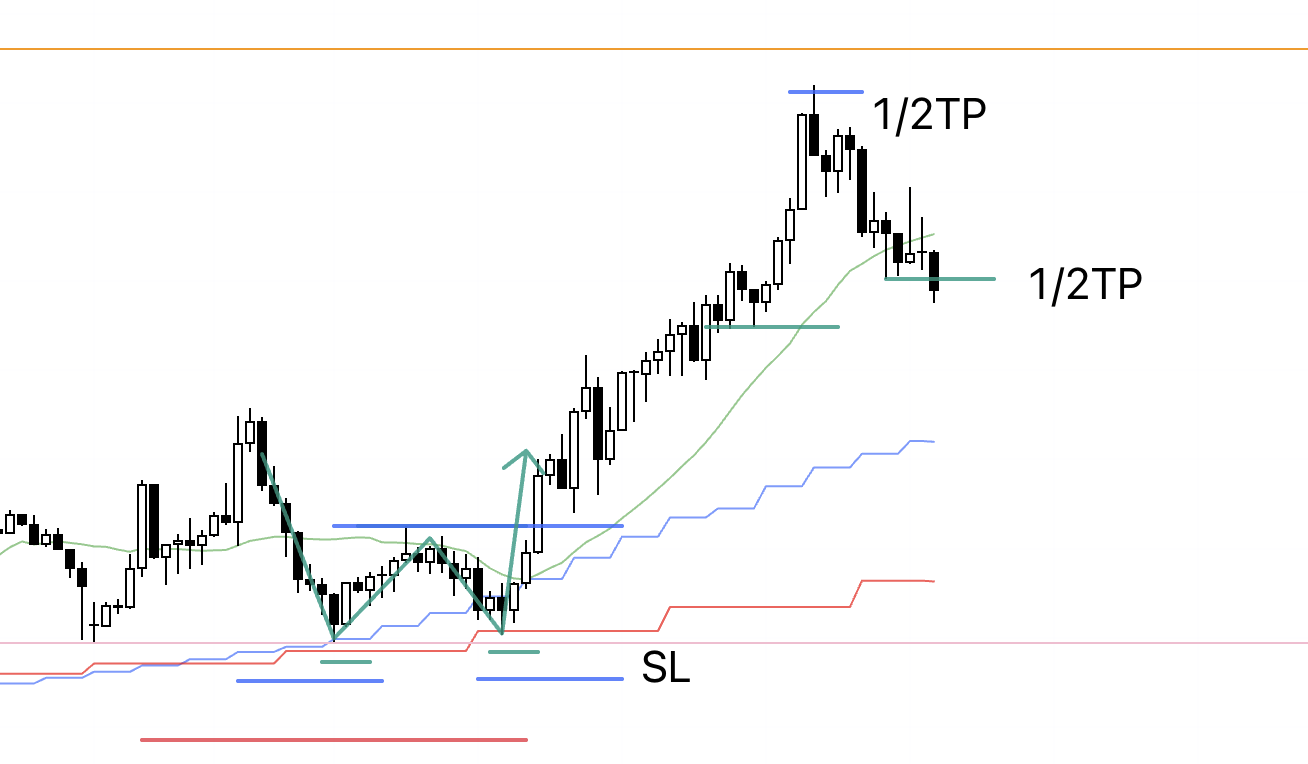

15m

I have moved the SL up.

15m

I have moved the SL up.

15m

I have moved the SL up.

15m

Price has approached the orange line, so I have secured profits on half of the position.

15m

I have moved the SL up.

15m

The trailing stop has been hit, and this trade is now closed.

〜・〜・〜・〜・〜・〜・〜・

That is all.

This week I ended up taking only this one trade in EURUSD.

Many people feel unsatisfied with having only a single trade and tend to force things by trying to manufacture opportunities here and there, but what matters is to “do only what you should do, only when you truly should be doing it.”

I always map out in advance, in my scenarios, the conditions under which an edge will appear and where the risks lie, so for me, trading in areas without an edge is a very bad thing.

How many trading opportunities there are in a given week depends on the market and is not something I can control.

If there are no trading opportunities at all in a week, then not trading even once that week is the correct course of action.

No matter how few trades you take, if you only keep trading in situations where you have an edge, your capital will grow, and focusing solely on that is actually the shortcut.

As I have written many times, for me the bulk of the work is already done at the stage of building scenarios and preparing in advance.

After that, all I do is look at the chart and execute according to the scenarios I have laid out.

It may sound or look simple, but it is precisely within this simplicity that the real skill lies.

How far you have gone in preparing and practicing, and the experience you have built up there, will be tested.

Trading is not something you can do just because you understand it conceptually.

You need to train your eye to spot signals on charts where the outcome is still unknown, and in order to keep executing those signals with consistency “no matter what,” you need a solid trust that comes from having made the law of large numbers work “with your own hands” many times.

True skill lives inside simplicity, and that is what professional trading is.

Thank you for reading to the end.

I hope this blog will serve as a hint for those who are about to build their own strategies and for those who are struggling to achieve consistency.