Hello.

I’ll lay out my trading scenarios for the coming week.

I publish this “Trade Scenarios” blog every Sunday.

And every Saturday I post a “Weekly Trade Report” where I explain how I actually thought about the market and executed my trades during the week.

By reading this trading-scenario blog together with the Weekly Trade Report, I think you’ll be able to use my process as a practical reference for how to think ahead of time, what to wait for, and how to execute in a consistent way.

For the underlying strategy, please refer to my blog posts on Dow Theory and multi-timeframe analysis.

A “scenario” is not a forecast.

It is not a prediction, but my personal plan that says, “If the market does this, I will do that.”

I don’t try to predict the market, and this is not intended as such, so please keep that in mind.

Nor is this a set of instructions telling you what to buy or sell, or a service providing trading signals.

It does not guarantee any future profits; it is provided purely for educational purposes, using my own consistent process as the example.

I cannot take responsibility for any outcomes of the trades you place, so please trade at your own risk.

With that, let’s start with USDJPY.

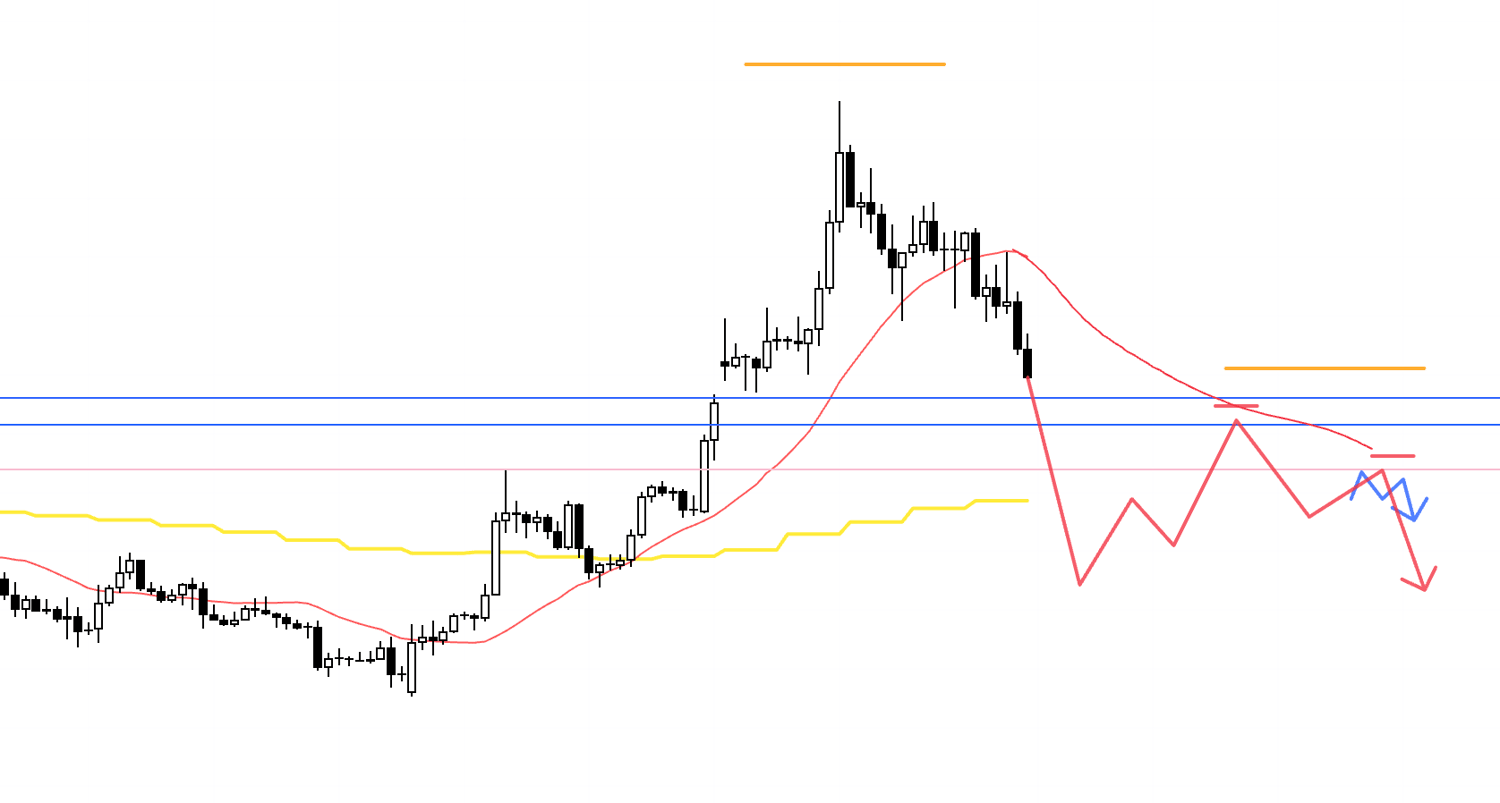

(On my charts, the colors of the lines I draw represent each timeframe: orange for the daily, red for 4h, blue for 1h, and green for 15m.)

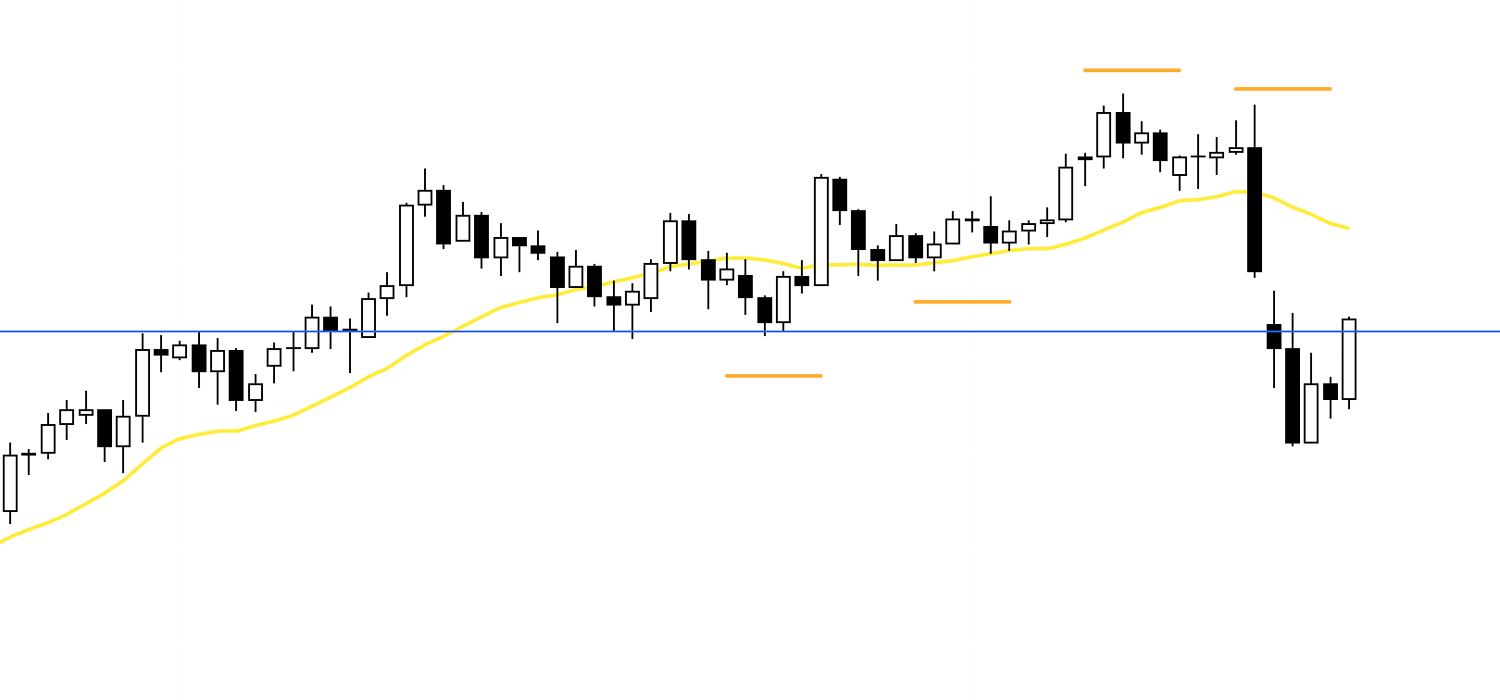

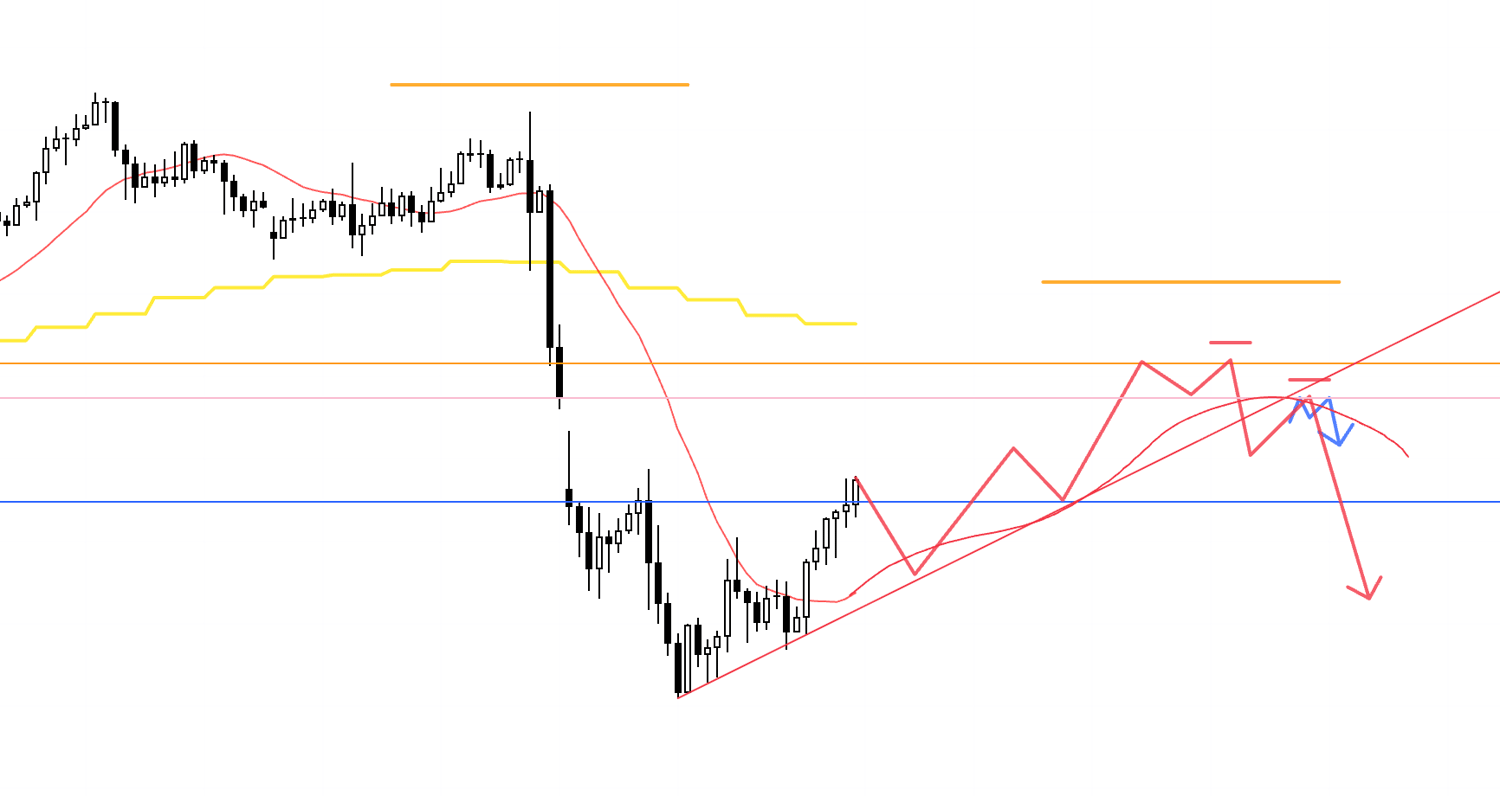

USDJPY

Daily

On the daily chart, the previous uptrend of higher lows and higher highs has ended.

Price has now moved into a downtrend of lower highs and lower lows.

From here, the question is whether to trade the upward leg that forms the daily pullback high, or to look to join the selling as a sell-the-rally move.

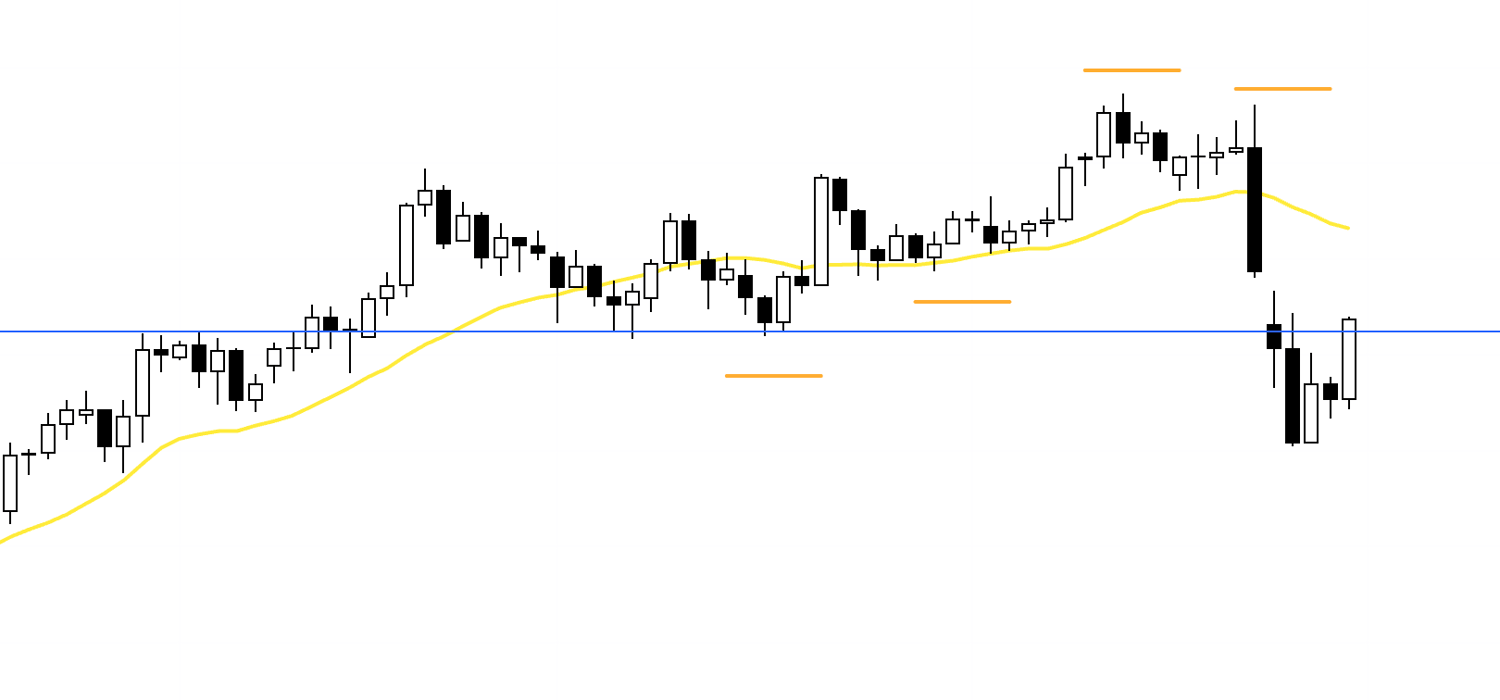

4h

If, as in this example, price forms a higher low on the 4h, supported by some kind of support line, I will start considering long entries on the lower timeframes.

However, this would be counter to the daily downtrend, so the higher price pushes, the greater the risk that sellers step in to sell the rally.

So I will only take an entry if it offers acceptable risk–reward, and if I do hold a position, I will manage it proactively—for example, taking profit on half the size if price reaches the orange line drawn above.

4h

There are several possible patterns for the upswing, but the approach is the same.

If the market is clearly supported and starts putting in higher lows, I will look for buys on the lower timeframes.

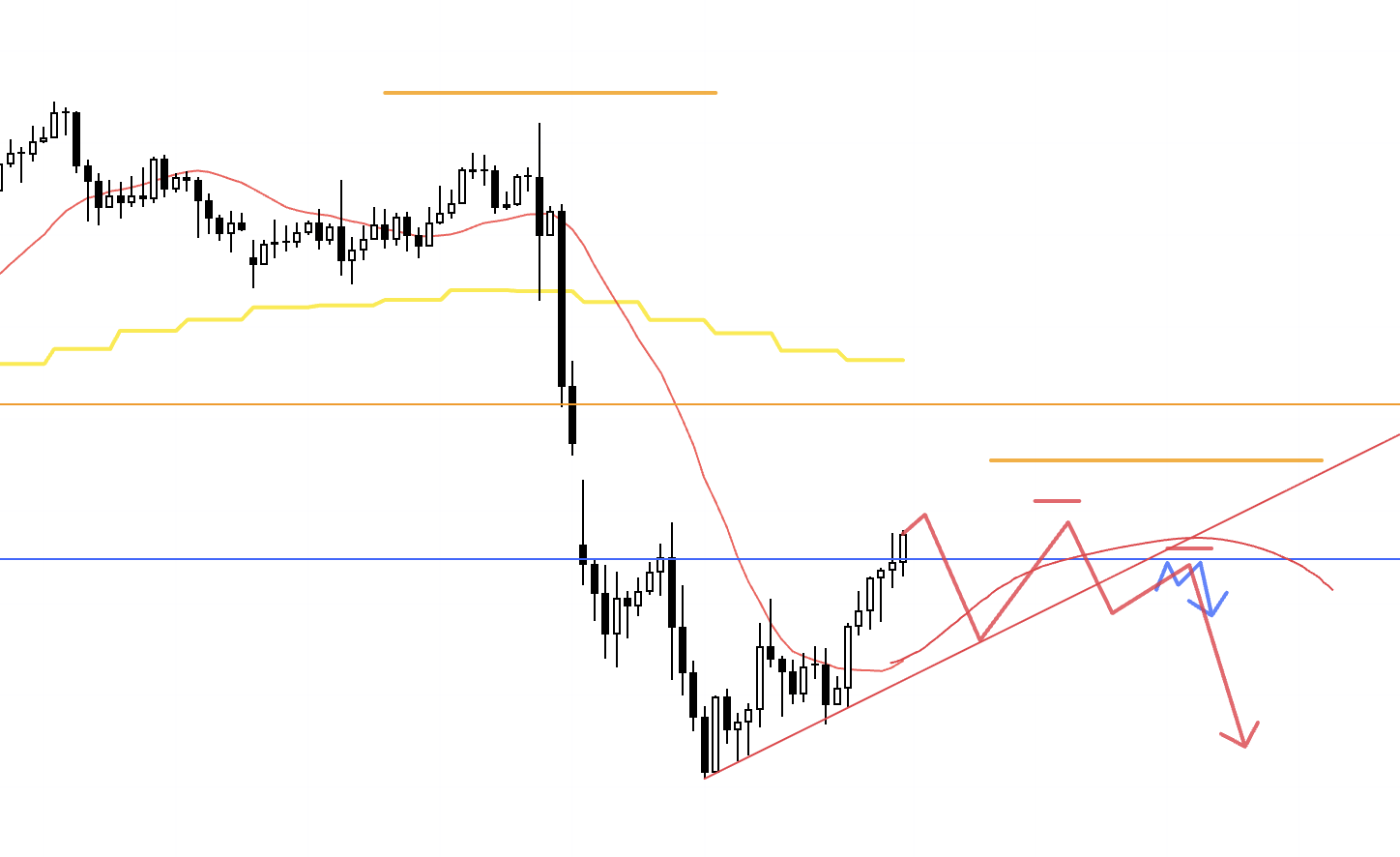

4h

At the point where the structure rolls over from an upswing into a downtrend on the 4h, I will start looking to sell on the lower timeframes in order to ride the daily sell-the-rally move.

4h

Here as well, there are various possible patterns, but what I do is the same.

I plan to build out the specific scenarios each time in real time, based on how the chart actually moves.

Next, let’s take a look at EURUSD.

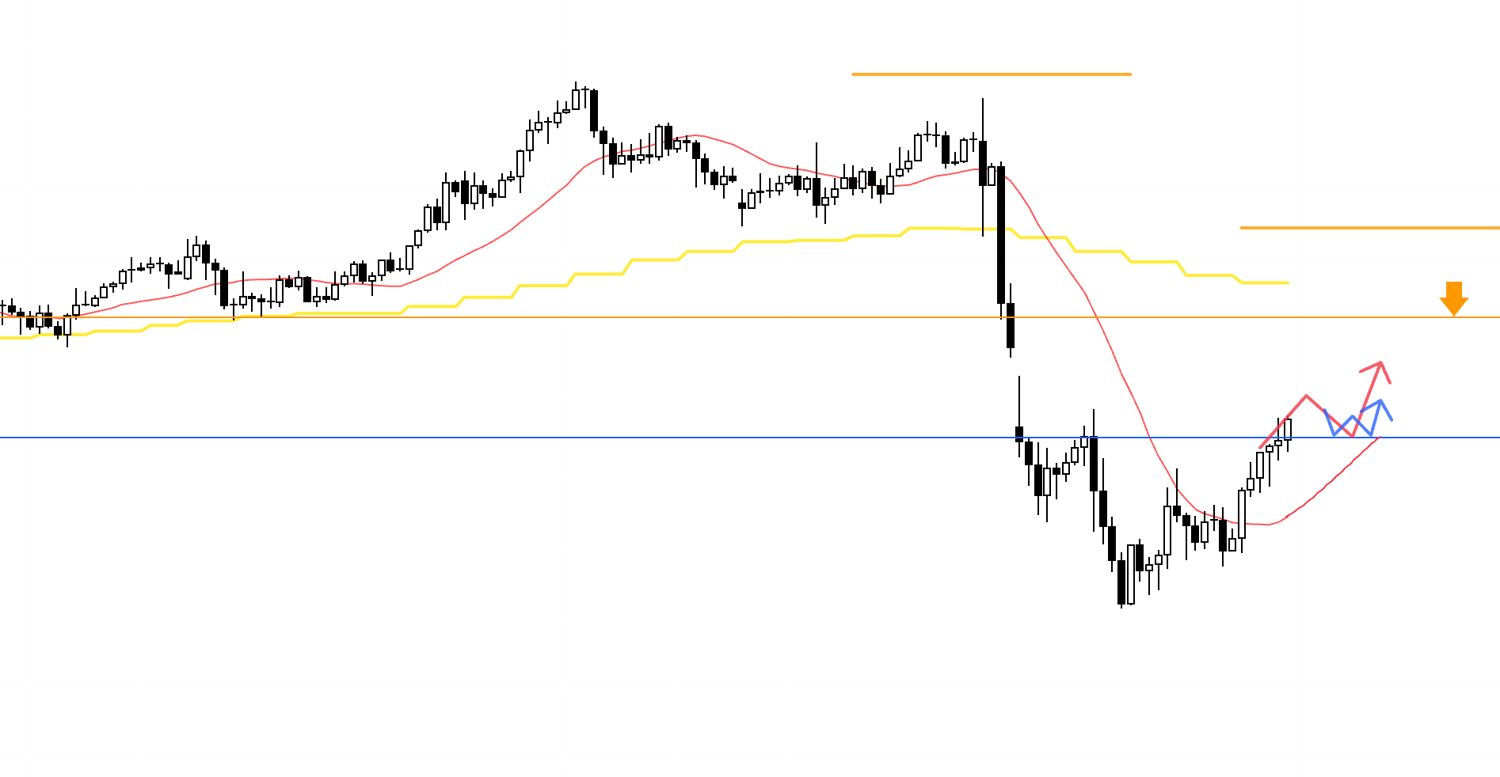

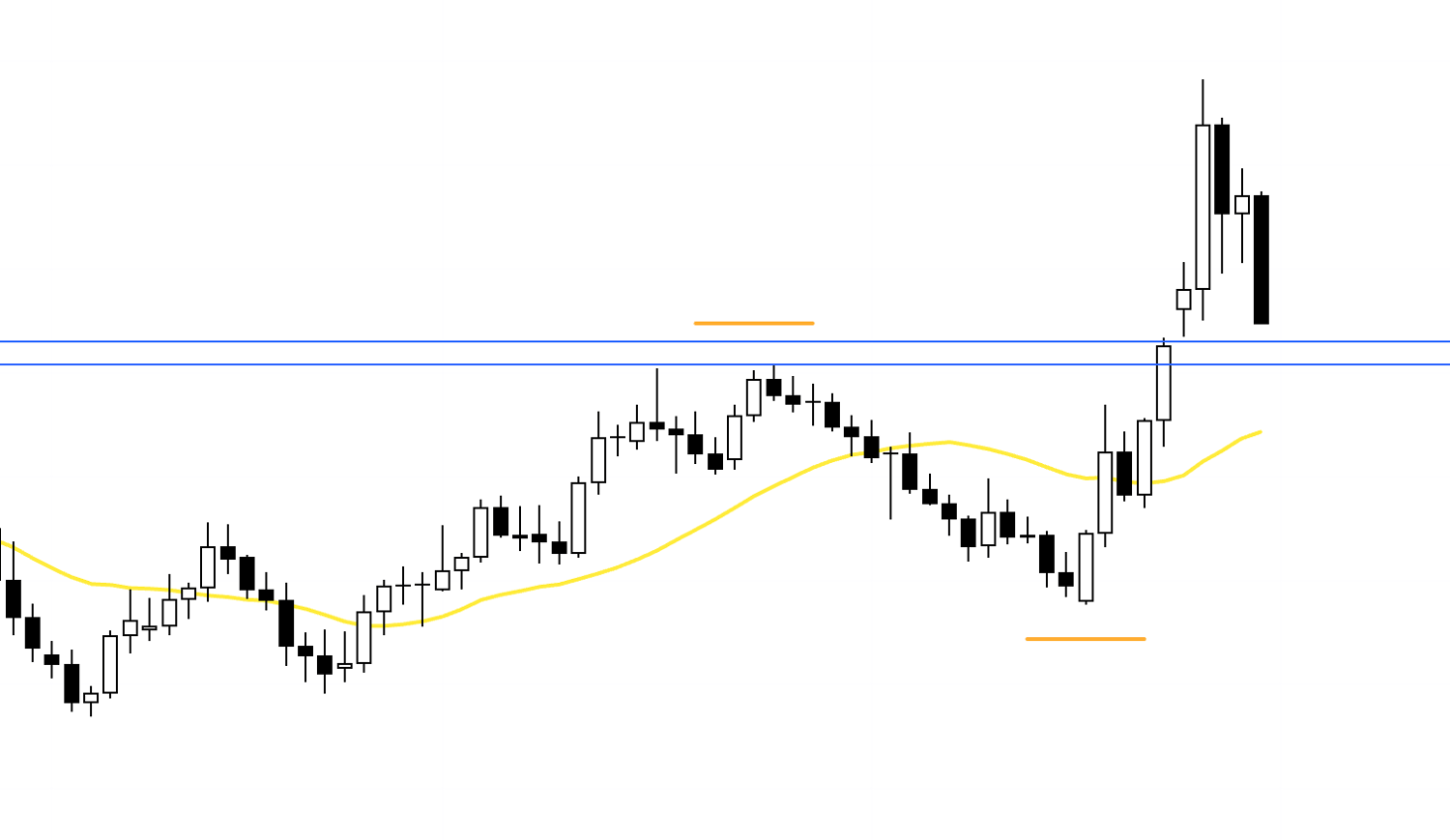

EURUSD

Daily

Price has broken above the previous high.

On the daily chart, the trend has now turned up.

This is a situation where I would like to wait for a pullback to buy.

There is a support line just below, so if price starts to hold around this area, I would like to look for buying opportunities.

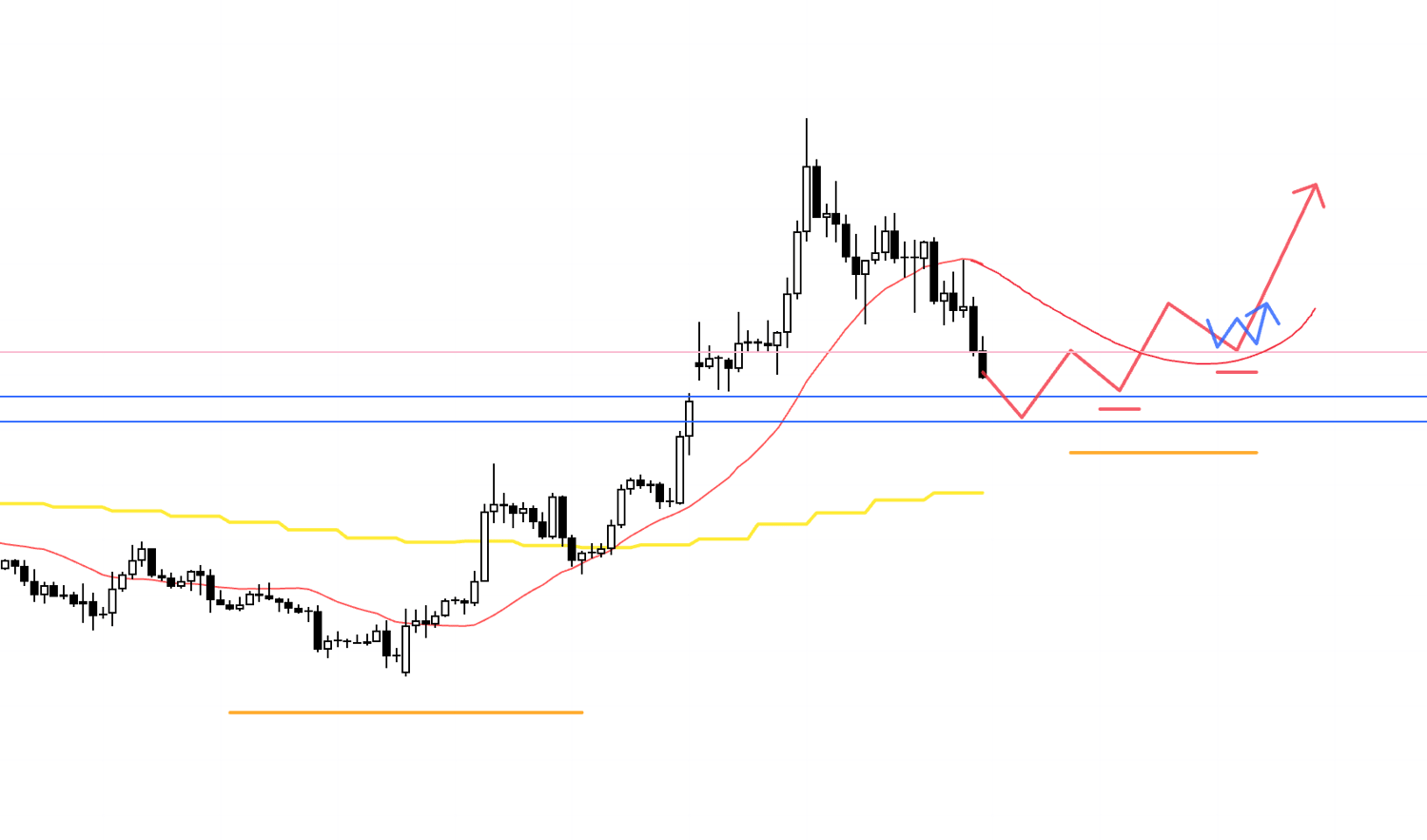

4h

If, as in this example, the 4h downtrend ends and price starts to put in higher lows and break to new highs again, that move will be the daily pullback-buy phase.

In that case, I would like to look for long entries on the even lower timeframes.

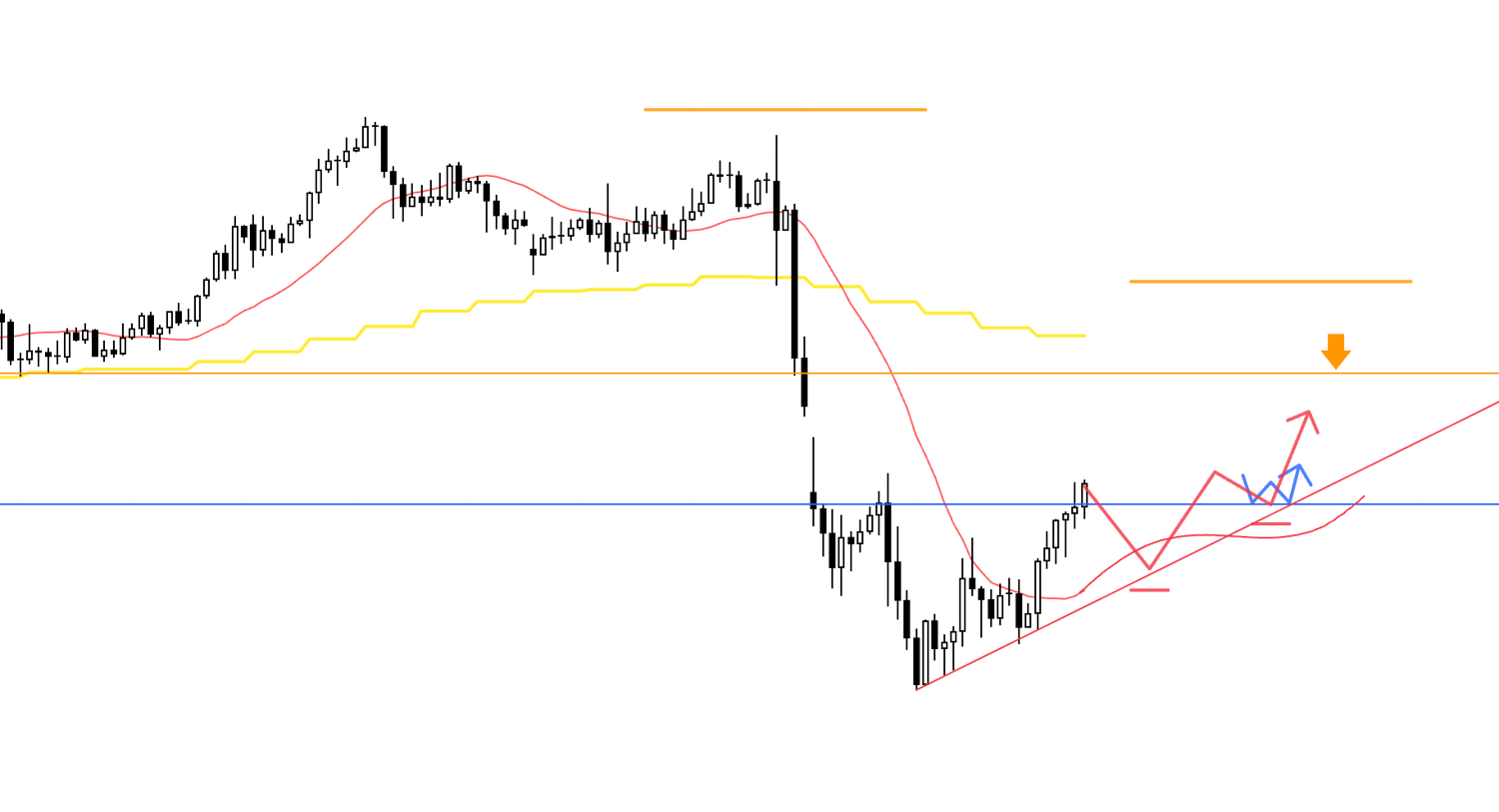

4h

At the moment, with the support line close by and the daily moving average (yellow) just below, it is difficult to justify selling immediately.

But if price were to break down through these lines and the moving average as well, then after it has formed the daily sell-the-rally bounce via a short-term 4h uptrend, I will look to sell on the lower timeframes at the point where the 4h starts to put in a lower high and attempt to roll back into a downtrend.

That is all for now.

I hope this is of some help.

These are scenarios as of now, and once the week actually gets underway, I plan to update and build them out each time as we see how price actually moves.

These trade scenarios are purely my own plan, so if you have not yet settled on your own trading style, feel free to use them as a reference when building your own strategy.

But if your own trading approach is already well established, please do not let my trade plan throw you off—stick firmly to your own rules.

Thank you for reading all the way to the end.