Hello.

I’ll lay out my trading scenarios for the coming week.

I publish this “Trade Scenarios” blog every Sunday.

And every Saturday I post a “Weekly Trade Report” where I explain how I actually thought about the market and executed my trades during the week.

By reading this trading-scenario blog together with the Weekly Trade Report, I think you’ll be able to use my process as a practical reference for how to think ahead of time, what to wait for, and how to execute in a consistent way.

For the underlying strategy, please refer to my blog posts on Dow Theory and multi-timeframe analysis.

A “scenario” is not a forecast.

It is not a prediction, but my personal plan that says, “If the market does this, I will do that.”

I don’t try to predict the market, and this is not intended as such, so please keep that in mind.

Nor is this a set of instructions telling you what to buy or sell, or a service providing trading signals.

It does not guarantee any future profits; it is provided purely for educational purposes, using my own consistent process as the example.

I cannot take responsibility for any outcomes of the trades you place, so please trade at your own risk.

With that, let’s start with USDJPY.

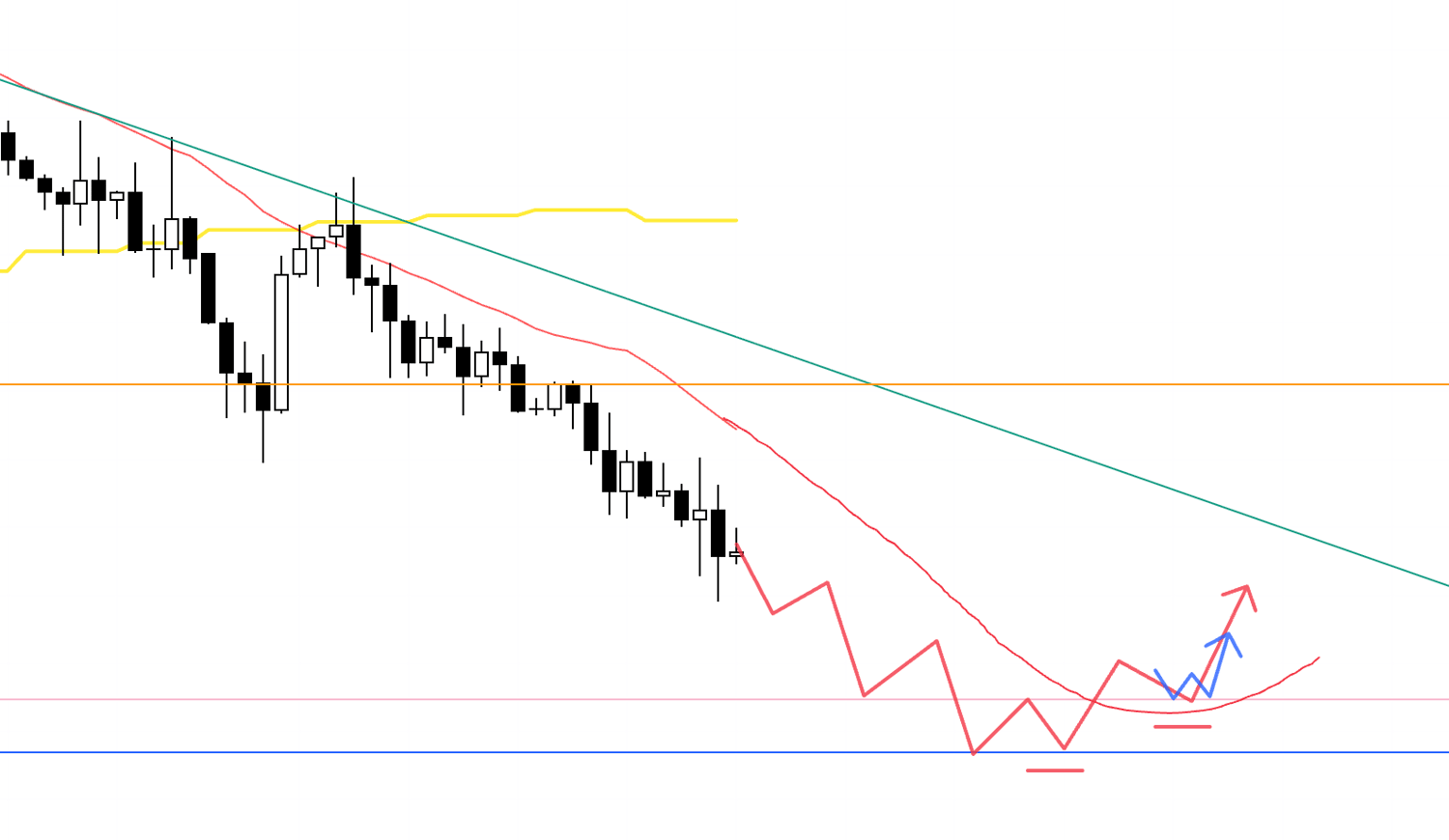

(On my charts, the colors of the lines I draw represent each timeframe: orange for the daily, red for 4h, blue for 1h, and green for 15m.)

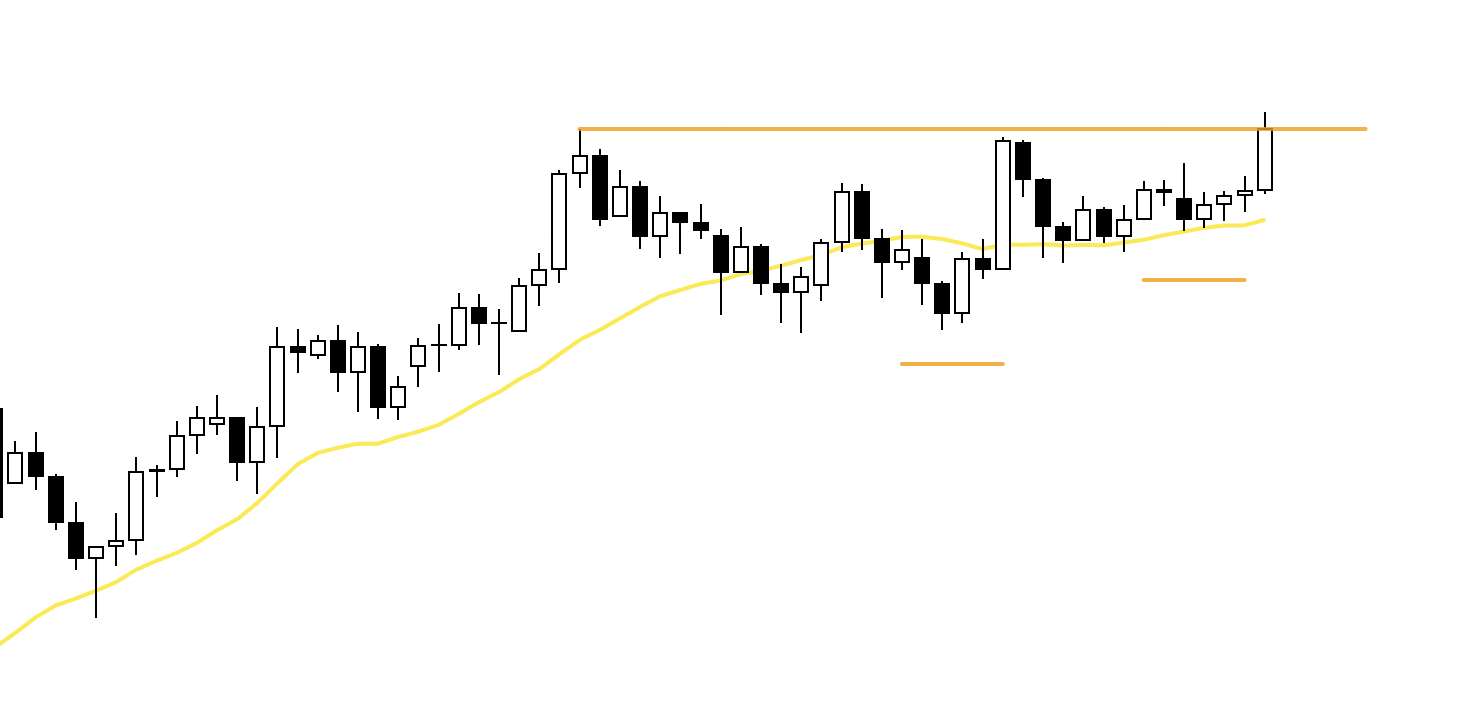

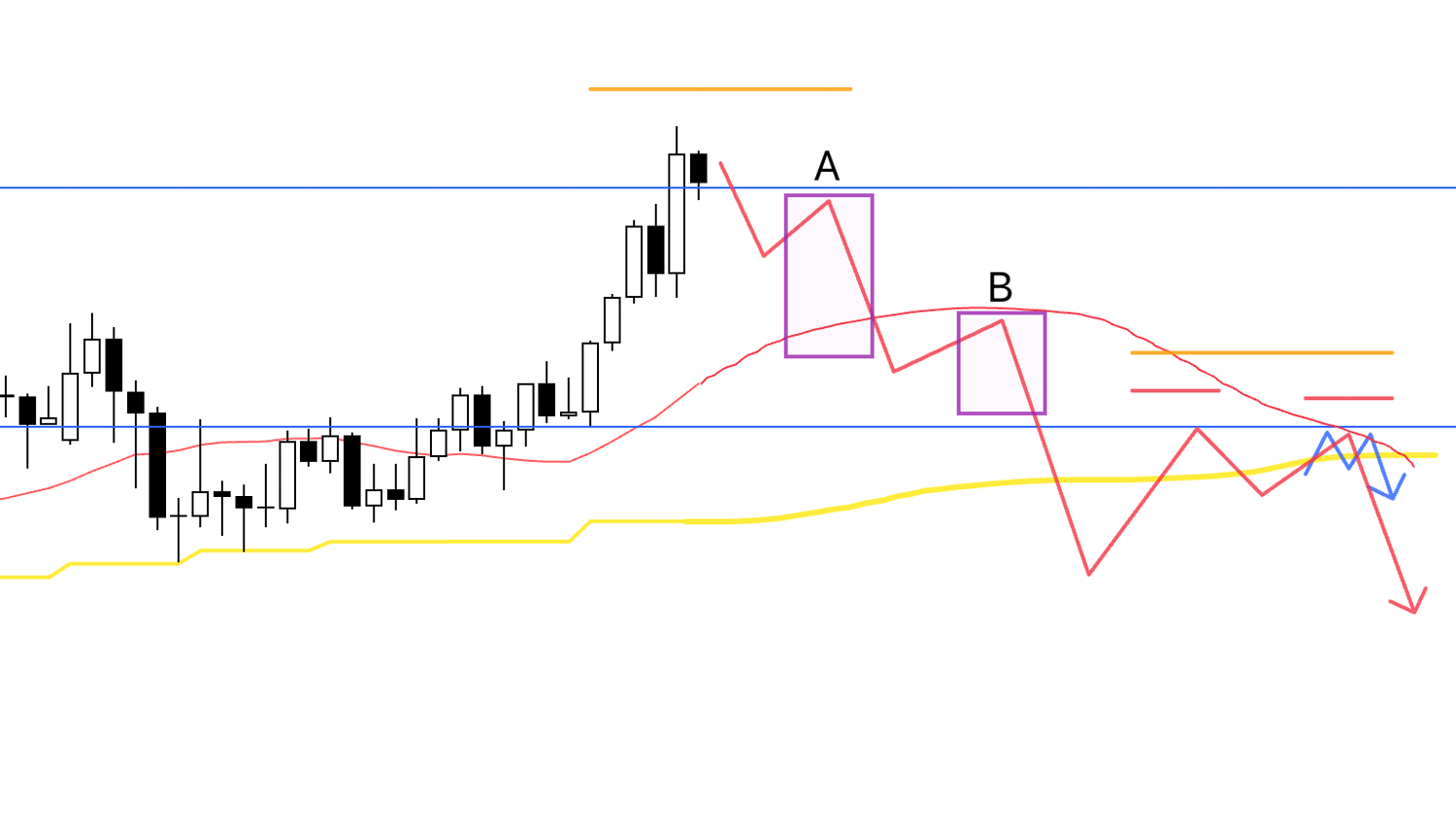

USDJPY

Daily

On the daily chart, price has been making higher lows and printing new highs, so the trend is up.

However, it’s debatable whether the previous high was clearly broken, and the candle closed with a wick.

I want to build my scenarios while watching how price behaves around this high.

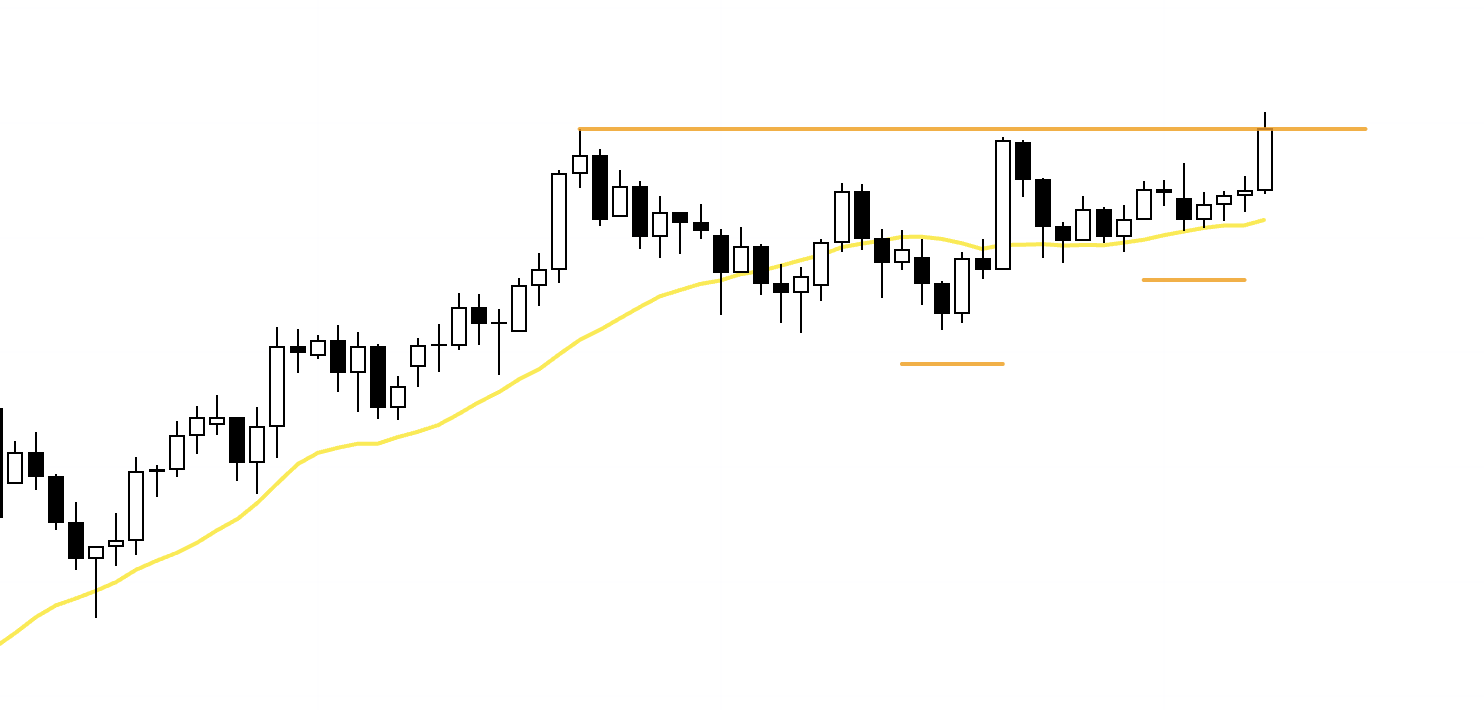

4h

If, like this, price is supported by the blue line and forms a 4h higher-low structure, I’ll look for longs on the lower timeframes.

That said, the weekend rally hasn’t broken the trend on 1h yet—it’s still moving higher.

The reason I closed my trade was simply my rule and preference not to hold positions over the weekend.

In other words, on 1h the uptrend is still intact and already extended, so entering from here carries the risk of buying the top.

So I want to wait for 1h to break the higher-lows / higher-highs structure, and then look to trade the point where a new uptrend starts again.

4h

On the other hand, if price ultimately can’t push higher and instead forms a 4h lower-high structure as if capped by this blue line, and also shows a setup where moving averages are acting as resistance, I’ll look for shorts on the lower timeframes.

However, the daily chart is still in an uptrend, and the more it drops, the greater the risk that dip-buying demand on the daily timeframe steps in.

So I want to judge it by whether an entry appears with risk-reward that makes sense—such as down to the pink line drawn below.

If I take a position, I’ll manage it by taking partial profits (e.g., securing half) as price approaches that area.

4h

Even if price is capped by the upper blue line and forms a 4h lower-high structure, I won’t consider selling in a situation like point A, where the moving average (red) comes up from below and acts as support.

Even if price breaks below the moving average and then forms a 4h lower-high structure as if being capped by the moving average like point B, I’ll pass because it’s close to the daily moving average (yellow) and a key level—meaning it’s a daily dip-buy area.

If price then breaks below the daily moving average and that level, and forms a daily lower-high structure that’s visible on the daily chart as well, I’ll look for shorts within that, using the 4h lower-high structure as the framework.

4h

The daily dip-buy area I was treating as a risk for shorts could instead become an opportunity.

If 4h forms a higher-low structure at that point, we need to follow the daily dip-buy move higher, and the edge for longs increases significantly.

Now let’s take a look at EURUSD.

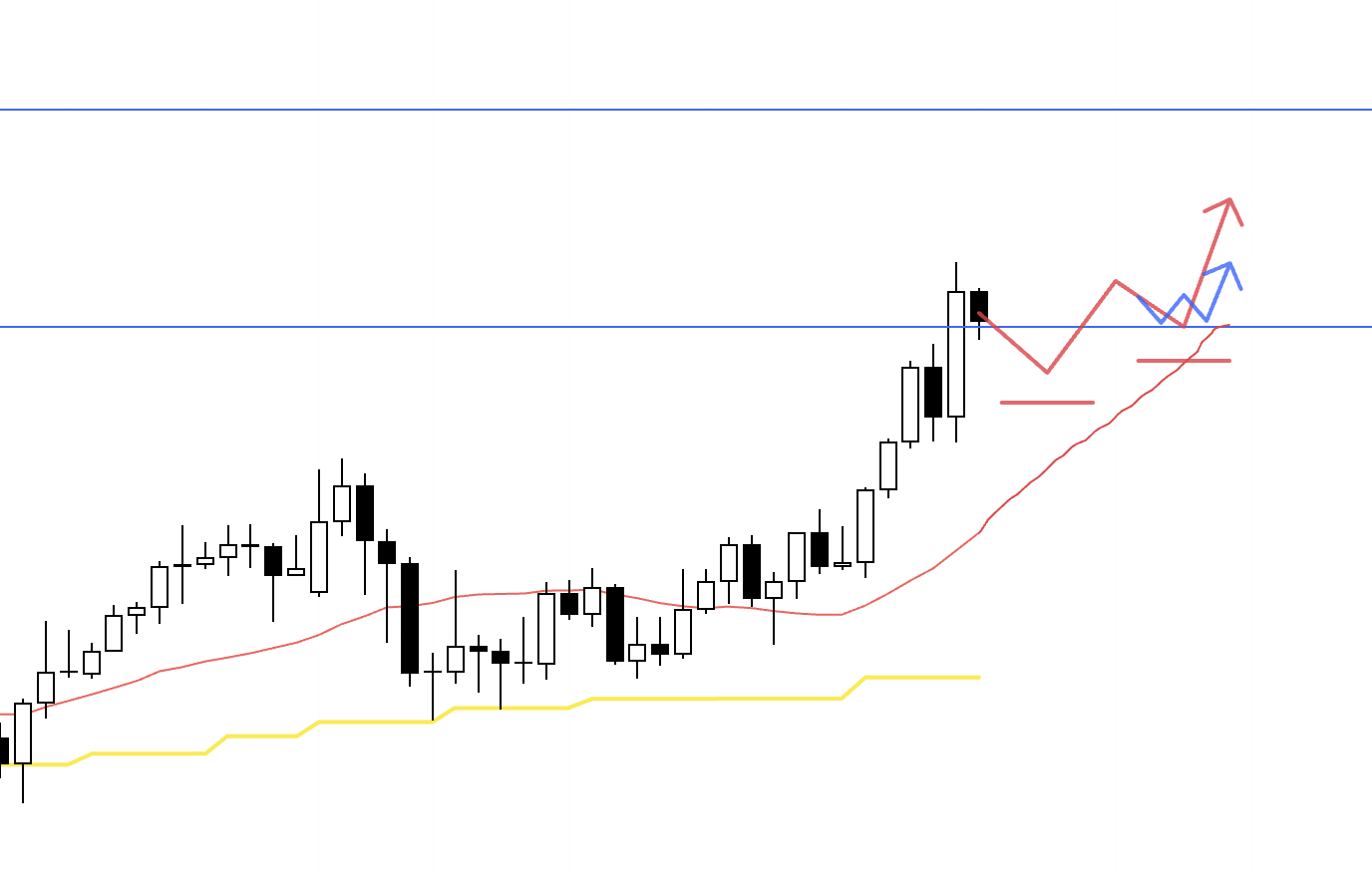

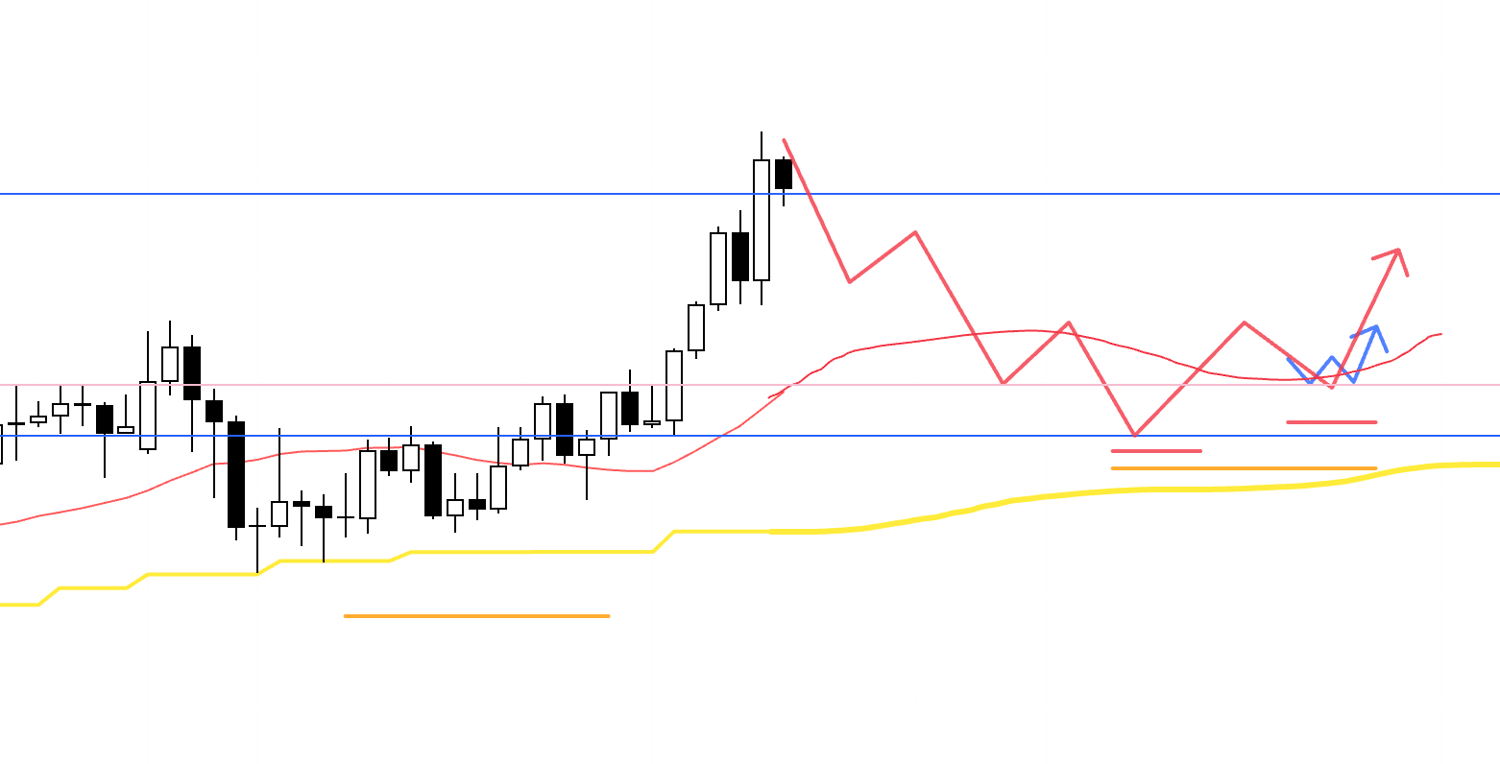

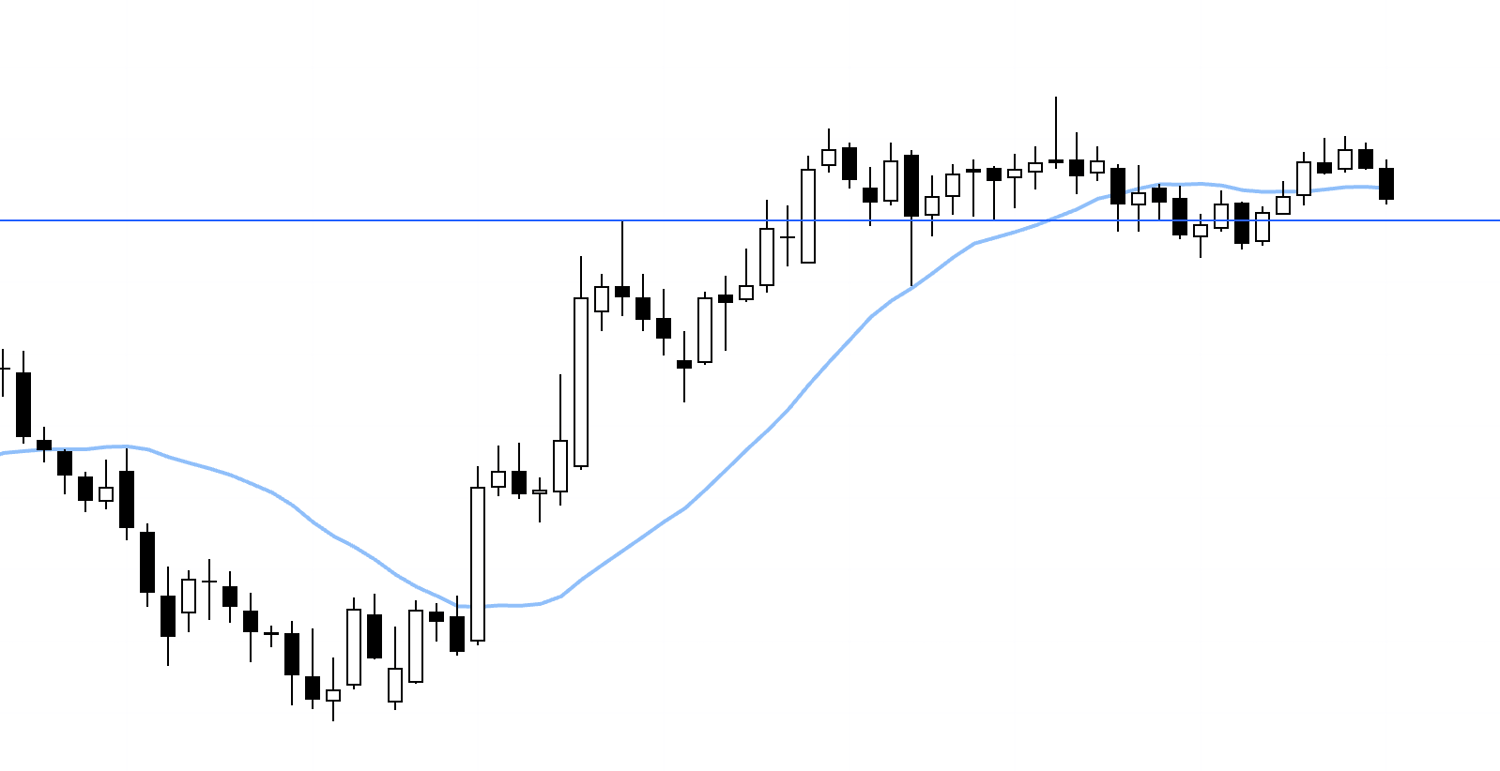

EURUSD

Daily

On the daily chart, price had been in an uptrend—making higher lows and printing new highs—but the upside was capped in a double-top-like manner, and the uptrend broke when the most recent low was taken out.

From here, the higher it bounces, the more sellers will look to fade the move, so I also want to look for short-on-retracement opportunities.

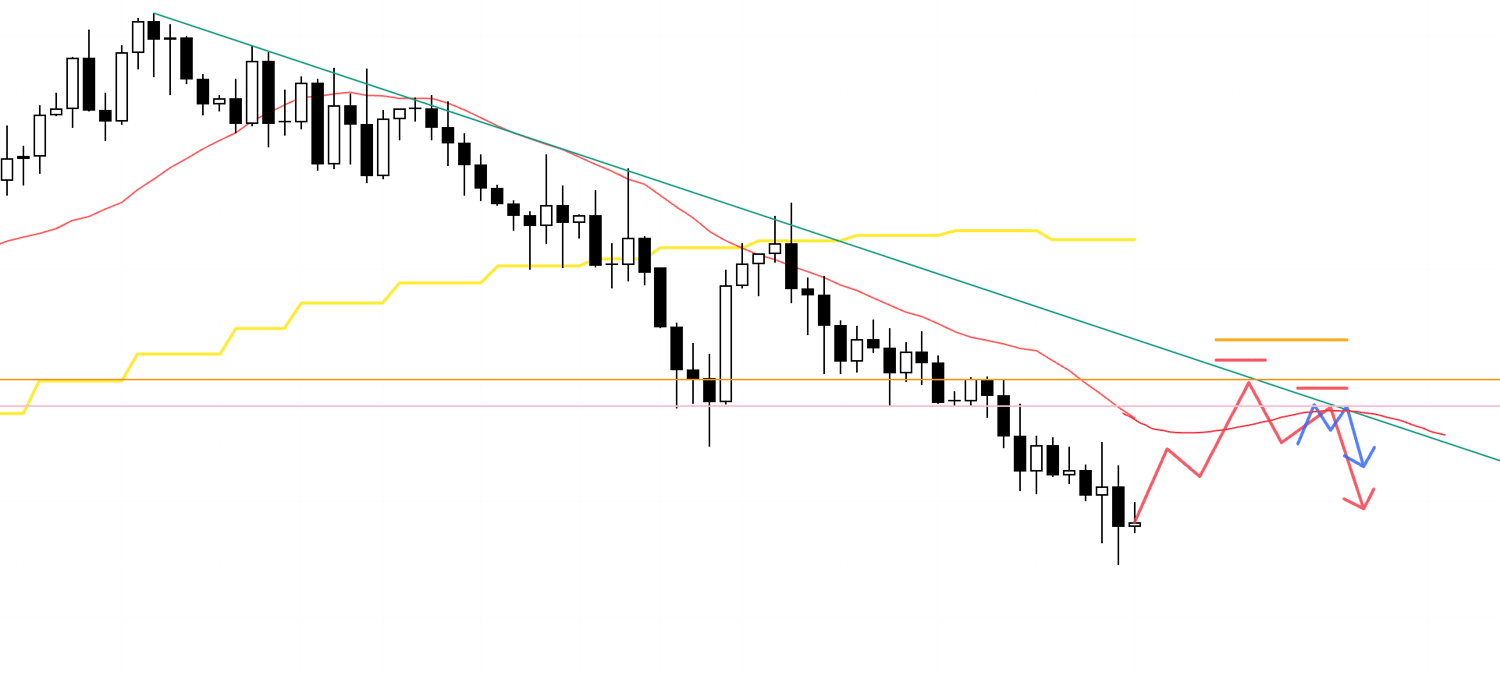

4h

A longer downtrend is already in place on 4h, so it becomes easier to sell if we first end this downtrend and then get a clear point where a new downtrend begins.

The upswing that ends this 4h downtrend will form the daily lower-high structure for the pullback-sell setup, so within that daily lower-high, I’ll look for a 4h lower-high, and then consider shorts on the lower timeframes.

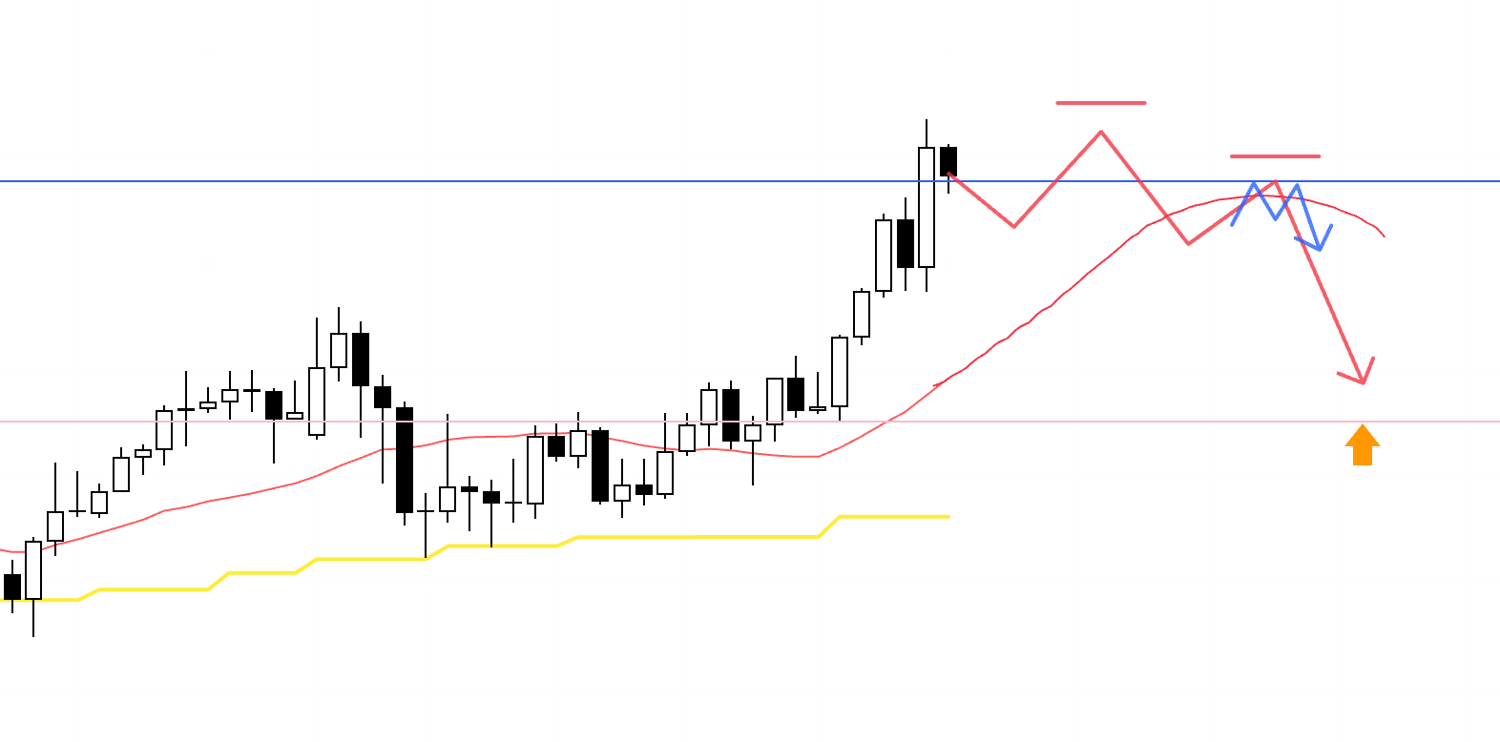

4h

If price continues to fall and then gets stopped at, for example, the lower blue line and starts to reverse, I’ll look to ride the rebound that comes from buy-to-cover flows after the prolonged decline, following the move that closes the gap versus the daily moving average.

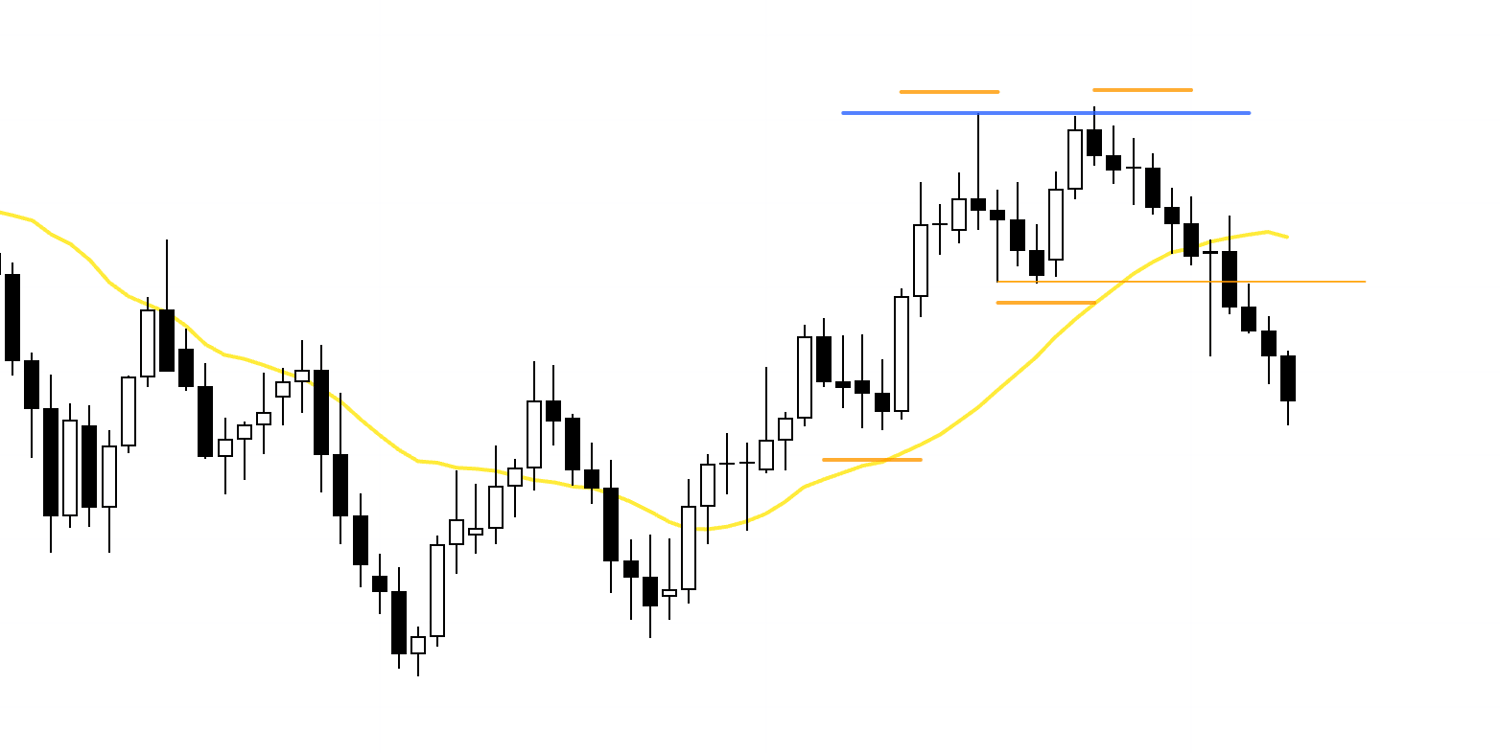

To make it clearer where this blue line is drawn from, please refer to the weekly chart below.

Weekly

The lower blue line we were watching on the 4h chart corresponds to this line on the weekly chart.

It looks like a well-watched level that previously capped highs and later supported lows, so if price gets stopped and starts to reverse here, I want to follow the daily bounce that forms the pullback.

However, this would be trading against the daily trend, so I need to confirm whether the risk-reward to the green trendline makes sense.

And if I take a position, I plan to manage it by taking partial profits (e.g., securing half) at key levels.

That’s it.

These are my scenarios as of now, and I plan to update and refine them as the week begins and we see how price actually moves.

This trade scenario is strictly my own plan, so if you’re still working on establishing your approach, feel free to use it as a reference for building your strategy.

But if your own trading is already dialed in, don’t let my plan distract you—stick to your rules.

Thanks for reading all the way through.