Happy New Year.

Thank you, as always, for reading my blog.

I hope 2026 will be a great trading year for you.

Now, I’ll look back on the key trading points, focusing on the trades I took this week.

This Weekly Trade Report is published every Saturday.

When you read it together with Trade Scenarios, which I post every Sunday, I believe it will give you a useful reference for how I think in advance and how I actually execute trades based on those scenarios.

This is not advice saying “you should trade like this,” nor am I claiming that this is the correct answer.

It is not about showcasing individual winning or losing trades, nor is it about recommending a specific strategy based on those results.

My purpose is to show, at a practical level, how I repeatedly follow a consistent process based on pre-defined scenarios, and to offer that as a reference for your own strategy building and for achieving consistency in your process.

The outcomes I show are nothing more than my personal results, and they do not guarantee your future profits.

Please keep that firmly in mind, and when it comes to your own trading, make sure you carry out your own testing and preparation, and trade entirely under your own responsibility.

My trading is based on buying pullbacks and selling rallies on the 4h timeframe.

If you are interested in my pullback and rally strategy, please read my past blog posts on Dow Theory and multi-timeframe analysis.

Now, please take a look at the following charts.

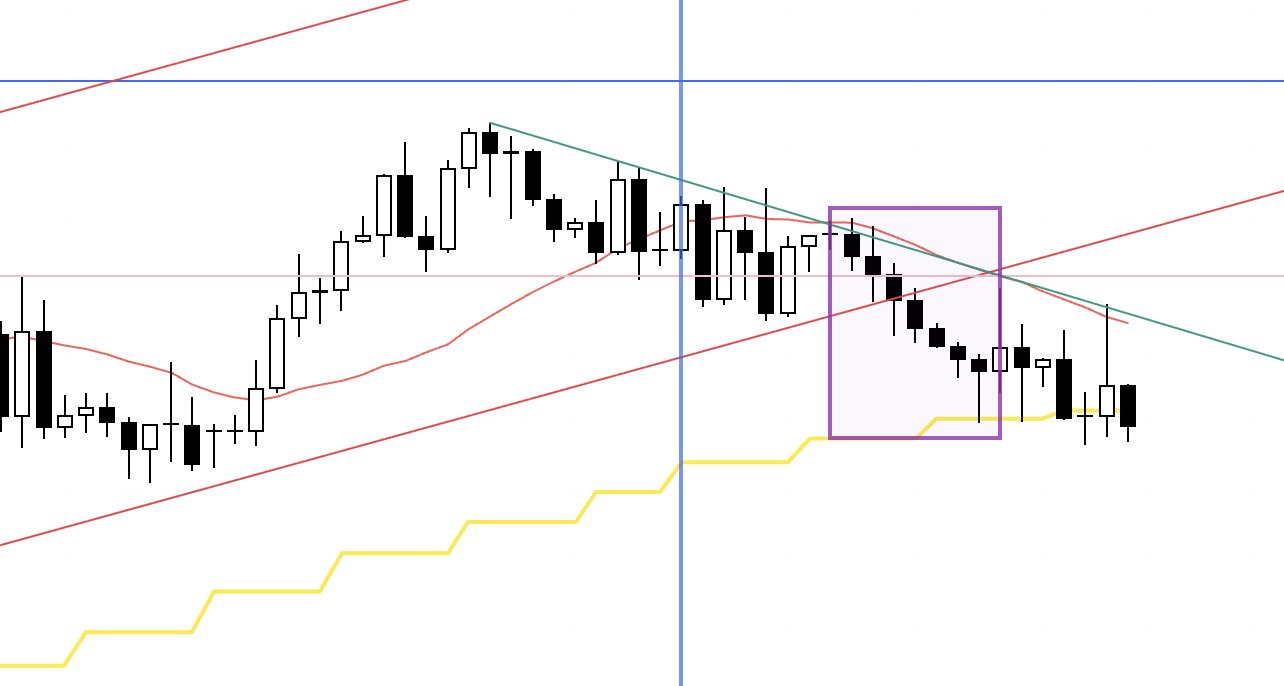

USDJPY 4h

This is the USDJPY 4h chart.

This week’s price action starts from the blue vertical line shown on the chart.

USDJPY had fewer tradable days than usual this week due to the year-end and New Year holidays, including market-closed days.

But even technically, there were no levels where I could take a trade.

What I’ve drawn in orange on this 4h chart is the daily move.

As we also saw in last week’s scenario post, the daily was in an uptrend and we were in a “waiting for a pullback buy” situation.

So I couldn’t trade the drop after the week began, and even the subsequent rise as a daily pullback-buy move didn’t give me a trade either, because on the 4h it continued higher without printing a higher low.

Next, please take a look at the EURUSD chart below.

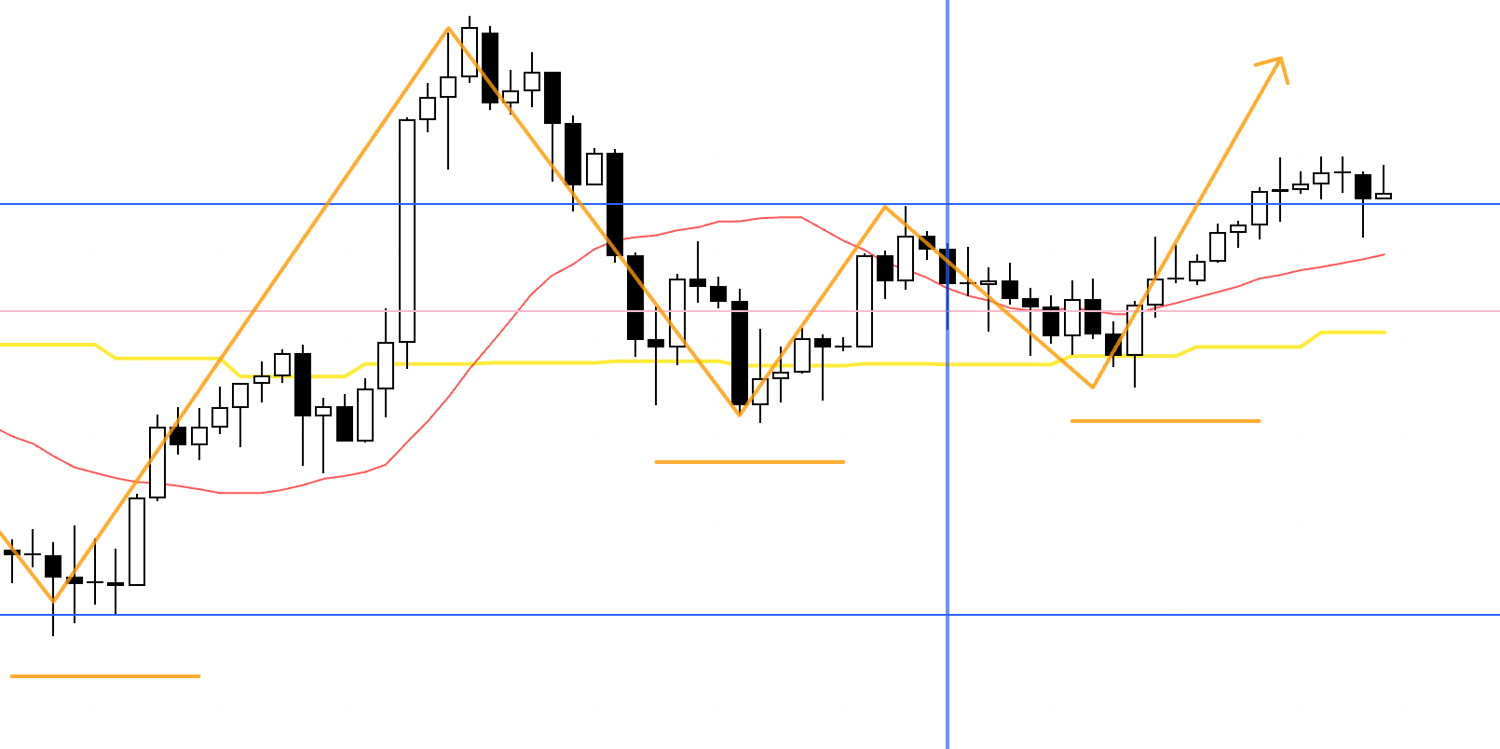

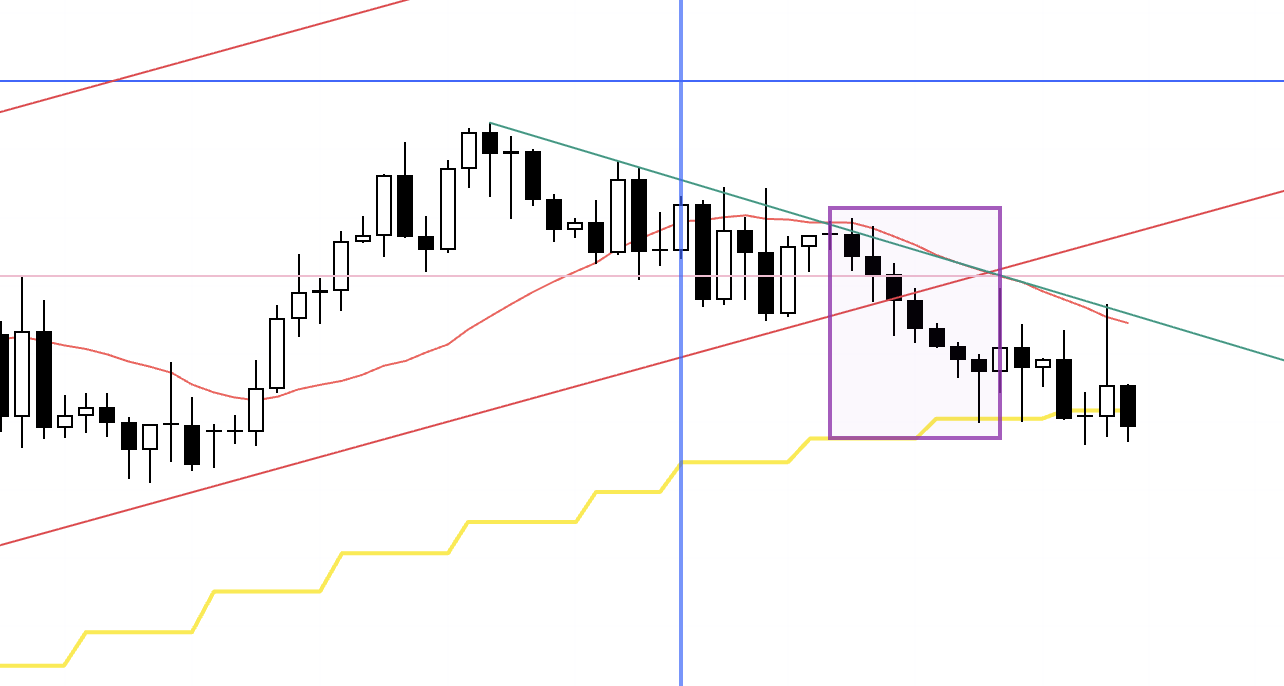

EURUSD 4h

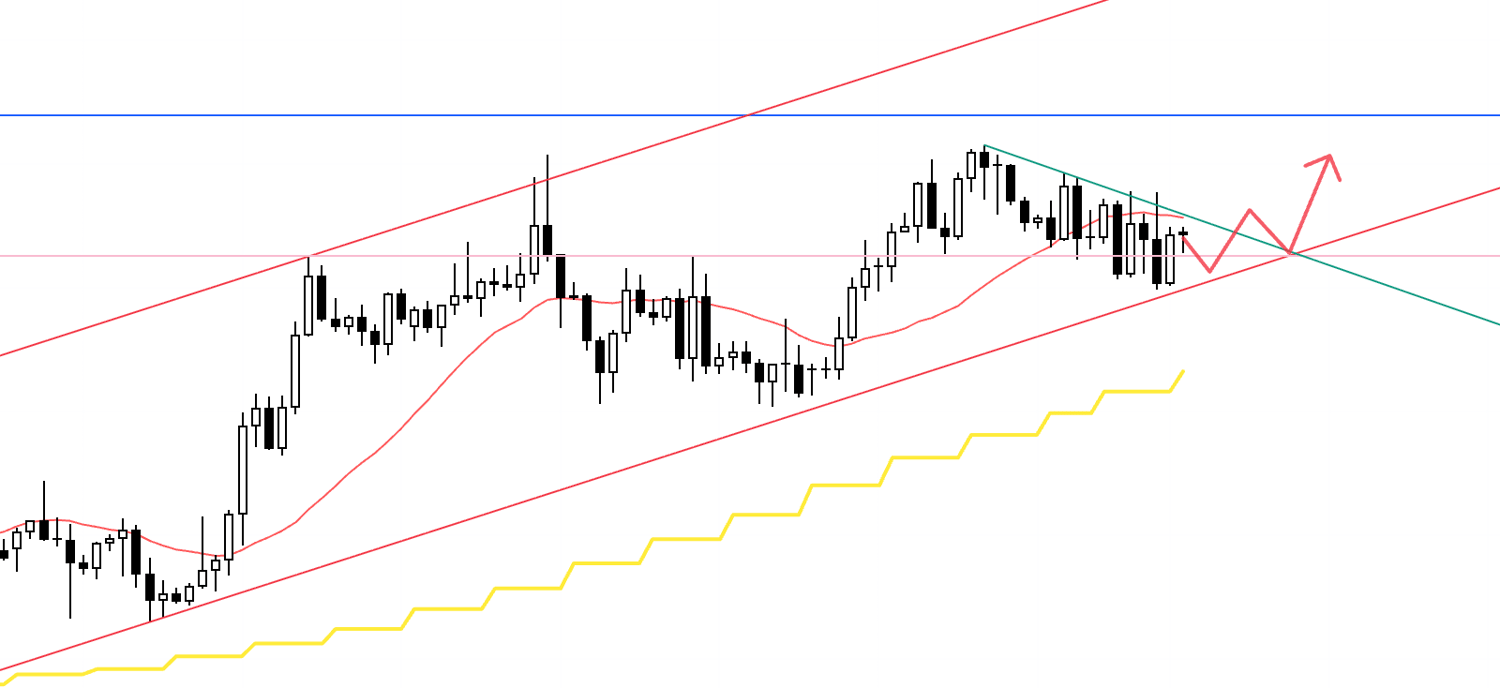

This is the EURUSD 4h chart.

I couldn’t trade EURUSD this week either.

The area boxed on the chart is a 4h retracement-sell level, but the daily was in an uptrend and there was a trendline just below, so I didn’t enter.

As it turned out, price moved lower from there, but this was actually a level where I was waiting to buy.

4h

This is a screenshot I took as of December 30.

Since the daily setup was one where I was waiting for a pullback buy, if the 4h down move stopped—meaning the sequence of lower highs and new lows stalled—and a point emerged where price began to print a higher low, I would have needed to buy.

However, it didn’t develop that way and instead kept dropping, so I didn’t trade.

That’s it.

2026, with the turn of the year, is the perfect time for a reset.

I hope you can stop getting pulled around by wins and losses, and instead keep following the rules of a strategy you’ve properly tested and practiced in advance—so you can actually draw out your edge.

Looking back, I barely traded in December, but that’s simply how it worked out.

I don’t have a rule like “don’t trade during the holiday season.”

It’s just that those seasons often come with wider spreads and choppier price action, and as a result they don’t provide me with signals on the chart.

Since I have a rule not to trade when spreads widen beyond a certain level, it means that, in practice, I end up not trading during those illiquid periods.

I always make decisions purely on technicals, and I don’t add any other decision factors.

Because I don’t place importance on the outcome of any single trade in front of me, I keep repeating trades only on charts where the conditions are met, and by increasing the sample size using only those trades, I draw out the strategy’s edge—this is something I understand deeply.

That deep understanding and unwavering trust are built through preparation beforehand.

I’ve spent an extremely long time preparing up to this point.

I understand well what happens when I keep repeating what I do, and I also understand well what the real work that’s required of me is.

So I don’t do things like “this one is special,” or bring in untested conditions and add new filters to the single trade right in front of me.

I don’t want you to misunderstand: this isn’t a rejection of factors beyond technicals.

I’m simply speaking based on my own rules.

If a trader has tested non-technical factors as part of their rules, then that trader needs to follow them.

What matters for a trader is to do solid preparation in advance, build firm trust in long-term outcomes there, let that trust naturally create a long-term perspective, and become able to keep following the rules consistently.

Each trader has different rules.

But what matters isn’t which rules are “right.”

What matters is whether you can keep following your rules consistently.

The real work required of a trader—the core of it—is the same for everyone.

Are you being pulled around by the short-term results in front of you in a “win-or-loss game”?

In 2026, let’s switch to a “probability game,” do the preparation you need, and calmly repeat the work you need to do—so you can grow into doing the real work of a trader.

If you haven’t read them yet, please give my two books a try.

I think they’re a great fit for starting 2026.

2026 is the year you truly start as a “trader.”

I’m wishing you a great year.

https://payhip.com/YumiSakura/collection/e-books