Hello.

I’ll lay out my trading scenarios for the coming week.

I publish this “Trade Scenarios” blog every Sunday.

And every Saturday I post a “Weekly Trade Report” where I explain how I actually thought about the market and executed my trades during the week.

By reading this trading-scenario blog together with the Weekly Trade Report, I think you’ll be able to use my process as a practical reference for how to think ahead of time, what to wait for, and how to execute in a consistent way.

For the underlying strategy, please refer to my blog posts on Dow Theory and multi-timeframe analysis.

A “scenario” is not a forecast.

It is not a prediction, but my personal plan that says, “If the market does this, I will do that.”

I don’t try to predict the market, and this is not intended as such, so please keep that in mind.

Nor is this a set of instructions telling you what to buy or sell, or a service providing trading signals.

It does not guarantee any future profits; it is provided purely for educational purposes, using my own consistent process as the example.

I cannot take responsibility for any outcomes of the trades you place, so please trade at your own risk.

With that, let’s start with USDJPY.

(On my charts, the colors of the lines I draw represent each timeframe: orange for the daily, red for 4h, blue for 1h, and green for 15m.)

〜・〜・〜・〜・〜・〜・〜・

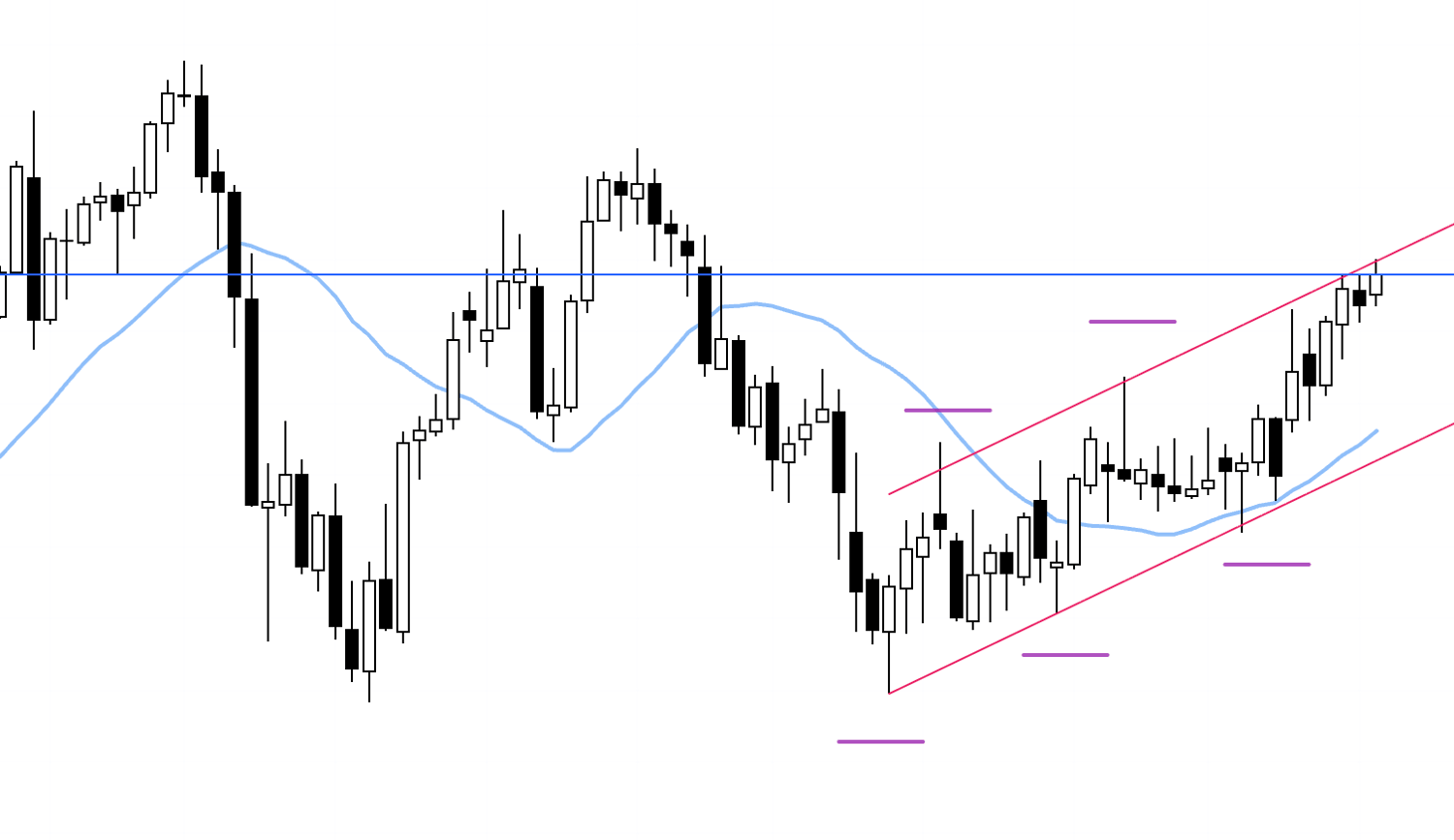

USDJPY

Weekly chart

On the weekly chart, the pair remains in an uptrend, continuing to make higher lows and higher highs, but it has now almost reached the upper boundary of the channel drawn with the red line and has not been able to break cleanly through the blue line I’ve been watching for some time.

I want to build my scenarios around how price behaves around this blue line.

Daily chart

On the daily chart as well, the market is in an uptrend, making higher lows and higher highs.

However, as we saw on the weekly, price is up against the top of the channel, so topside is heavy.

Whether I’m looking to buy or to sell, I need to factor that risk in when structuring trades.

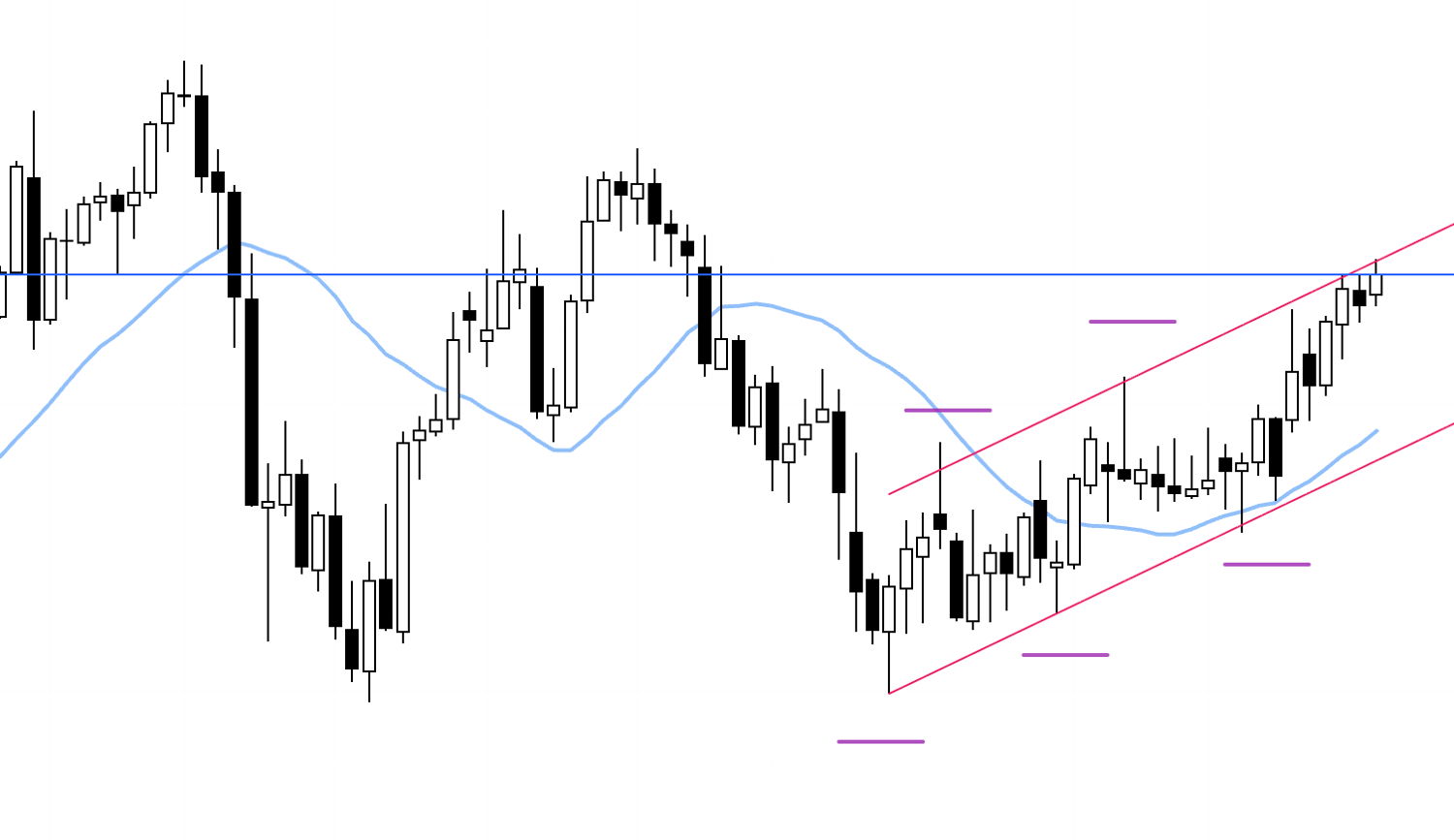

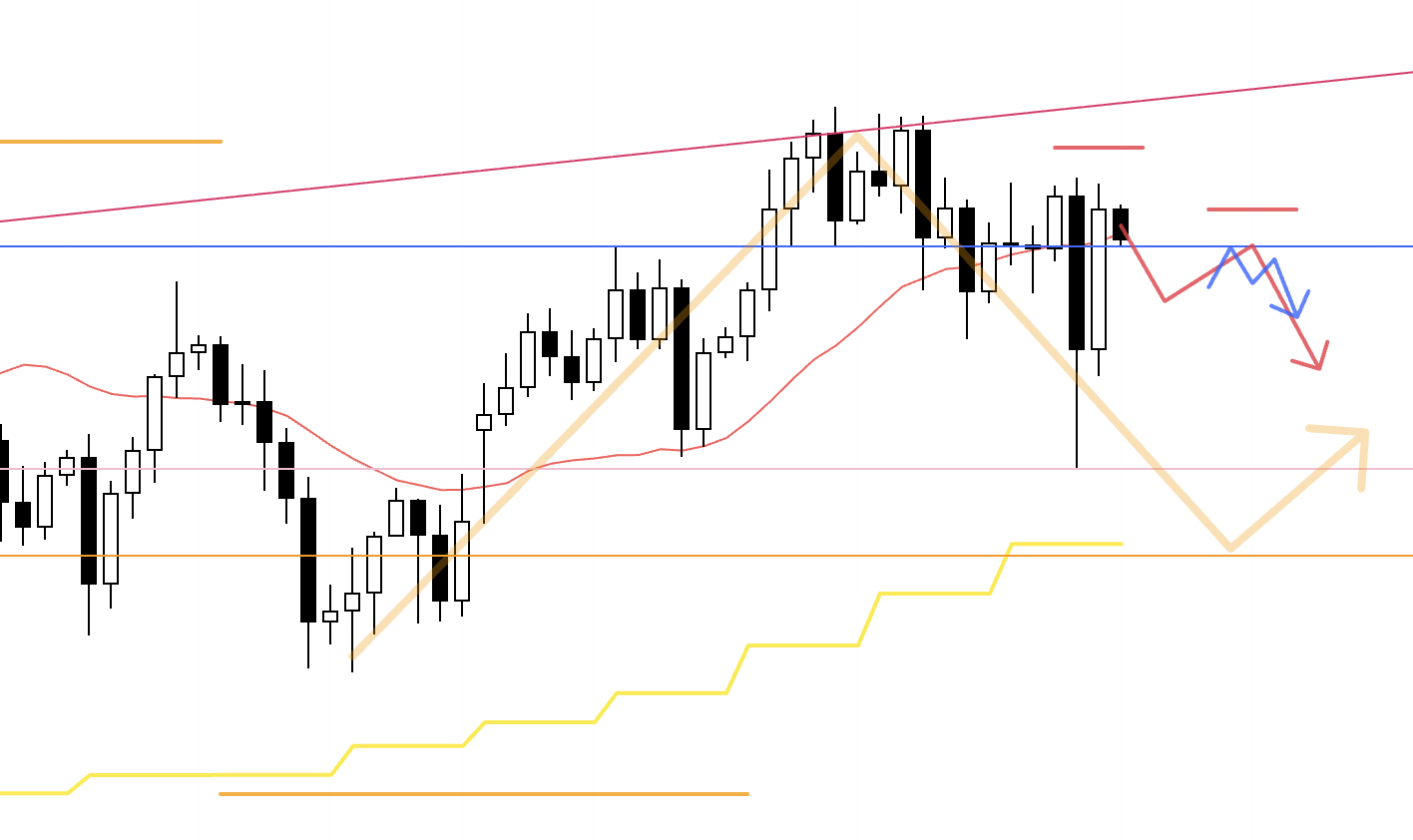

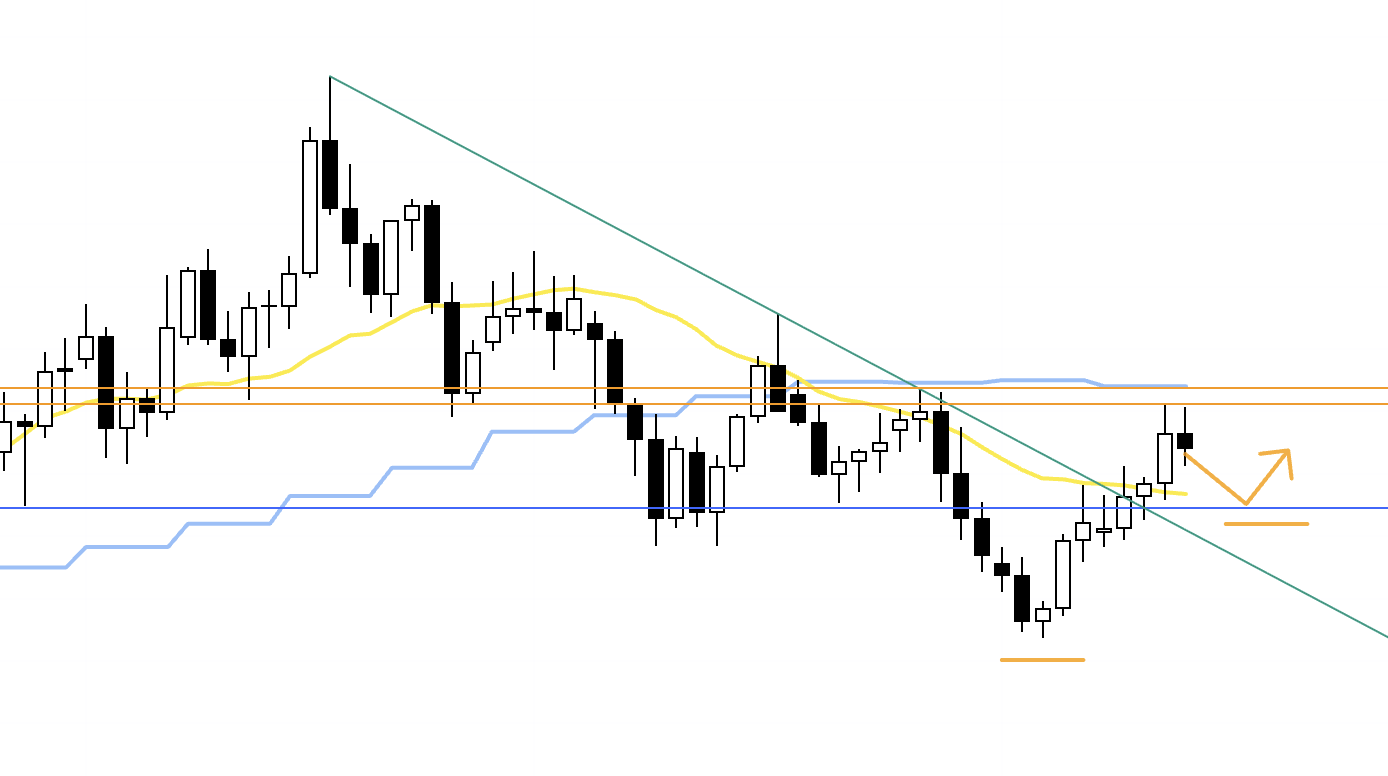

4h

If price starts to form higher lows, holding above this blue line and related levels as support, I’ll look for buying opportunities on the lower timeframes.

4h

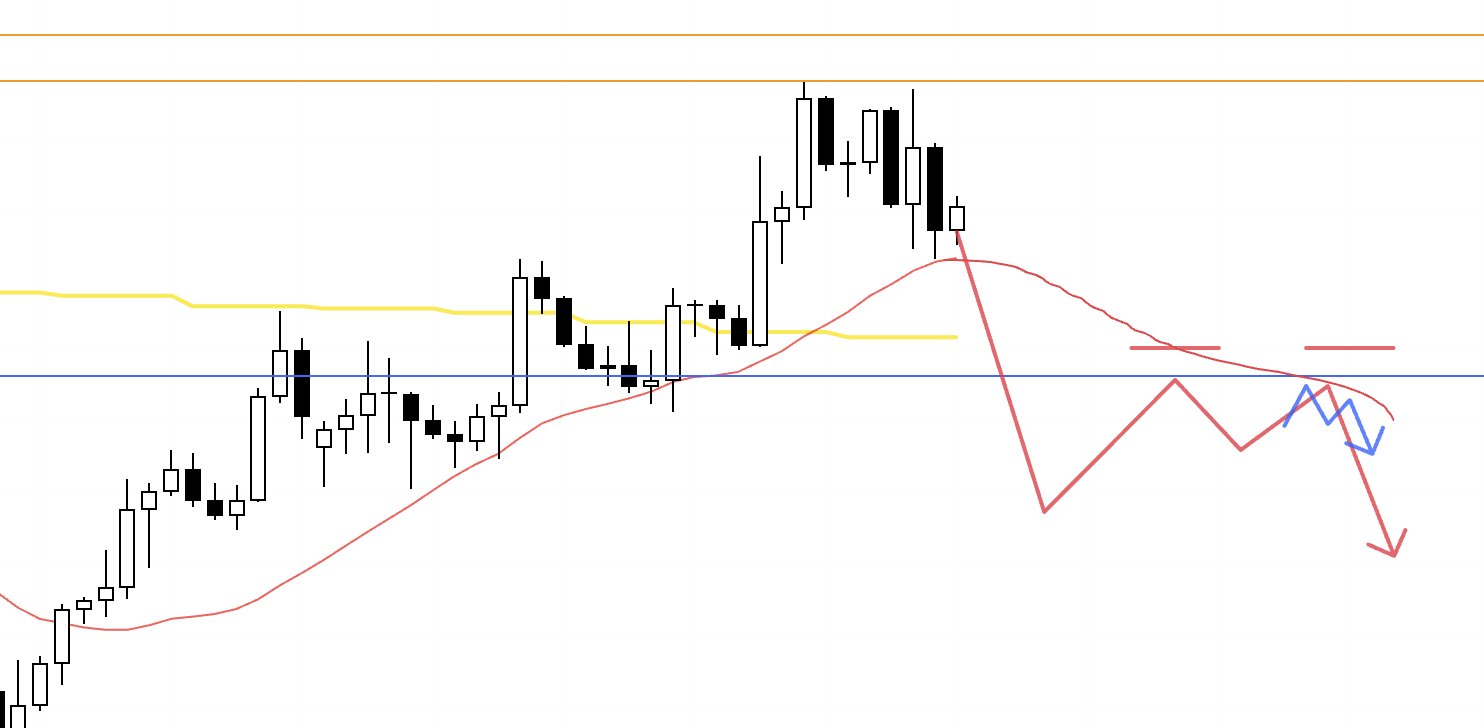

Conversely, if price starts to form lower highs as if capped by this blue line, I’ll look to follow a 4h downtrend as the daily chart builds out a pullback.

In that case, because the daily has been making new highs, the cheaper it gets the more dip-buying interest is likely to step in, so I’ll be focused on whether I can enter at levels with attractive risk–reward. Once in a position, I plan to take partial profits—such as securing half the gains—around key levels.

4h

After that decline, if the 4h then turns back into an uptrend, I’ll consider buying it as a daily pullback buy.

Next, let’s look at EURUSD.

〜・〜・〜・〜・〜・〜・〜・

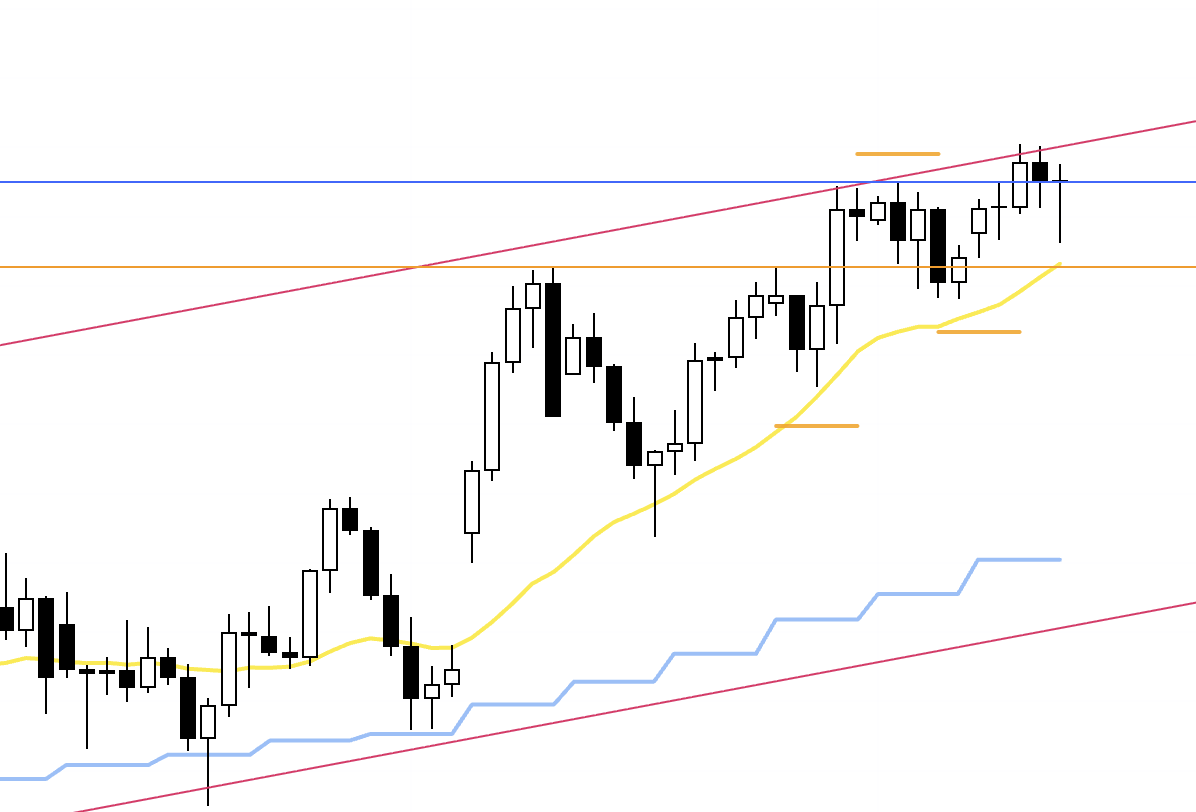

EURUSD

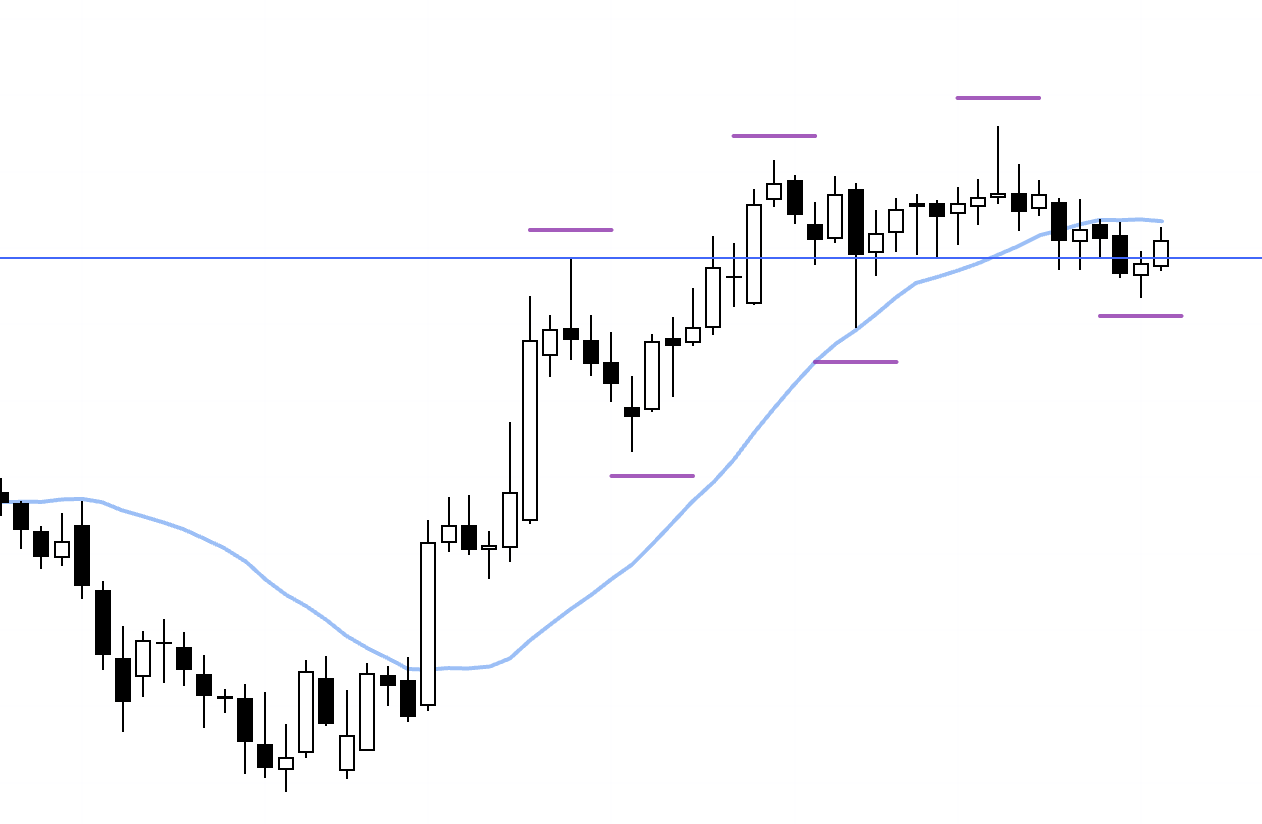

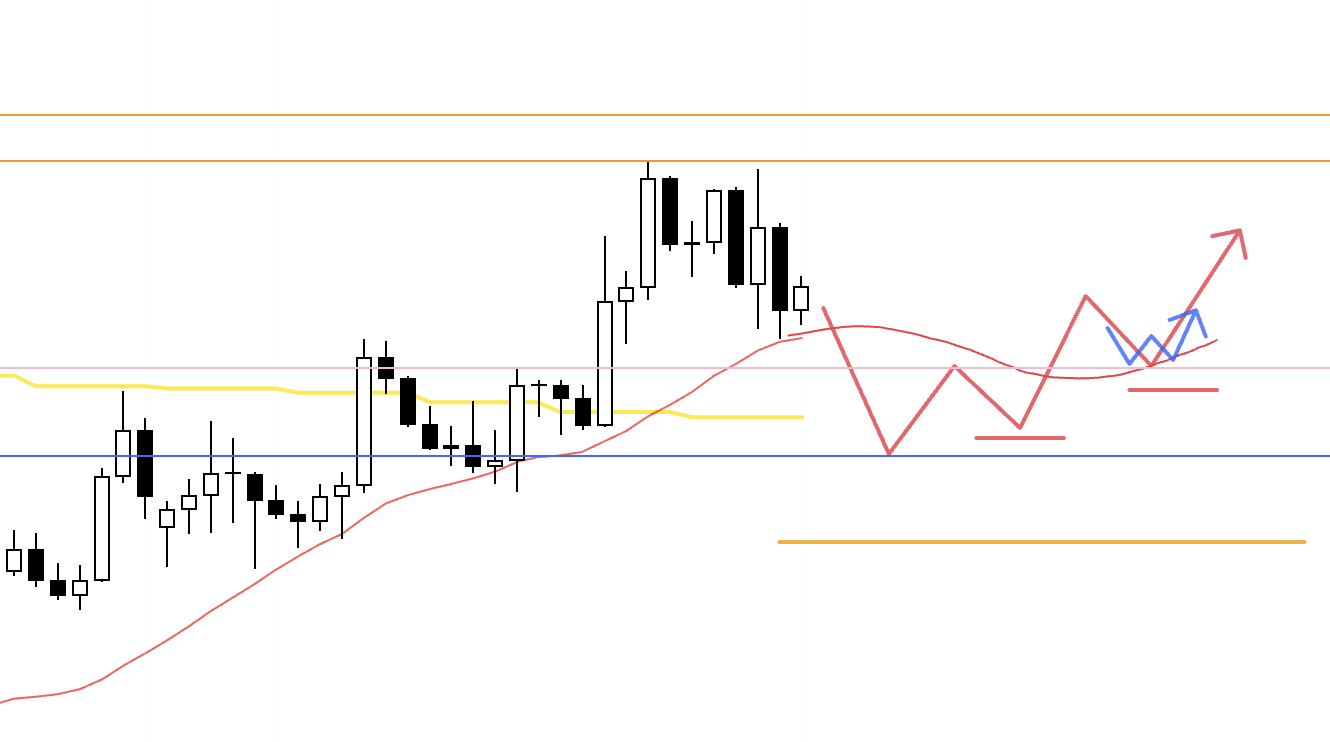

Weekly chart

On the weekly chart, we’ve made a new high and have not yet broken the prior low, so there is a buy-side camp that is waiting to buy the dip.

At the same time, if you treat the blue line as the key low, that level has already been broken, so there is a sell-side camp that sees this as a lower high and the start of a downtrend.

It’s a difficult area where the market is naturally split between these two camps.

Weekly chart

For traders who are looking at the structure in more detail, price is putting in lower highs and breaking lows, and is now being capped by the moving averages, so it also looks like an area where they would want to sell rallies.

This is not about which way of reading the chart is “right”; the key is to build scenarios with the understanding that there are traders on both sides of that interpretation.

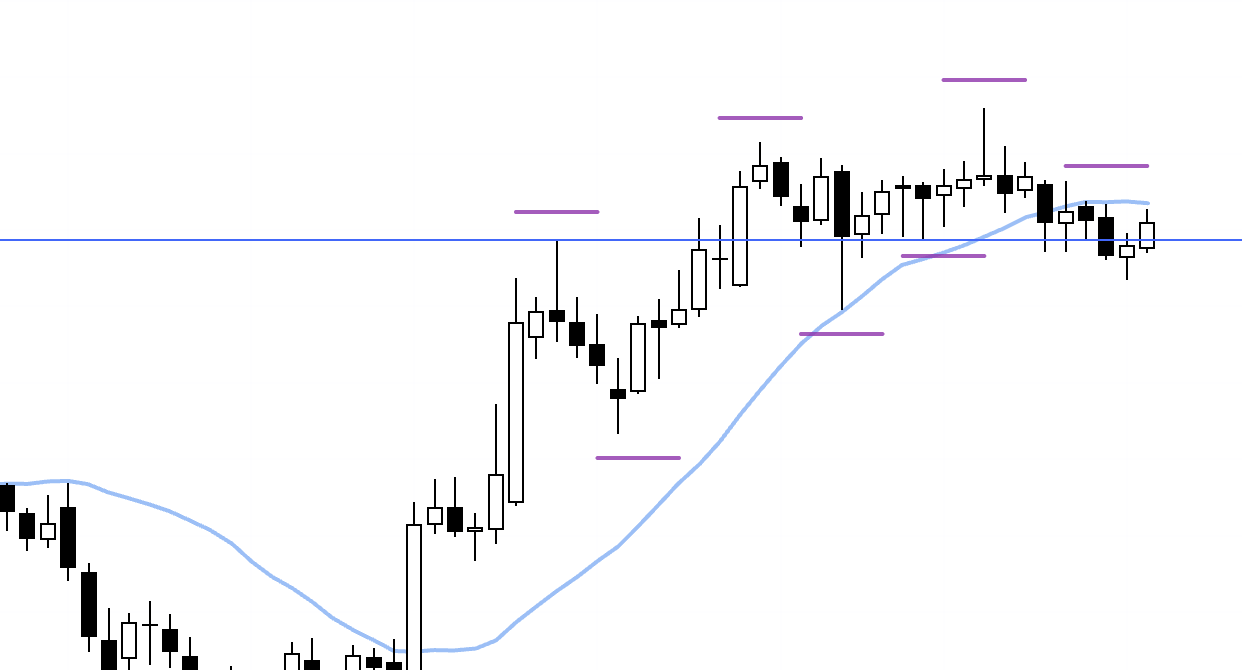

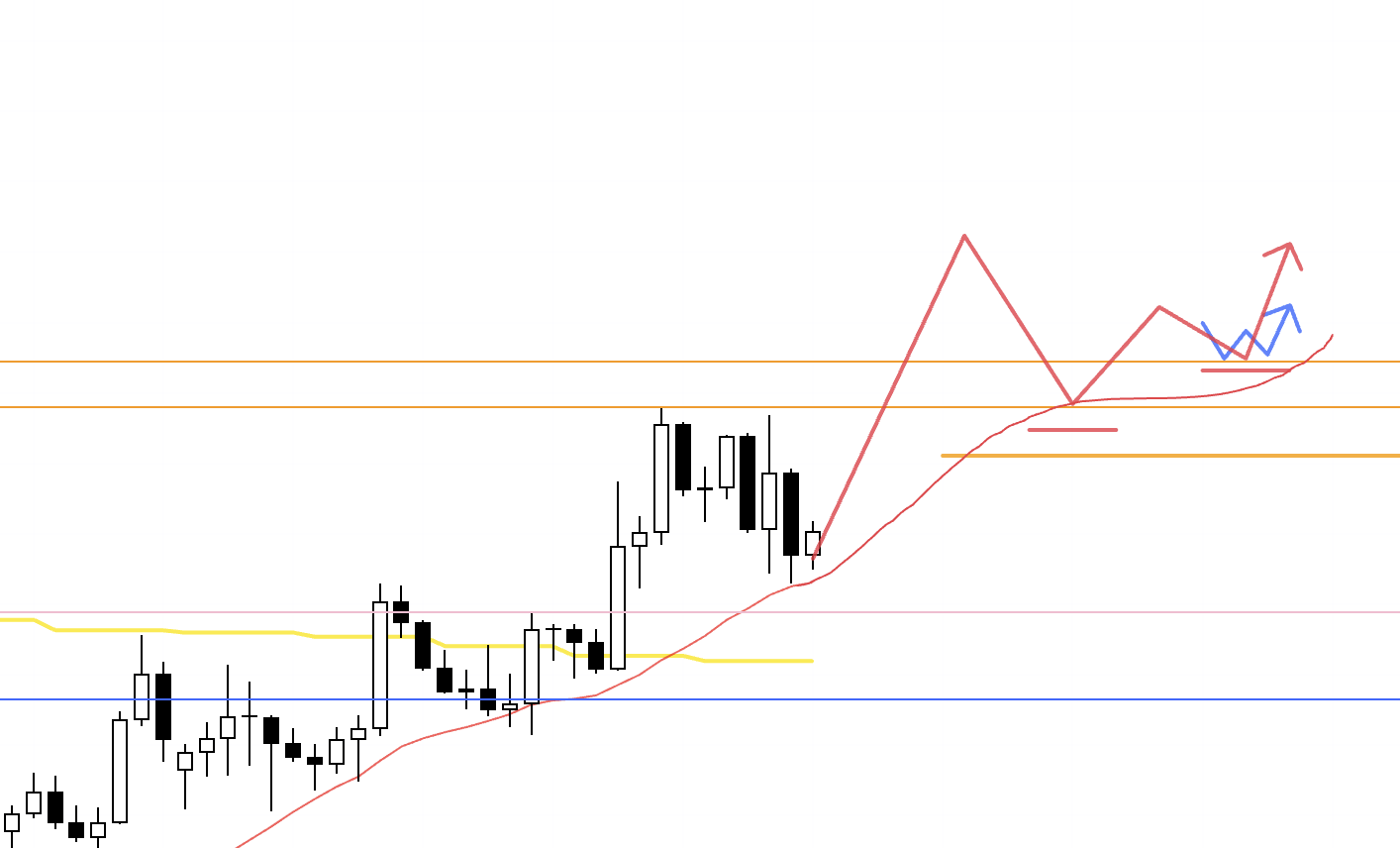

Daily chart

On the daily, we are in a downtrend with lower highs and lower lows, but price has already broken above the moving averages.

If, from here, price is supported at a key level and forms a new higher low, I can also consider a long.

However, there are also players watching for a weekly pullback sell, so around the orange line I’ve drawn there is a risk of increased selling interest, and the question is whether we actually get an entry with a reasonable risk–reward.

Daily chart

On the other hand, we have not yet taken out the previous high and remain in a downtrend, so there are also traders viewing this as a rally to sell into.

That said, the lower blue line is a level that has been respected many times in the past, so if price is capped by that line in a way that produces an entry on the lower timeframes, I’ll look at short setups.

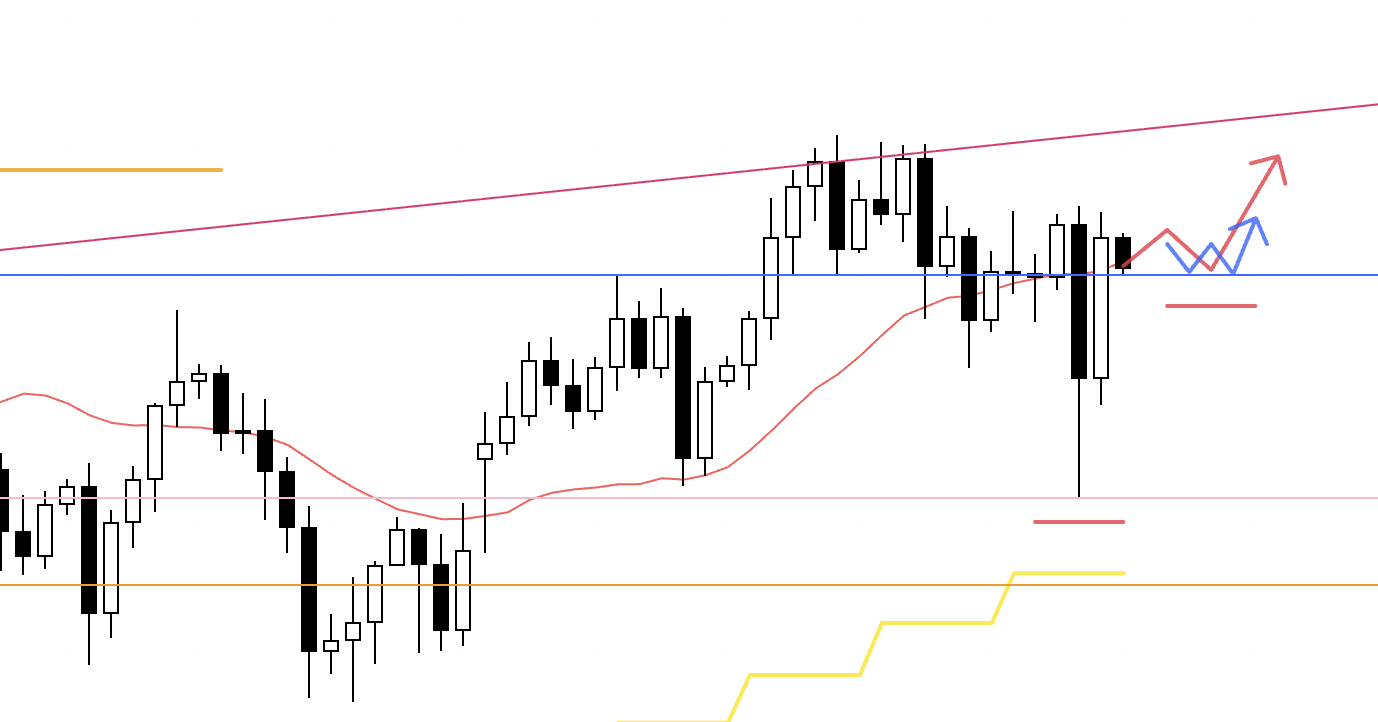

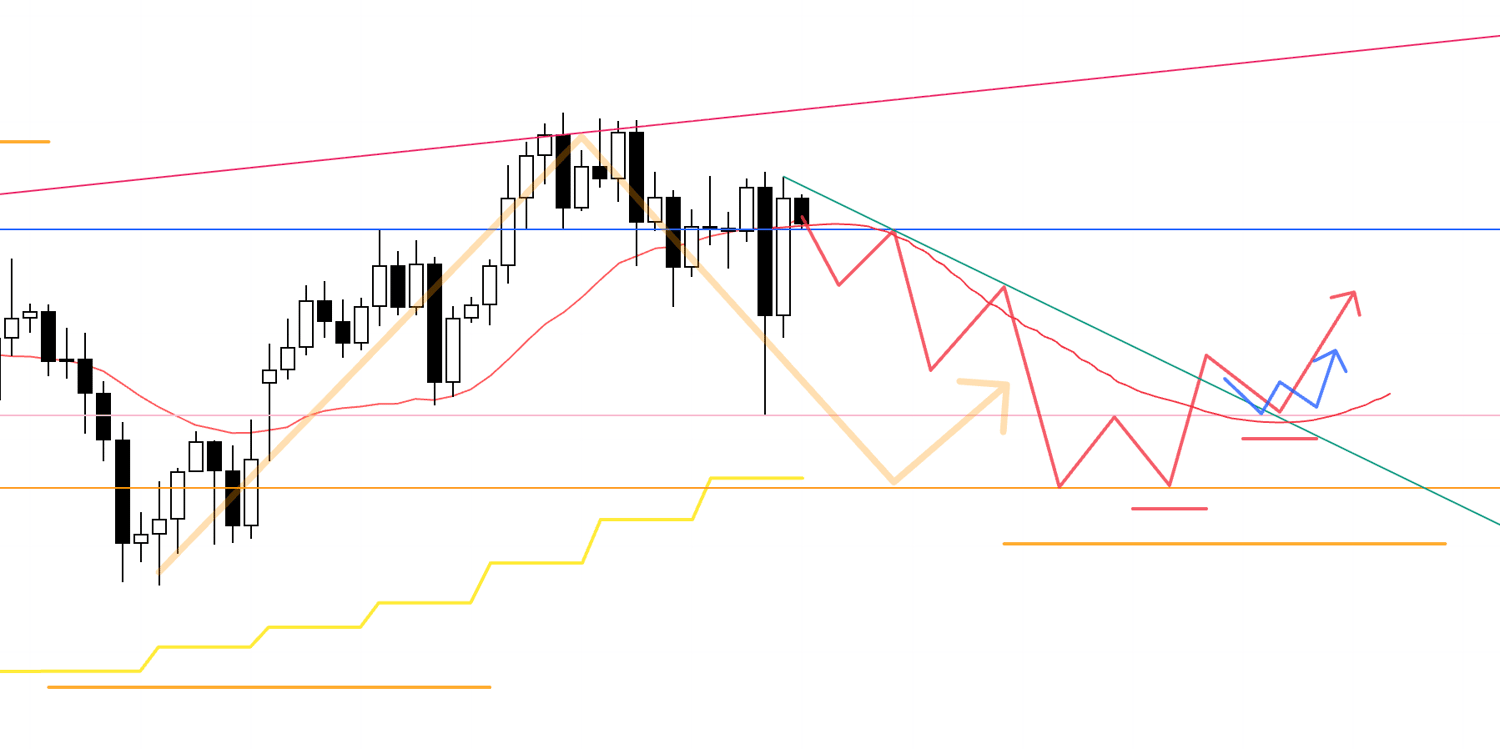

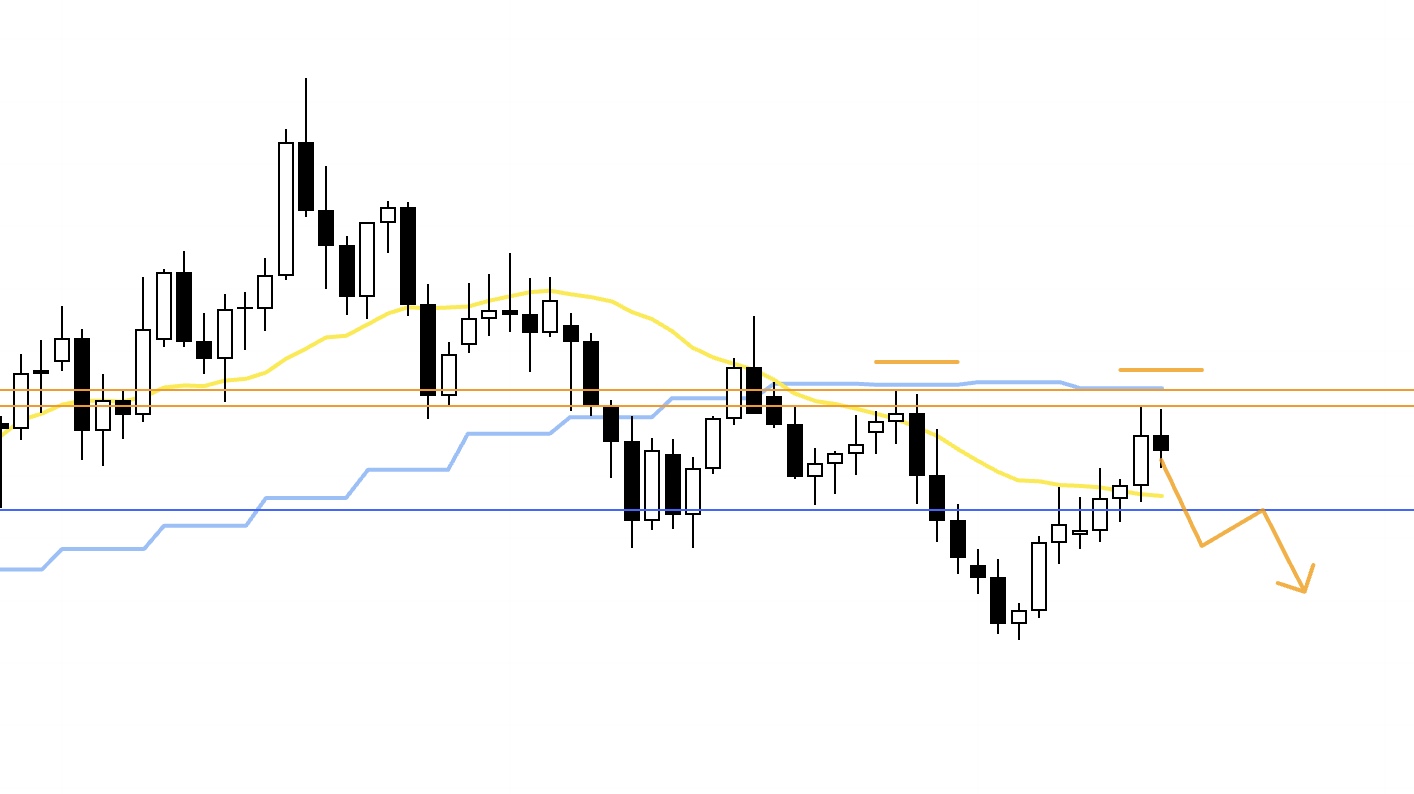

4h

This is the same long scenario I discussed last Sunday: if the daily chart forms a new higher low and the 4h turns into an uptrend, I’ll then look to buy on the lower timeframes.

In that case, around the upper orange line there is a risk of increased weekly sellers stepping in, so the question is whether I can structure an entry with good risk–reward. If I do take a position, I plan to lock in half the profits around that line.

4h

Alternatively, if price breaks above the prior daily high and clearly negates the daily downtrend, and then goes on to form another higher low on the 4h, I’ll also look for long setups.

4h

For shorts, I’d like to see price break below the lower blue line and then form lower highs as it retests that line from underneath; in that case I’ll consider selling.

〜・〜・〜・〜・〜・〜・〜・

That’s all for this update.

These are the scenarios as of today, and as the week unfolds I will update and refine them based on how price actually trades.

EURUSD is currently trading in a difficult area.

But when the market is “difficult,” the simple answer is not to trade it; there is no need to be in a position all the time.

If you define in advance under what conditions a long has an edge and under what conditions a short has an edge, and then just follow the scenarios you’ve laid out, the fact that it’s “difficult” is no longer an issue.

The key when building scenarios is whether you clearly understand why it feels “difficult.”

That, in turn, depends on how clearly you can map out things like which timeframe’s participants are positioned which way, and what significance each swing high carries, and at what level of granularity you understand all of that.

This is not a game of guessing the right answer.

It doesn’t matter whose view is “correct.”

The point is to recognize that “there are traders who think about it this way and traders who think about it that way,” and then simply wait for the conditions under which “I have an edge on the buy side here” or “I have an edge on the sell side there.”

If you are clear that “because of these reasons, I will not touch it until X happens,” then all that remains is to execute.

If this is fuzzy, you end up looking at the chart after the fact and thinking “If only I had taken that, I could have made money,” or you feel anxious before entry, wondering “Should I really be taking this?”, or you start trying to invent reasons to trade, asking yourself “How can I frame this so that I can justify a trade here?”

That kind of hesitation is the true nature of what we call “difficult.”

If there is no hesitation, it’s “easy.”

By the time I’ve laid out my scenarios, I consider most of the work of trading already done.

All that’s left is to watch the actual price action and check the details against my entry criteria: does the trade offer acceptable risk–reward, is price holding at key levels, how is it behaving relative to the moving averages, and so on.

Once I’m in a trade, there’s nothing much left for me to think about; I feel as if almost all of the work has already been done, so I’m not particularly interested in the outcome.

Many people interpret “focus on the process” as referring to the moment you click the mouse to place the trade, but for me it already begins at the scenario-building stage, and the key is how clearly I can embed my market view into those scenarios at that stage.

These trade scenarios are purely my own plan, so if your own trading approach is not yet fixed, I hope you can use them as one reference when building your own strategy.

But if your own trading is already well established, please don’t let my plan distract you from rigorously following your own rules.

Thanks for reading to the end.