Hello.

I am laying out the trading scenarios for the coming week.

This “Trade Scenarios” blog is published every Sunday.

Every Saturday I also post a “Weekly Trade Report” that shows how I thought through and executed trades during the week.

Read together, these give you a practical, front‑line view of how I think ahead, what I wait for, and how I execute with a consistent process.

For the underlying strategy, please see my posts on Dow Theory and multi‑timeframe analysis.

A scenario is not a forecast.

It is my personal plan of “if this happens, I will do that,” not a prediction.

I do not predict markets, and this is not intended as such.

This is not an instruction to buy or sell, nor is it a signal service.

It does not guarantee future profits and is provided for educational purposes to show how I execute a consistent process.

I cannot assume responsibility for any outcomes of your trades, so please trade at your own risk.

Let’s start with USDJPY.

(On my charts, orange denotes the daily, red the 4h, blue the 1h, and green the 15m, each reflecting its timeframe’s structure.)

〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・

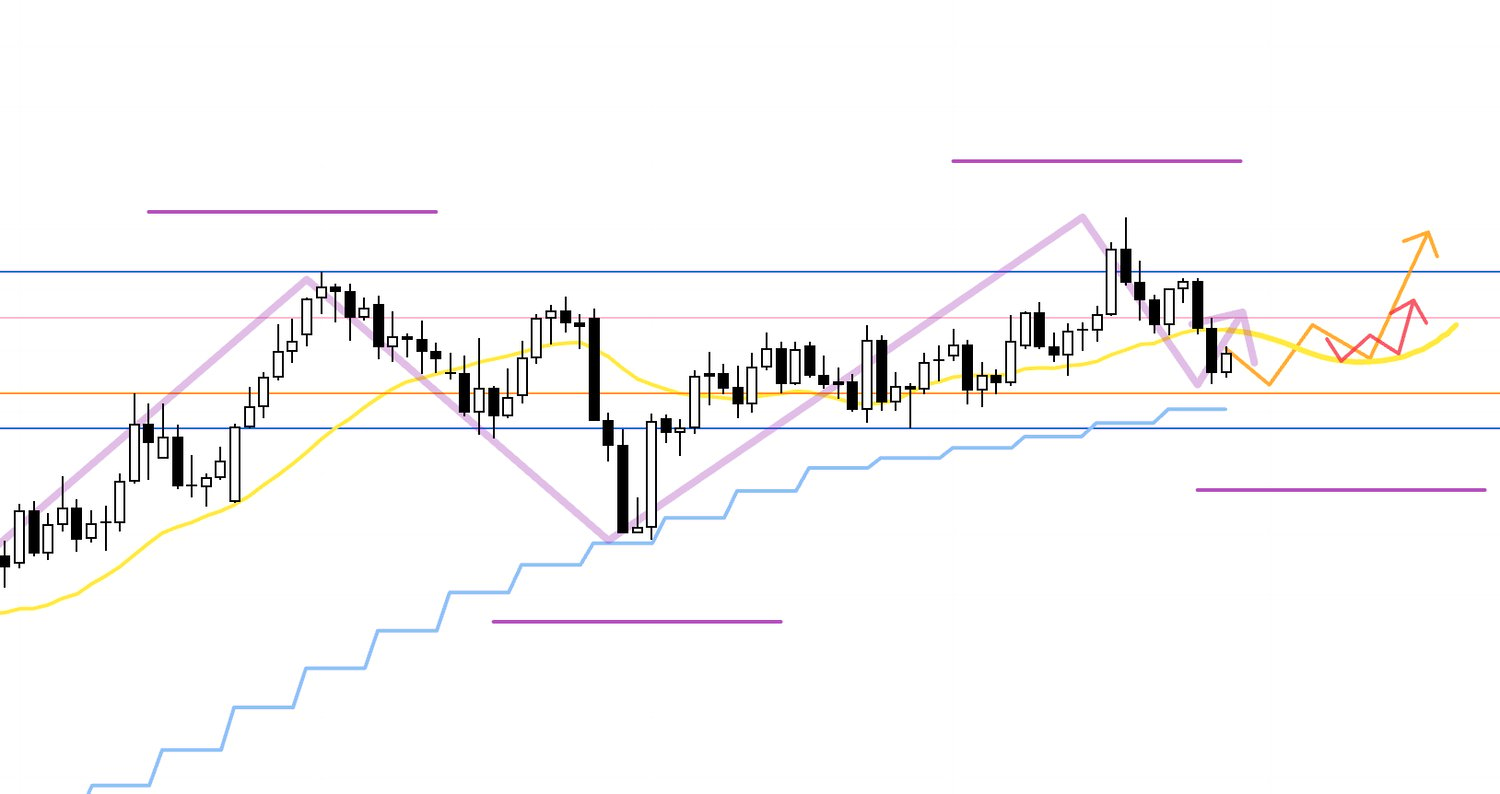

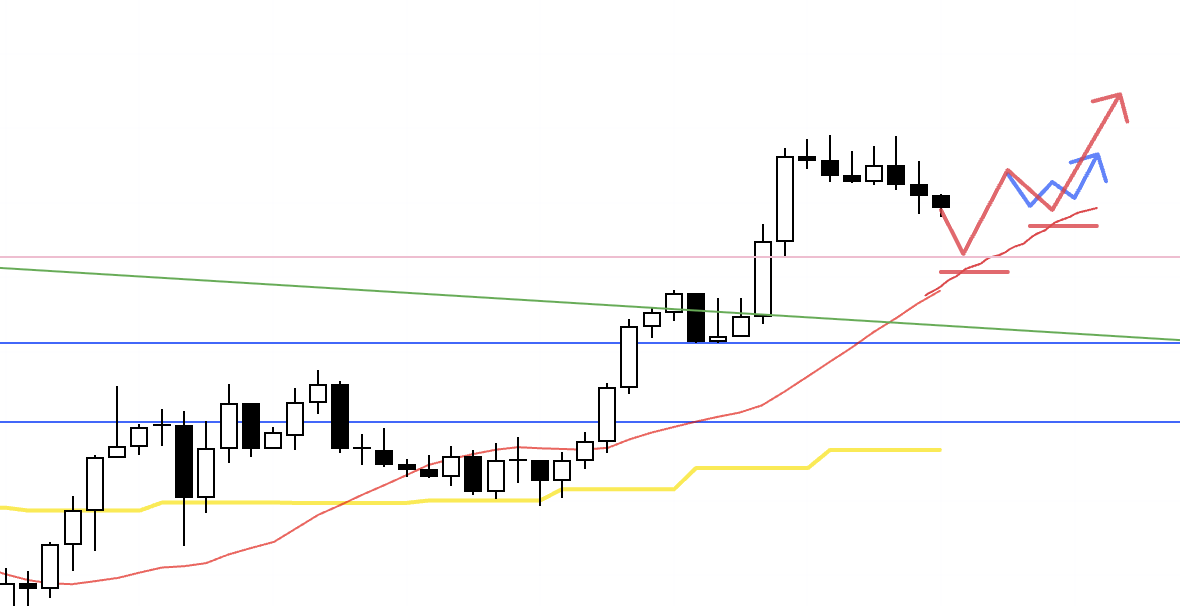

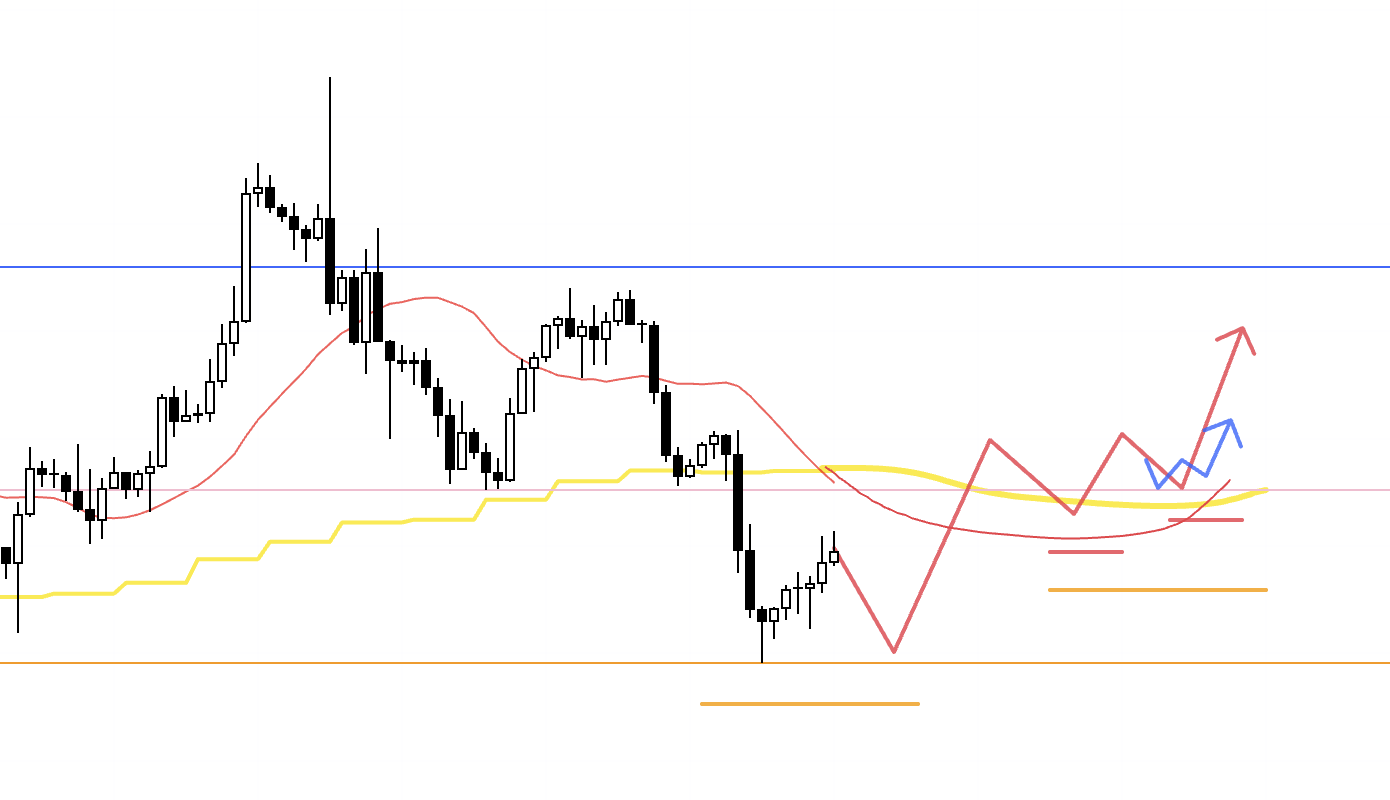

USDJPY

Daily

On the daily, price has finally broken out of the prolonged range, so I want to buy pullbacks straightforwardly.

A daily pullback is formed by a downtrend on the lower timeframes.

I target the first point where those lower timeframes base and rotate back into an uptrend.

I cannot and need not predict exactly where the decline will stop.

If price stalls with clear support at a prior swing high or a horizontal level and then prints a higher low and a higher high, that becomes an excellent buying opportunity.

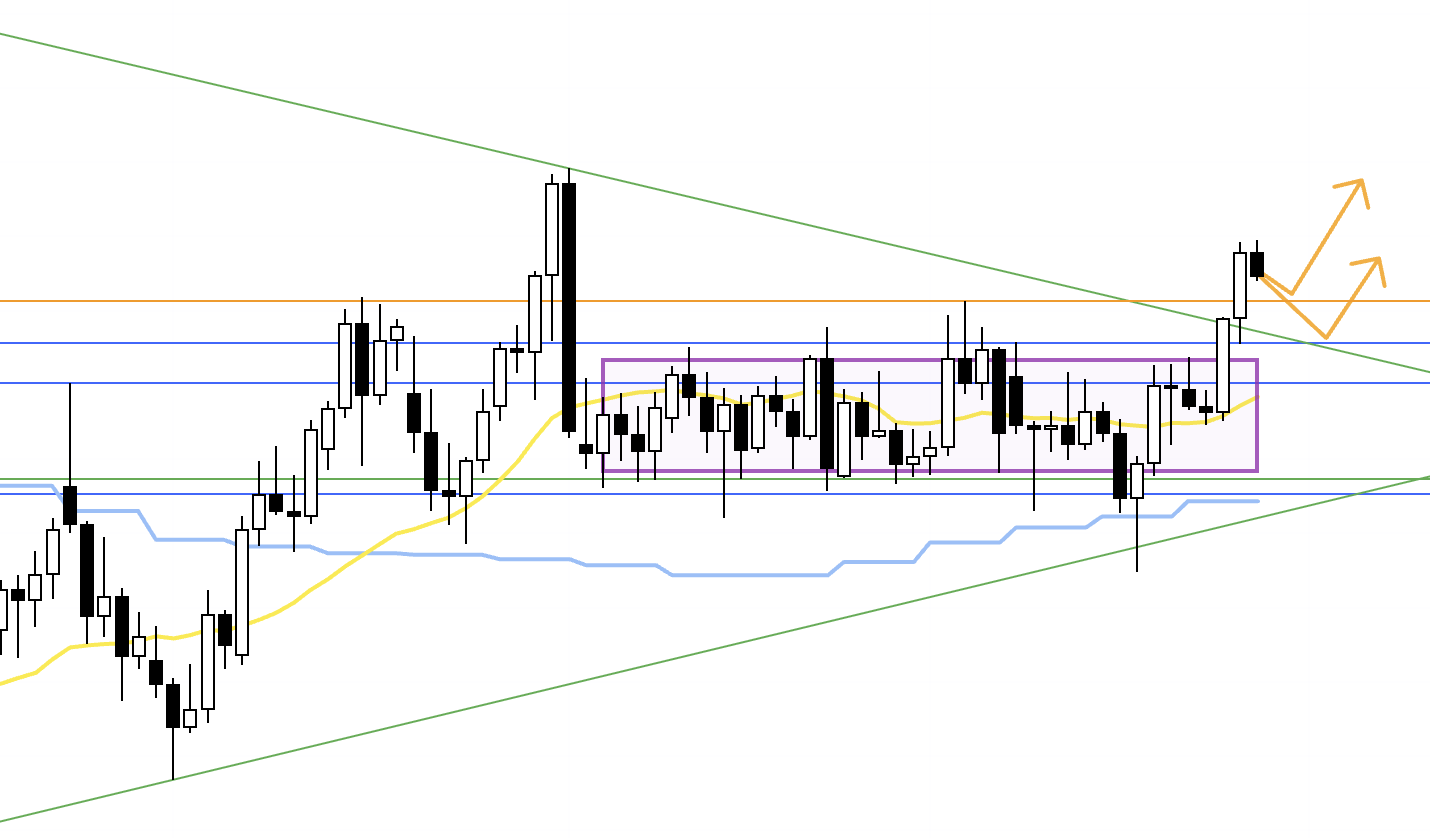

To clarify where the green trendline originates, let’s step up to the weekly chart.

Weekly

As you can see, price has been making higher lows and higher highs and is supported by the moving average, so the weekly is in an uptrend.

On the still higher monthly timeframe, however, price had been making lower highs, leaving buyers and sellers in a standoff until the range finally broke.

For now, I will watch whether price can travel up to the blue horizontal line shown above.

With that in mind, let’s look at the 4h.

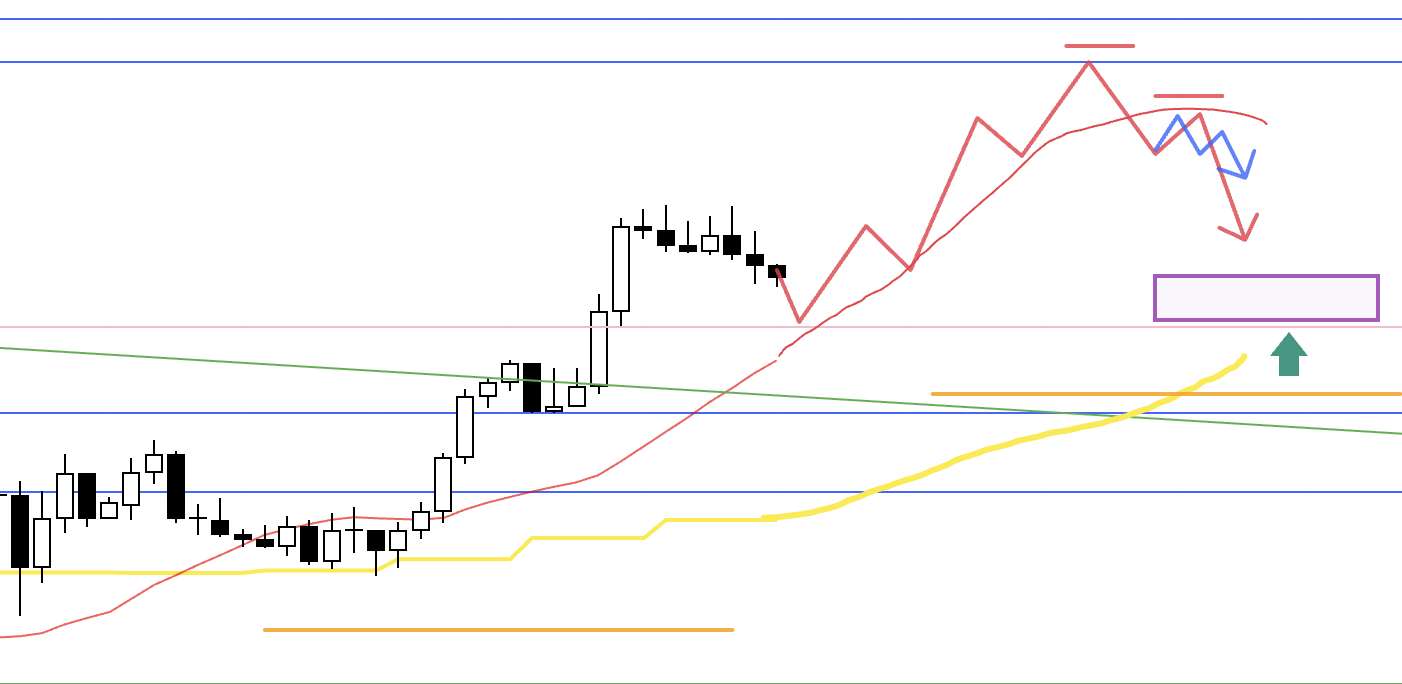

4h

I do not know where the decline will end, but as a daily buy‑the‑dip I will consider a long at the point where the lower‑timeframe downtrend flips back to an uptrend, in confluence with the moving averages.

4h

After an advance, if price is capped by, for example, a prior weekly high and starts to roll over with lower highs, I will consider shorting the downswing that forms the daily pullback, while monitoring the relationship with the moving averages.

Because the daily is trending higher, dip‑buyers will emerge where price is perceived as cheap, so I need to be mindful of the daily moving average (yellow) and prior highs or horizontal levels.

The key is whether a setup appears that lets me engage from as high a level as possible with acceptable risk‑reward, and once in, I would secure half into the daily buy‑the‑dip area and manage the rest accordingly.

Now let’s turn to EURUSD.

〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・

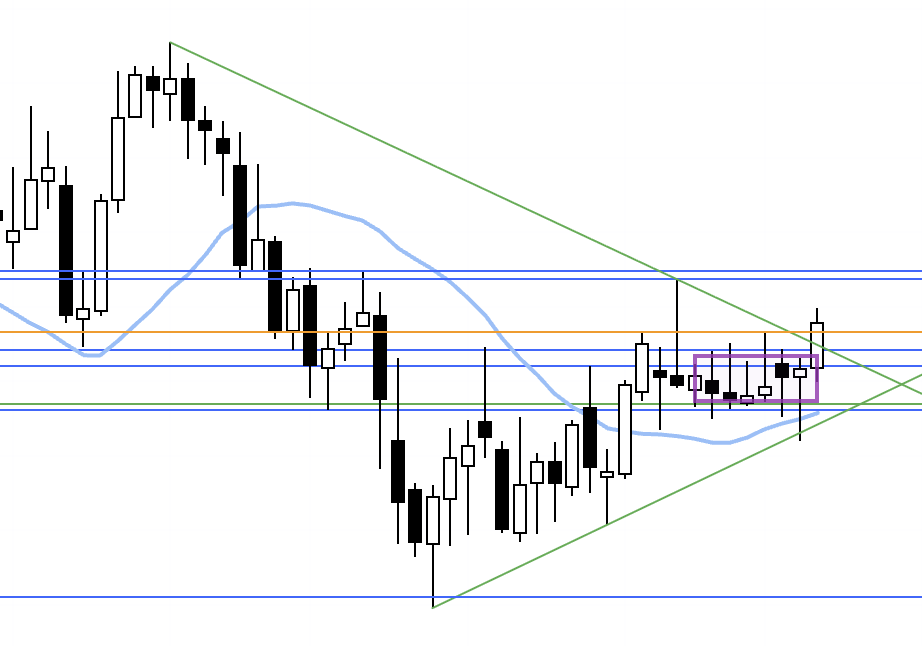

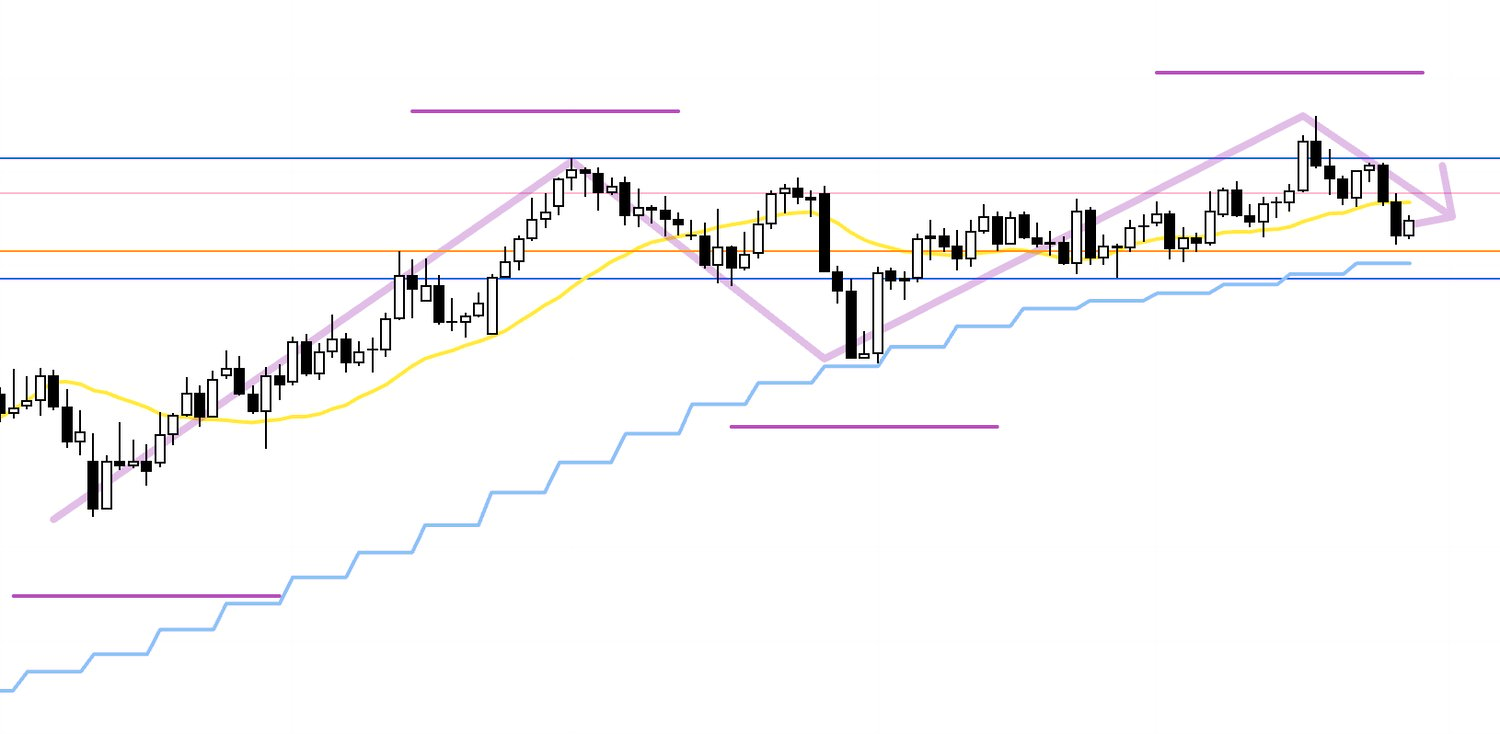

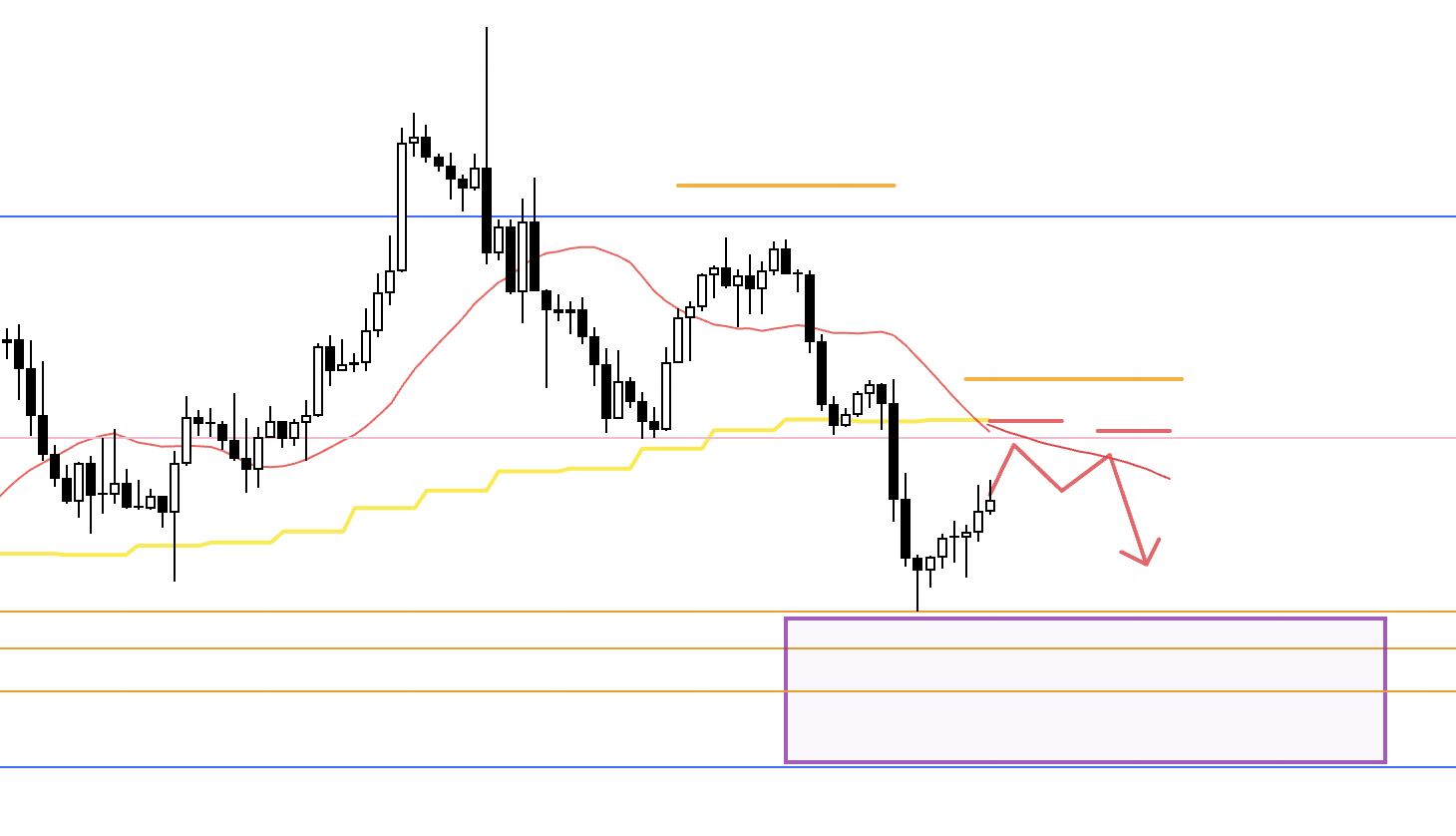

EURUSD

Daily

On the daily, price barely poked above the prior weekly high shown in blue, but was ultimately capped there and transitioned into a downtrend with lower highs.

The motion sketched in purple represents the weekly structure overlaid on this daily chart.

While the daily has turned down, on the weekly this is a pullback within an uptrend, which creates a zone where daily sellers and weekly buyers collide and requires shorts to be structured with that risk in mind.

That does not mean we can buy immediately.

The daily has flipped into a downtrend and the moving averages are beginning to press from above, so if I am to buy I want to first see the daily put in a higher low.

Daily

For example, if the daily bases and then transitions back into an uptrend with a higher low and a higher high, I will look to enter long via a lower‑timeframe higher‑low trigger.

In that case, the weekly pullback‑buy, the daily pullback‑buy, and the 4h pullback‑buy all align, creating a highly favorable buying environment.

Let’s drill down to the 4h for detail.

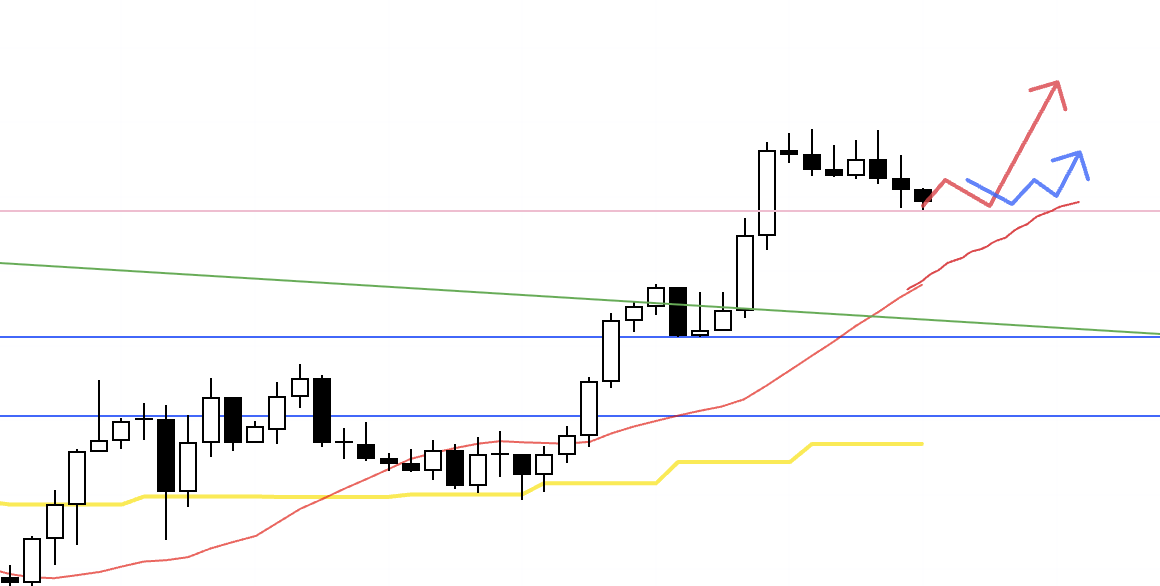

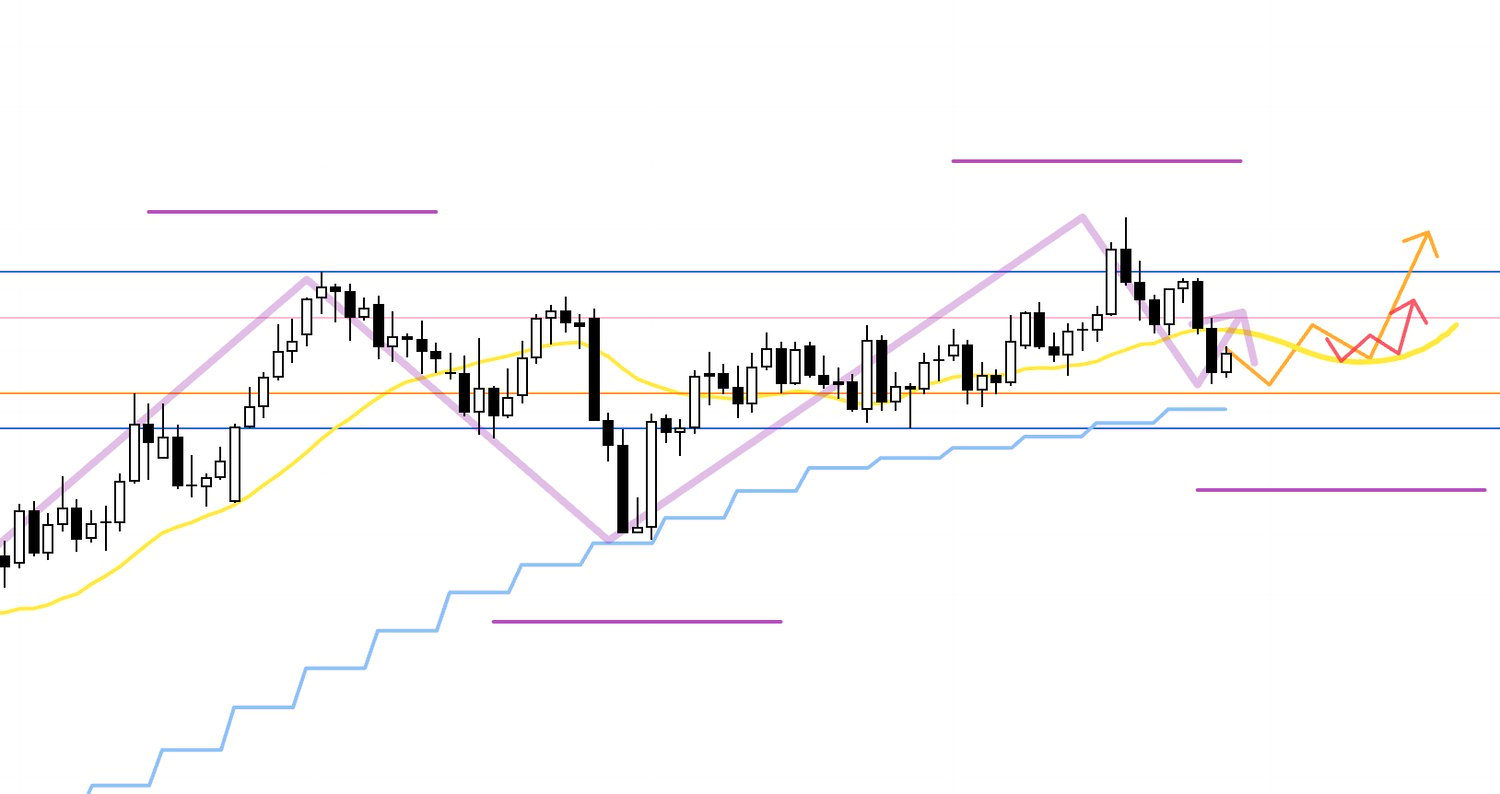

4h

Inside the daily higher‑low zone in orange, just before the daily turns back up, and inside that the 4h higher‑low zone in red, I will look to buy at the precise point where the still lower timeframe transitions to an uptrend.

This should function as a weekly pullback‑buy and offers strong edge.

4h

It is also possible to consider a short as a daily rally‑sell, but the boxed area at the bottom of this chart is a weekly pullback‑buy zone where buying and selling flows cross, which brings a risk of choppy price action and calls for caution.

If shorting, the focus is on whether an entry appears with acceptable risk‑reward, and if holding a short, I would take measures such as securing half when price reaches the riskier zone.

〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・〜・

That is all.

These are the scenarios as of now, and as the week unfolds I will update and build them in real time based on price action.

Every week I do the same thing, assess risk the same way, lay out scenarios the same way, and keep repeating the same kind of trades.

Whatever the chart does, I wait for high‑edge conditions and trade only there, so any path the chart takes is acceptable.

The point is to avoid unnecessary actions and keep executing where orders are most likely to concentrate, while managing risk.

Because I repeat the same trade, my screenshots tend to look identical.

As I always show here, in a higher‑timeframe buy‑the‑dip, I enter when the lower timeframe rotates from a downtrend to an uptrend in alignment with the moving averages, and then I hold until the trend breaks.

I know that collecting one hundred screenshots of this same setup is enough to grow capital, so I do not get tossed around by recent results, I do not look for something “extra,” and I simply keep repeating the same thing.

I wrote one hundred, but in practice I understand my performance over a much larger sample size, and I have trained thoroughly at that scale.

What matters is thinking long term and repeating consistent actions.

I hope this is useful.

These scenarios are my personal plan.

If your approach is not yet set, feel free to use this as input for your own strategy construction.

If your playbook is already established, do not let my plan sway you.

Stick to your rules.

Thanks for reading to the end.