Professional Training - IR & Credit Curve Calibration

Professional Training - Credit Curve Calibration

Excel Workbook & Guide

Contents

CreditCurve.xlsm - Excel Workbook

CreditDerivatives.pdf - PDF Guide

Understanding Credit Curve Calibration

Credit markets sit at the intersection of probability, pricing, and risk management. A credit curve captures the evolving market view of default risk for a corporate or sovereign entity, translating observable Credit Default Swap (CDS) spreads into implied hazard rates — the instantaneous probabilities of default over time.

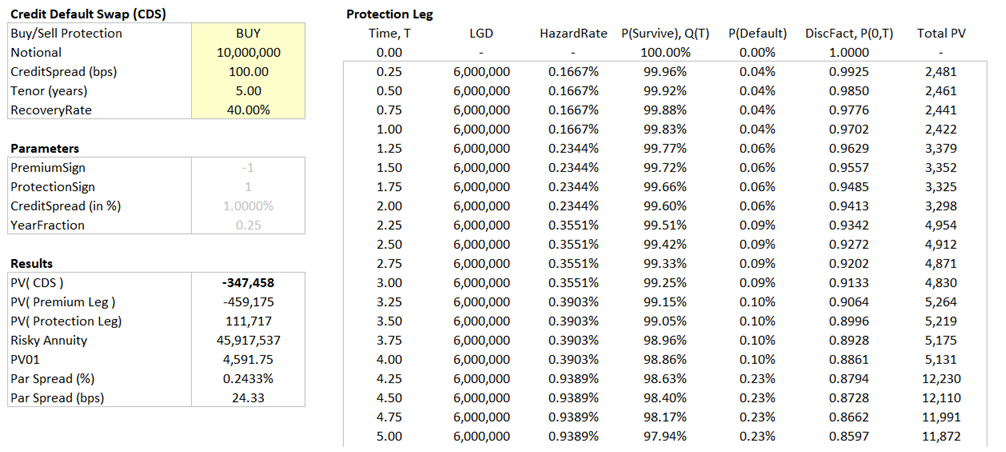

This training workbook provides a complete, practical framework for calibrating and understanding credit curves from first principles. Using Excel, we build a fully functional credit curve calibrated to market CDS par spread quotes using a multi-variate Newton–Raphson algorithm. The solver achieves convergence in just a few iterations, producing a credit curve fully calibrated to market CDS instruments in real-time.

We further develop the analytical machinery behind the calibration: the credit curve Jacobian, which represents the first-order sensitivity of CDS spreads to changes in hazard rates. Both numerical and closed-form derivations are explored, allowing participants to understand and verify every step of the process. With these tools, users can reprice calibration instruments and bespoke CDS. The framework allows us evaluate credit exposure for any given reference entity.

Excel Workbook

The Excel workbook demonstrates how to calibrate a credit curve in practice. This requires knowledge of how to build IR yield curves, which is included.

It includes:

- IR yield curve calibration using swap market inputs - required for credit curves and CDS pricing.

- Credit curve calibration using market CDS inputs.

- Full pricing and repricing of CDS calibration instruments

- Full implementation of multivariate Newton-Raphson Algorithm

- Analytical and numerical computation of the Jacobian matrix

- Bespoke CDS pricing using the hazard rates i.e. curve calibration outputs

The model is designed for transparency and teaching: every assumption, intermediate calculation, and equation is fully visible and editable, making it ideal for both learning and further quantitative research.

Credit Derivatives Article

To complement the Excel model, the included Credit Derivatives Primer provides theoretical depth and market context. The paper aligns with the International Swaps and Derivatives Association (ISDA) standards for CDS contracts and credit model calibration. It acts as both a technical companion and a conceptual guide — reviewing key elements of credit market structure, standardization, and pricing methodologies.

The article discusses:

- CDS contract definitions, terminology, and settlement conventions.

- The evolution of ISDA model standardization for pricing consistency and XVA capital cost reduction.

- Probability and credit modelling fundamentals used by market practitioners.

- Comparison of the ISDA Standard Model, ISDA Fair Value Model, and Bloomberg Fair Value Model.

- Practical perspectives on CDS liquidity, proxy hedging, and the role of credit indices.

Together, the workbook and article offer a unified learning experience — combining transparent implementation with real-world context, enabling readers to move seamlessly from concept to computation.

Keywords: Credit Curves, Calibration, Credit Default Swaps, Hazard Rates, Probability of Default, Probability of Survival, Recovery Rates, Bloomberg, Pricing, Risk, Solver, Algorithms, Optimization, Credit Spreads, Par Rates, Financial Markets, Credit Markets, Fixed Income, Credit Derivatives