New Terms of Service – EU VAT

Last updated: July 29, 2020

TLDR; we’ve updated our terms of service so that we can handle EU VAT for you.

When we announced we were handling EU VAT for our customers, we got a lot of positive feedback which we really appreciate as feedback is what keeps us pushing forward.

We’ve now updated our terms of service so that you provide us a licence to sell your work for you. This allows us to take on the legal burden of calculating VAT and reporting it to HMRC (UK) on your behalf. The important bit to read is under the heading “Licence to redistribute and sub-licence your content”. The new terms of service is effective as of today – 31st December 2014.

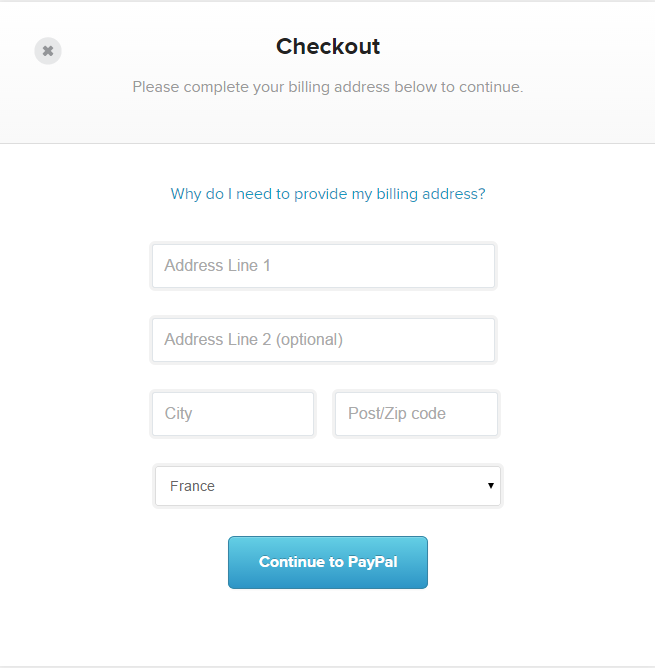

The main changes for your buyers will be that we ask them for their billing address if they are based in the EU, this is an example of what they will see:

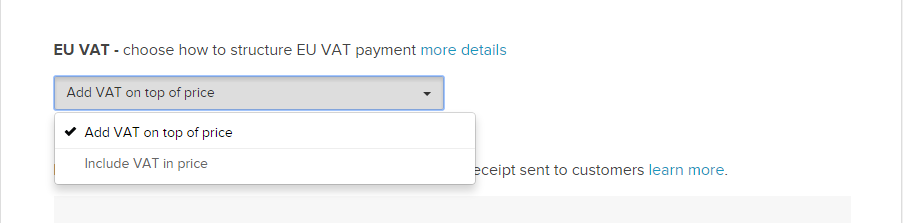

In addition, there is a new important setting you should be aware of in your dashboard under “Settings” > “Advanced Settings”. You can set whether you want VAT to be included or excluded from your price. We have defaulted to excluding it from your price which means your sales will not be affected, however, EU buyers will be paying a higher price than non-EU buyers.

There is a lot more information on this topic in our EU VAT help section.

If there any questions or feedback, we’d love to hear them via email, Twitter or just comment below.

We hope you all have a wonderful and prosperous new year! 🙂

Comments

Leave a Comment