American Options - Live Pricing, Risk & Trading Strategies

American Options - Live Pricing, Risk & Trading Strategies

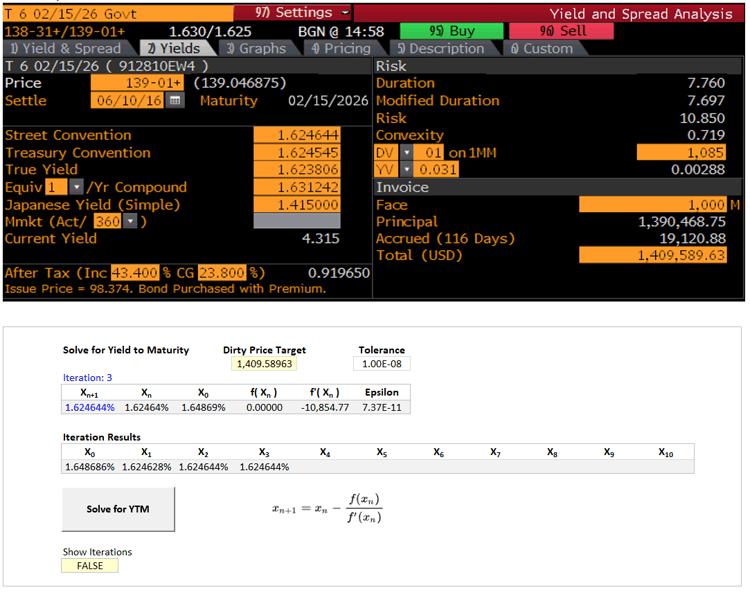

Pricing American options is more complex than European options, since the possibility of early exercise removes the luxury of a simple closed-form solutions. Market practitioners often turn to a mix of analytical approximations and numerical methods to achieve reliable valuations.

Contents

In this downloadable bundle, you will find:

1. American Options Excel Workbook

This is the core of the package and a practical tool for quants, traders, and students of derivatives.

Unlike many purely theoretical models, this workbook bridges the gap between textbook formulas and real-world trading. It can be a valuable companion in both learning environments and for supporting live trading decisions. This workbook is supports and is useful for,

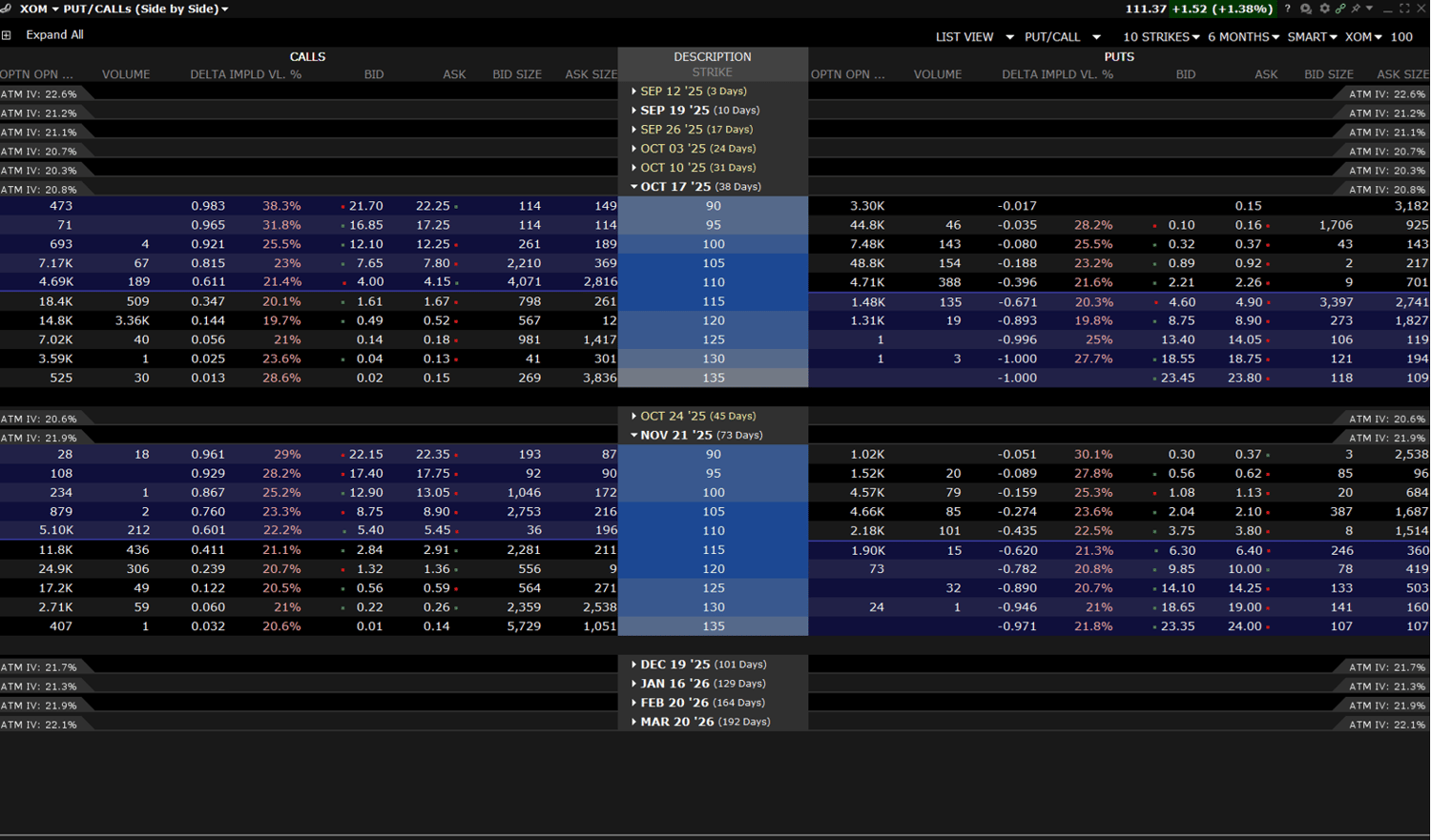

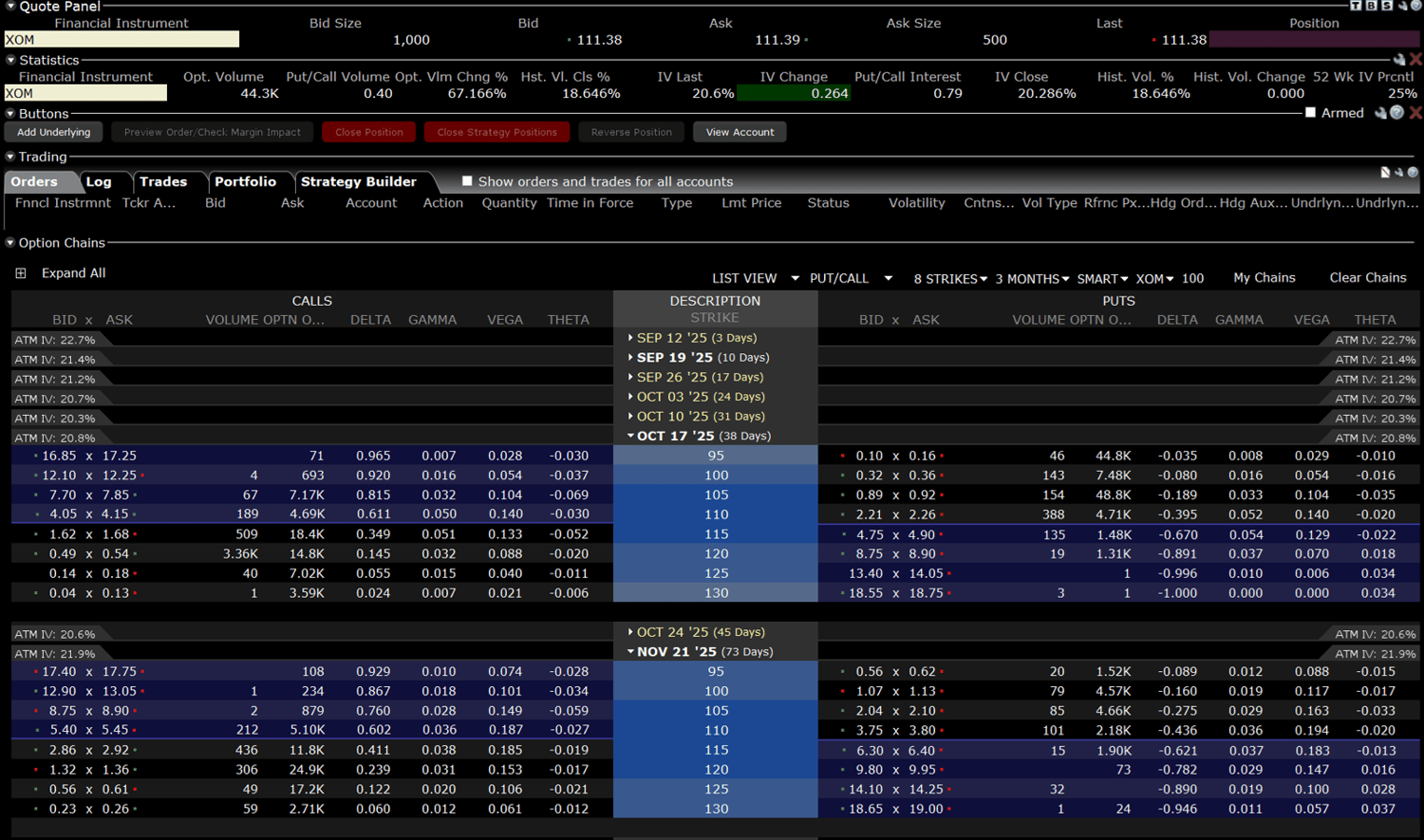

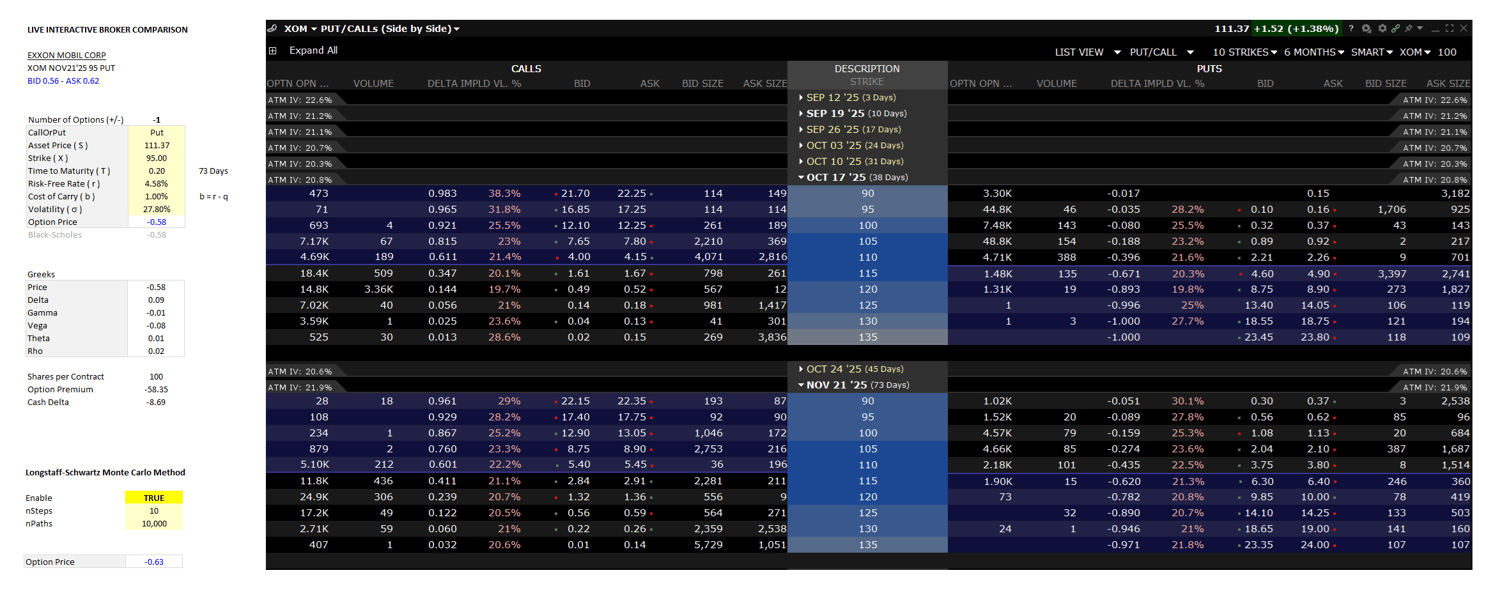

a) Live Trading: results are benchmarked against live Interactive Brokers (IBKR) option chains, demonstrating that the pricing aligns closely within observed bid-offer spreads.

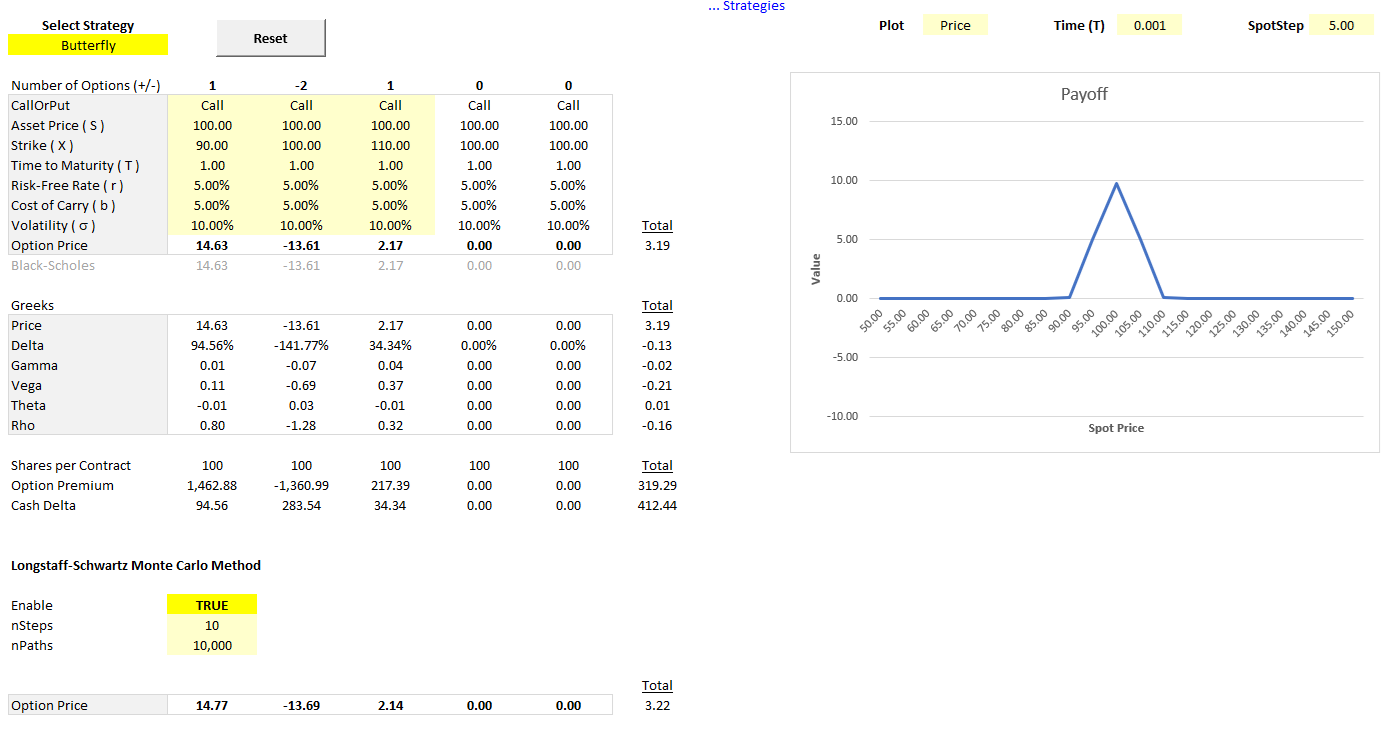

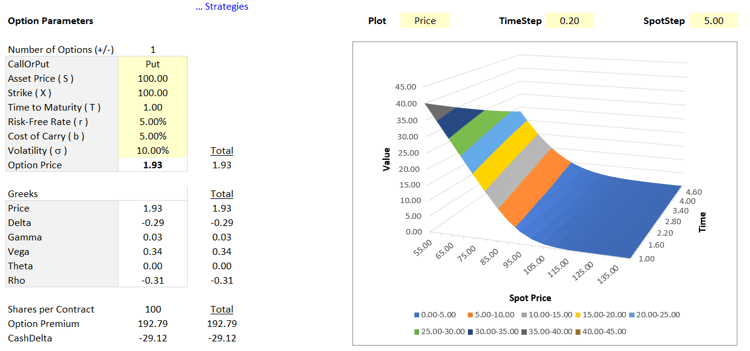

b) Analyze Trading Strategies: price, structure and study a wide range of option structures, including Box spreads, Calendar spreads, Vertical spreads, Iron Condors, Butterflies, Straddles, Strangles, and more.

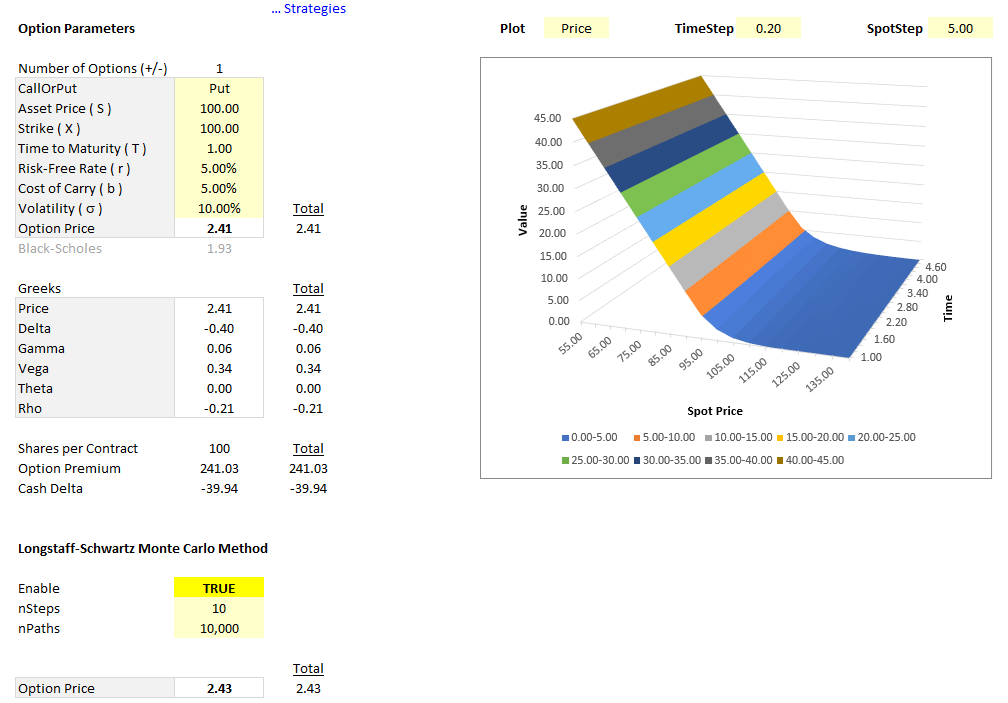

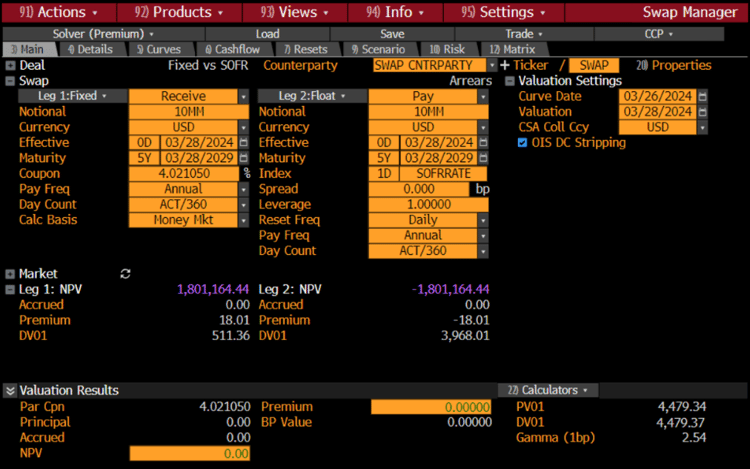

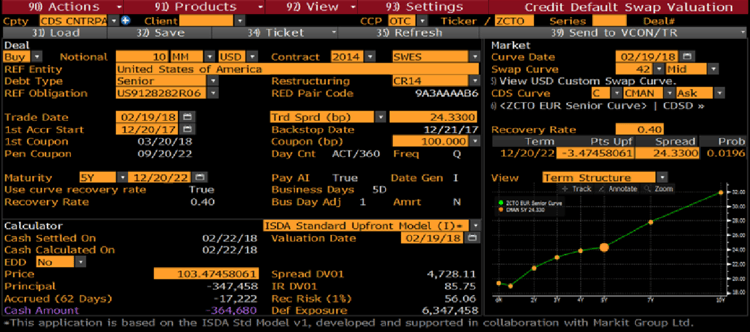

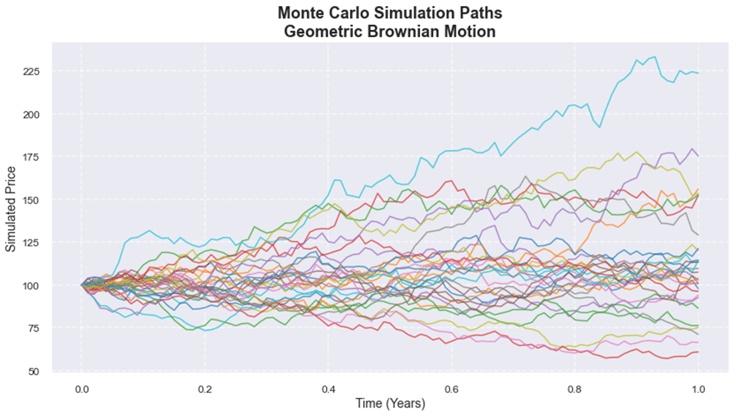

c) Price American Options: We show how to price American Options using both the analytical Bjerksund–Stensland approximation and the Longstaff–Schwartz Least Squares Monte Carlo (LSM) method.

d) Greeks for American options: we compute and provide crucial sensitivities for risk management.

2. Reference Research Articles

Two landmark academic papers are included in the download for quick reference:

a) Bjerksund and Stensland – Analytical Approximations for American Options

b) Longstaff and Schwartz – Least-Squares Monte Carlo for American Options

These references are freely available academic works and are bundled here strictly for convenience, so you have a complete set of background materials at your fingertips.

Why Purchase this Download?

While Black–Scholes remains the cornerstone of European option pricing, valuing American options requires more robust approaches. The Excel workbook brings these techniques to life by:

- Combining analytical speed with Monte Carlo flexibility.

- Delivering practical insights into Greeks and trading strategies.

- Demonstrating how to match live trading prices, giving confidence in the results.

- Showing how to create and price a wide range of option trading strategies.

This is not just a teaching aid—it is a practical tool that shows theory in action and provides a structured way to deepen your understanding of American option pricing.

Keywords

American Options, Excel Workbook, Live Trading, Interactive Brokers, IBKR, Bjerksund-Stensland, Analytical Pricing, Closed-Form Solutions, Longstaff-Schwartz, Least Squares Monte Carlo, Greeks, Early Exercise, Trading Strategies, Option Pricing, The Greeks, Risk Management