About Me

Hello I am George Pruitt and live in the mountains of western North Carolina with my lovely family. I have a degree in Computer Science from my beloved UNC-Asheville. The synergy between trading and computer expert systems is ever increasing - I personally believe it is impossible to successfully trade without some form of system - I have dedicated 30 plus years in this endeavor. For this reason I have written four books on algorithmic trading. Check out my author page at amazon.com.

George's Amazon Author Page

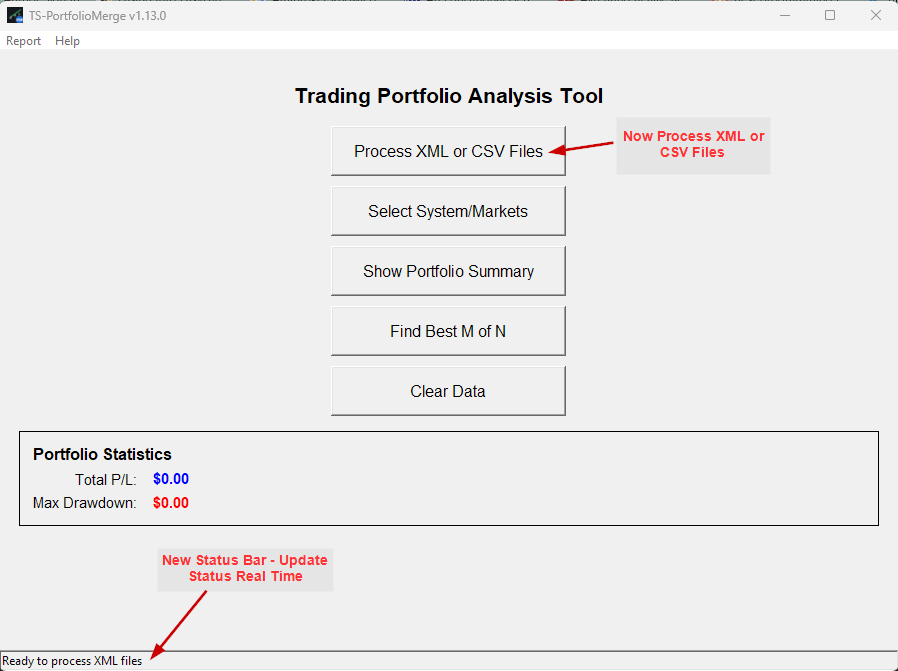

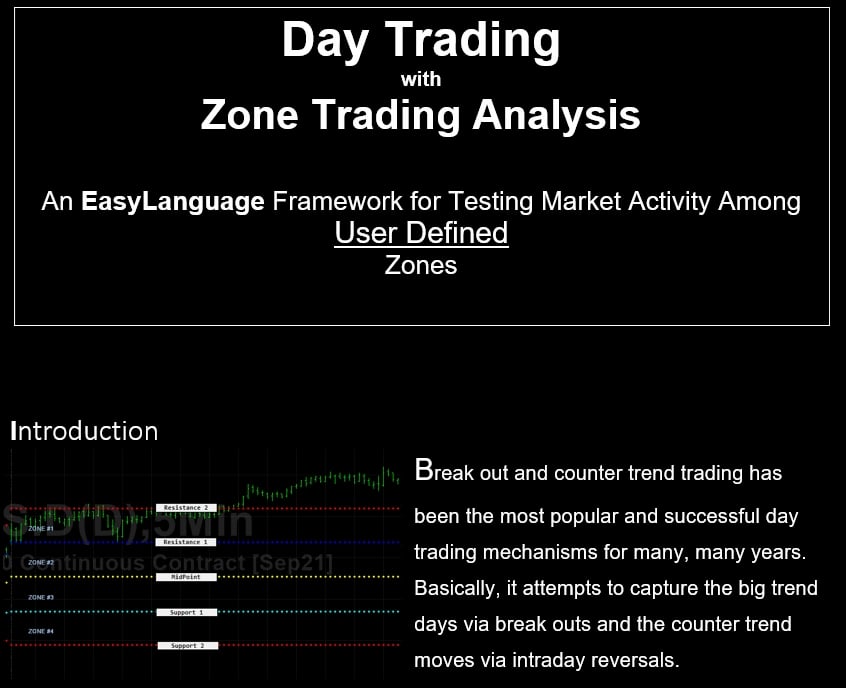

The products I have for sale at this store front are meant to further one's education in programming trading systems using EasyLanguage, PowerLanguage and Python. I have somethings in Excel too! I will add videos explaining the software when I can. I always tech support via email and try my best to answer within 24 hours. Contact me at: georgeppruitt@gmail.com

Good luck and if you are interested in learning more about me check out my blog at www.georgepruitt.com.

George's Amazon Author Page

The products I have for sale at this store front are meant to further one's education in programming trading systems using EasyLanguage, PowerLanguage and Python. I have somethings in Excel too! I will add videos explaining the software when I can. I always tech support via email and try my best to answer within 24 hours. Contact me at: georgeppruitt@gmail.com

Good luck and if you are interested in learning more about me check out my blog at www.georgepruitt.com.